"It would convert the Treasury of the United States into a manufactory of paper money. It makes the House of Representatives and the Senate, or the caucus of the party which happens to be in the majority, the absolute dictator of the financial and business affairs of this country. This scheme surpasses all the centralism and all the Caesarism that were ever charged upon the Republican party in the wildest days of the war or in the events growing out of the war."

James A Garfield, Speaking on the Greenback Party Monetary Proposal, April 1880

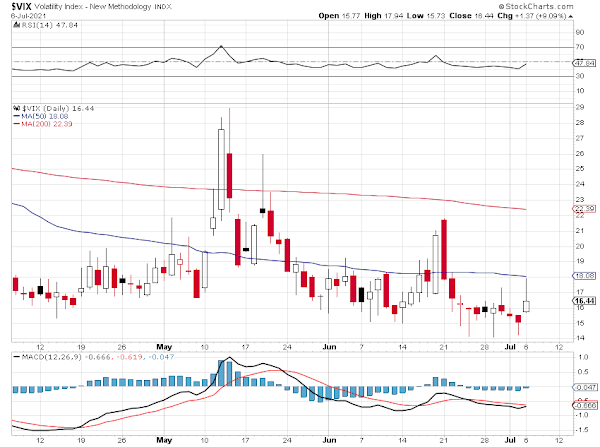

Stocks were loopy again today, for whatever reason one may wish or care to assign.

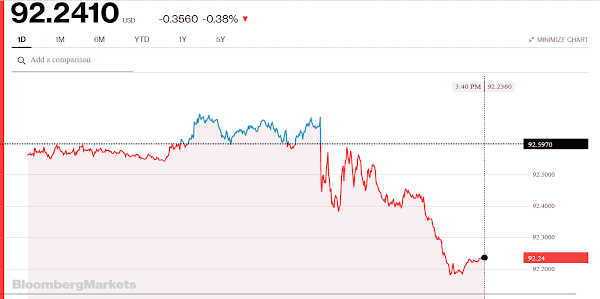

Silver and the Dollar declined a bit in value.

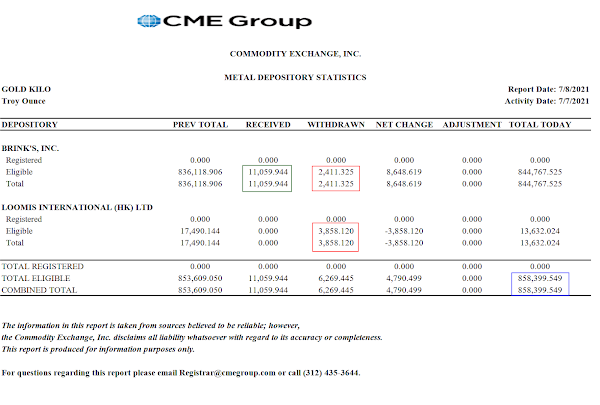

Gold managed to finish essentially unchanged.

I still think that this is second half positioning (a kinder word for churning) by the well supplied and under-regulated financial interests that dominate Wall Street.

But let's keep our eyes open for any 'trigger events' even though this is an unlikely time of the year for major trend changes to the downside.

With thunderstorms running in its advance, the storm Elsa is going to be rolling over the NY metro area in the early morning hours tomorrow.

Have a pleasant evening.