"The failure of normal empathy is central to sociopathy, which is marked by an absence of guilt, intentional manipulation, and controlling or even sadistically harming others for personal power or gratification.”

Bandy Lee

"I told you once that I was searching for the nature of evil. I think I've come close to defining it: a lack of empathy. It's the one characteristic that connects all the defendants. A genuine incapacity to feel with their fellow man. Evil, I think, is the absence of empathy."

G. M. Gilbert

“Once they’re in power, narcissists consolidate their position by firing everyone who challenges them. In their place rise a plague of toadies, opportunists, and enablers equally guided by self-interest and short on scruples. So you end up with these individualistic cultures with no teamwork and low integrity."

Lee Simmons, Stanford Business School

"As in all periods of speculation, men sought not to be persuaded by the reality of things but to find excuses for escaping into the new world of fantasy."

"John Kenneth Galbraith, The Great Crash of 1929

“Now we are witnessing a transformation: a true opium of the people is the belief in nothingness after death, the huge solace, the huge comfort of thinking that for our betrayals, our greed, our cowardice, our murders, that we are not going to be judged.”

Czeslaw Milosz, The Discreet Charm of Nihilism

"And they said to him, 'Where will this happen, Lord?' And He said to them, 'Where death is, there a gathering of vultures will be.'”

Luke 17:37

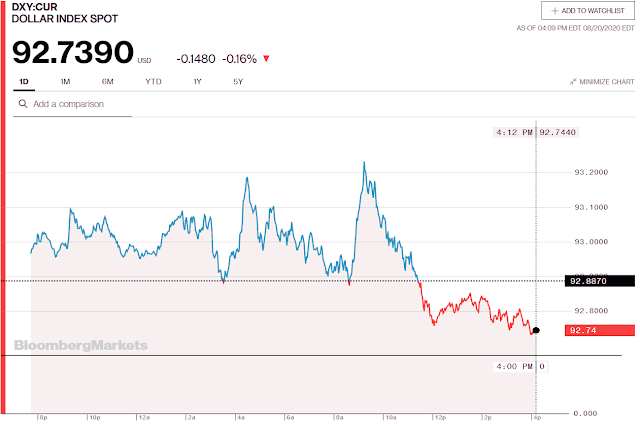

Today's market action was driven by a handful of 'new era' stocks.

In the SP 500, about 350 stocks were in the red.

Gold and silver gained again, despite the persistent price manipulation by the Hedge Funds and the Banks who are gaming the markets even further, now that it appears we are reaching the endgame.

There is a gathering storm. And like the pandemic, its mark on history may be lasting, and a sign and warning for the next generation.

Lord have mercy on us, and forgive us our rebellious ignorance and our impenetrable pride.

Have a pleasant evening.