"Price discovery is not a sexy function of markets, but it is critical to the efficient allocation of scarce capital and resources, and to the preservation of the long term wealth of investors and the economy as a whole. If price discovery is compromised by manipulation, then we will all be gradually impoverished and the economy will be imbalanced and unstable.

Over the past 25 years the forces of regulatory liberalisation and demutualisation of markets have allowed the largest global banks to set the rules, processes and infrastructure of global markets to their own self-interested requirements."

London Banker, Lies, Damn Lies, and LIBOR

"This is the Dr. Evil strategy, as so named by the US traders who got nailed pulling this baloney in the European bond market some years ago. It is a massive dumping of contracts into a dull market for the purpose of gaming the price to achieve some objective."

Jesse, 21 September 2018

"Most of them became wealthy by being well connected and crooked. And they are creating a society in which they can commit hugely damaging economic crimes with impunity, and in which only children of the wealthy have the opportunity to become successful. That’s what I have a problem with. And I think most people agree with me."

Charles Ferguson, Predator Nation

"No lie can live forever."

Thomas Carlyle

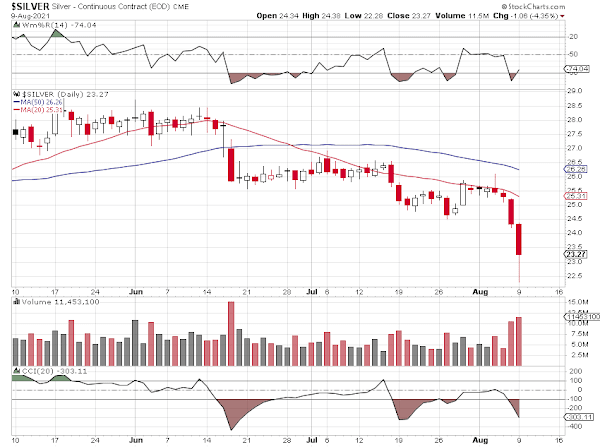

The data shows that about 24,000 gold futures contracts with a nominal value of 4 Billion in gold were dumped in the quiet overnight trading hours.

I wish we could be surprised by this, but it is an all too common event in US markets. In all these years I have learned to trade around it and live with it. But it is still discouraging to see this sort of thing so quietly tolerated.

There was no fundamental reason for this 'flash crash.' But you would not have picked the details of this up from the facts-lite description of this by the Wall Street spokesmodels and bubblevision bobbleheads.

Europe has taken steps to curb this malicious practice by the Banks in their bond markets, limiting the amount of heedless selling (dumping) that can be done in short periods of time in quiet markets.

The US continues to tolerate this and other abuses of its markets. It is particularly brazen in gold because it does not offend the powers that be in the Fed and Treasury, who look on it somewhat favorably.

Until this corruption is rooted out of its monopolized and under-regulated markets there can be no sustainable economic recovery in the US.

That's why we can't have nice things. It's an oligarchy, dominated by rigged markets and monopolies, and paid-for politicians, so that a very few benefit the most, without a meaningful counterbalance and accountability.

And now back to your favorite distractions, junk calls and spam emails, healthcare system landmines, demagogues, conflict entrepreneurs, and conmen.

Have a pleasant evening.