“There is nothing more deceptive than an obvious fact.”

Arthur Conan Doyle, The Boscombe Valley Mystery

“La plus belle des ruses du diable est de vous persuader qu'il n'existe pas."

(The devil's finest trick is to persuade you that he does not exist.)

Charles Baudelaire

“Falsehood flies, and truth comes limping after it, so that when men come to be undeceived, it is too late; the jest is over, and the tale hath had its effect.”

Jonathan Swift

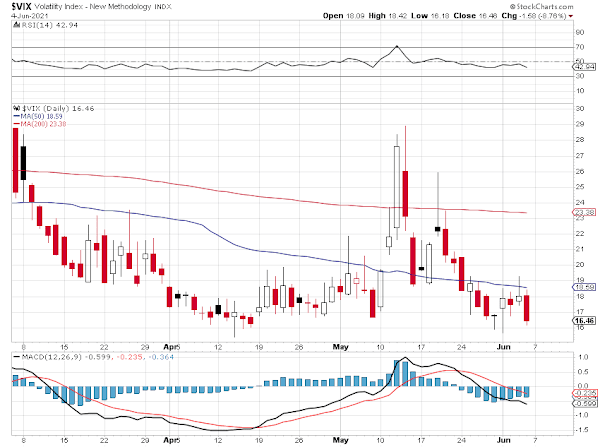

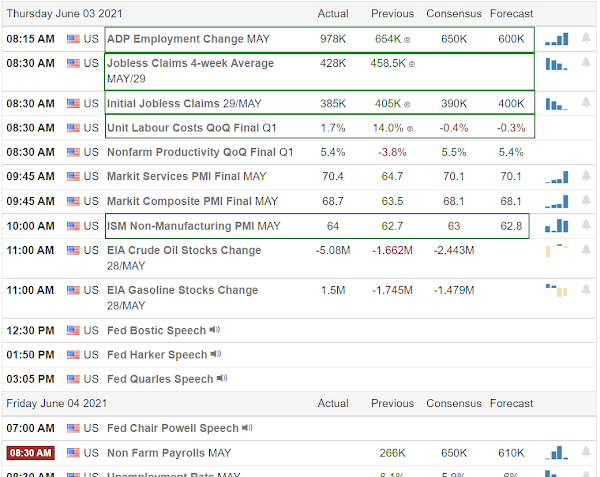

Stocks were edgy again today, managing to hold their ground at the end.

Small caps were leaders, with the Russell 2000 nearing a new all time high.

Gold and silver were off a bit.

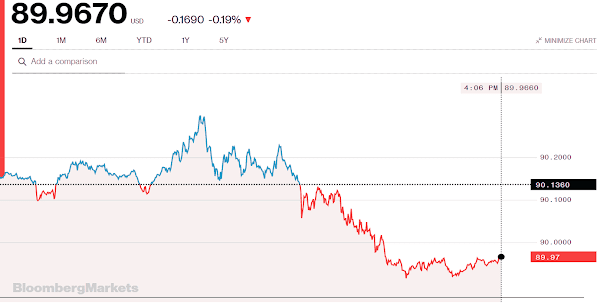

The Dollar was marginally higher.

The markets are looking ahead to the Consumer Price Index later this week.

And for what other reason?

The Fed. Mother of bubbles.

Have a pleasant evening.