"Monetary and regulatory policy encourage asset bubbles to proliferate. Hot money seeks out the conscious mispricing of risk. Capital, in the form of both money and personal talent, increasingly flows into malinvestment and the gaming of markets.

The productive economy languishes, left wanting for the lack of creative resources and attention. The bubble rises to unsustainable valuations— and fails, and a nation's capital is consumed."

Jesse 5 August 2019, The Men Who Sold the World

"Over the last thirty years, the United States has been taken over by an amoral financial oligarchy, and the American dream of opportunity, education, and upward mobility is now largely confined to the top few percent of the population.

Federal policy is increasingly dictated by the wealthy, by the financial sector, and by powerful (though sometimes badly mismanaged) industries such as telecommunications, health care, automobiles, and energy. These policies are implemented and praised by these groups’ willing servants, namely the increasingly bought-and-paid-for leadership of America’s political parties, academia, and lobbying industry.

If allowed to continue, this process will turn the United States into a declining, unfair society with an impoverished, angry, uneducated population under the control of a small, ultrawealthy elite. Such a society would be not only immoral but also eventually unstable, dangerously ripe for religious and political extremism."

Charles Ferguson, Predator Nation

Stocks moved sharply lower after some rose to new all time highs in the morning.

Declines were led by the big cap tech bubble.

The crypto bubble, or ponzi scheme, deflated a bit.

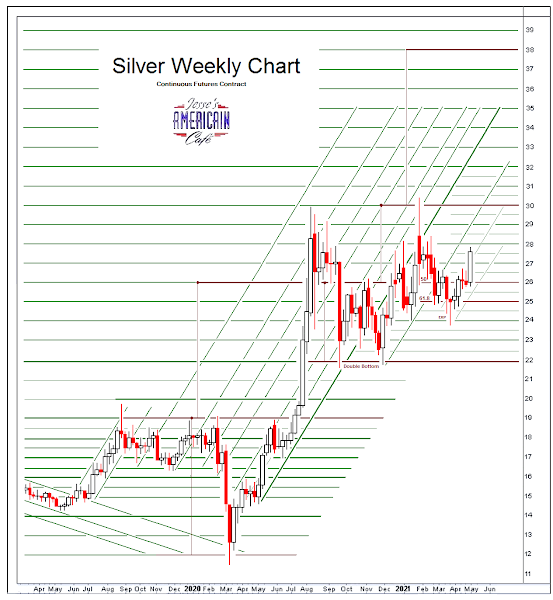

Gold was up slightly as silver edged lower.

The Dollar was unchanged.

The VIX was higher.

In a liquidation event everything declines. The object at that point is survival.

I am taking a little break, and my trading account has been sitting in cash since Friday.

My long term position are just as they have been, for years.

The commodity of greatest concern to these financial markets is the supply of greater fools.

Let's see what happens.

Depending on how things go I may trot out a few charts showing how various assets perform in deep corrections.

How America Became the Money-Laundering Capital of the World.

Have a pleasant evening.