"As Jesus passed on from there, he saw a man named Matthew sitting at his customs post. And he said to him, 'Follow me.' And he got up and followed. While he was at table in his house, many tax collectors and sinners came and sat with Jesus and his disciples. The Pharisees saw this and asked the disciples, 'Why does your teacher eat with tax collectors and sinners?' He heard this and said, 'Those who are well do not need a physician, but the afflicted do. Go and learn the meaning of the words, ‘I desire mercy, not sacrifice.’"

Matthew 9:9-13

“We are slow to master the great truth that even now Christ is, as it were, walking among us, and by His hand, or eye, or voice, bidding us to follow Him. We do not understand that His call is a thing that takes place now. We think it took place in the Apostles' days, but we do not believe in it; we do not look for it in our own case."

John Henry Newman

Stocks made a valiant attempt to rally off the bottom today— and failed. At least in the futures markets, which both finished in the red as of this posting.

There will be an FOMC rate decision announced tomorrow afternoon, with the attendant press conference and other Delphic pronouncements.

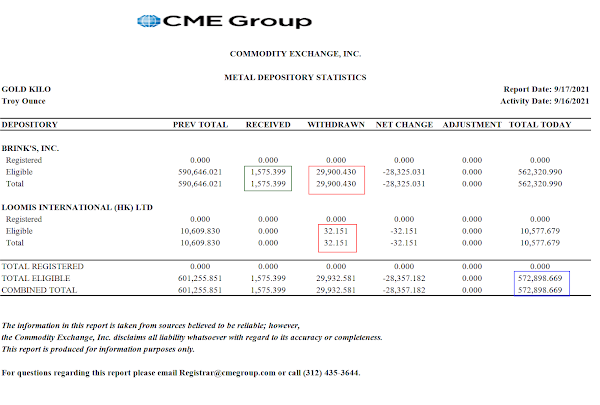

Gold and silver managed to rally off their lows and held the gains.

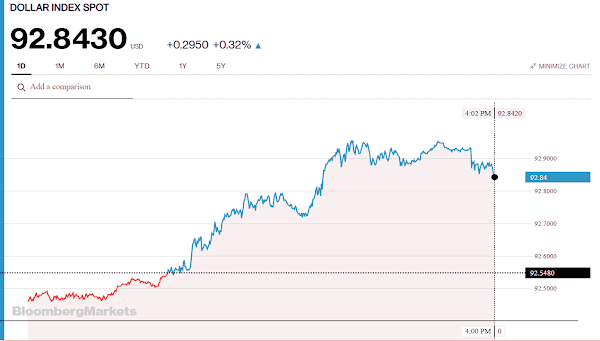

The Dollar was slightly lower.

The scandal about the Fed Presidents actively trading the stocks and bonds whose prices they were actively influencing is growing, and it is not pretty.

I am still sitting in cash in my trading accounts.

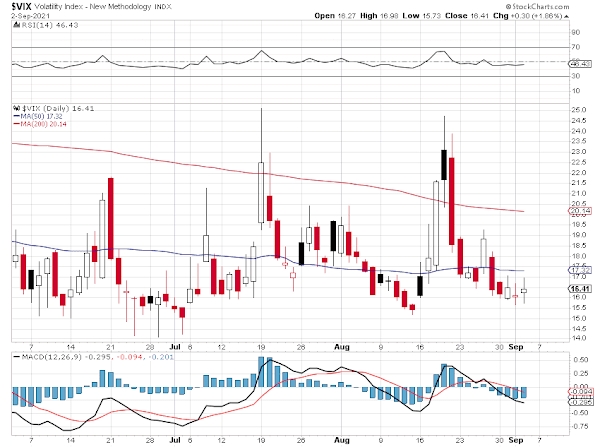

This market is skittish, and there is tension on the tape because of contagion risk from China's Evergrande.

There will be a key debt deadline for that beleaguered behemoth on this Thursday.

Let's see what the Fed has to say tomorrow, and if it is somehow reassuring. Or not.

Have a pleasant evening.