"What makes the silver (and gold) manipulation the perfect crime are a number of elements; short term price control through High Frequency Trading, compliant regulators and the fact that most victims don’t even realize they are being had, as the sellers are mostly just reacting to the deliberately-set lower prices.

It’s hard to end an ongoing crime in progress when so many don’t realize it is in progress. Worse, there are still some who profess that there is no manipulation underway.

And for the few who do realize what’s really going on, what can you do about it when the regulators are in bed with the manipulators? Perhaps the options are limited, but that’s not the same as non-existent."

Ted Butler, Busting the Perfect Crime

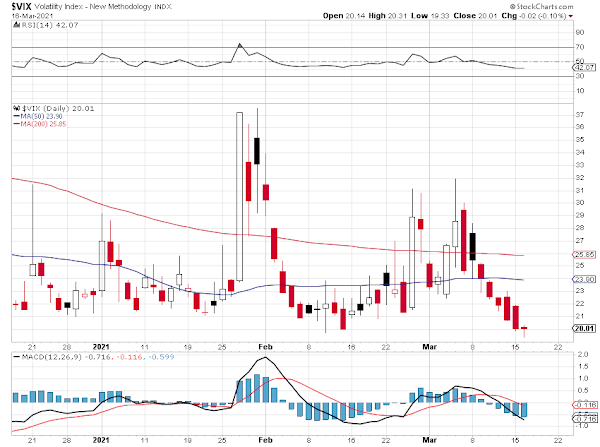

Earlier this week someone asked me what the markets might look like ahead of this quadruple option expiration.

I replied 'a zigzag.' Or in other words, a wash and rinse operation designed to shake speculators out of their positions.

It appears that the Banks are losing their special exemption from the reserves requirement.

It's all about the leverage. And perhaps the most inconvenienced bank is JP Morgan.

Next week we will have a metals option expiration on the Comex, on Thursday the 25th.

When you trade in the relatively lawless markets of deregulation and hellbound pigmen, you need to be on your guard.

They are not jealous of your freedom.

They just want your money.

Have a pleasant weekend.