"Power is always dangerous. Power attracts the worst and corrupts the best."

Edward Abbey

"This elite-generated social control maintains the status quo because the status quo benefits and validates those who created and sit atop it. People rise to prominence when they parrot the orthodoxy rather than critically analyze it. Intellectual regurgitation is prized over independent thought. Voices of the dispossessed, different, and un(formally)educated are neglected regardless of their morality, import, and validity.

Real change in politics or society cannot occur under the orthodoxy because if it did, it would threaten the legitimacy of the professional class and all of the systems that helped them achieve their status."

Kristine Mattis, The Cult of the Professional Class

"Most of them became wealthy by being well connected and crooked. And they are creating a society in which they can commit hugely damaging economic crimes with impunity, and in which only children of the wealthy have the opportunity to become successful."

Charles Ferguson

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

Upton Sinclair

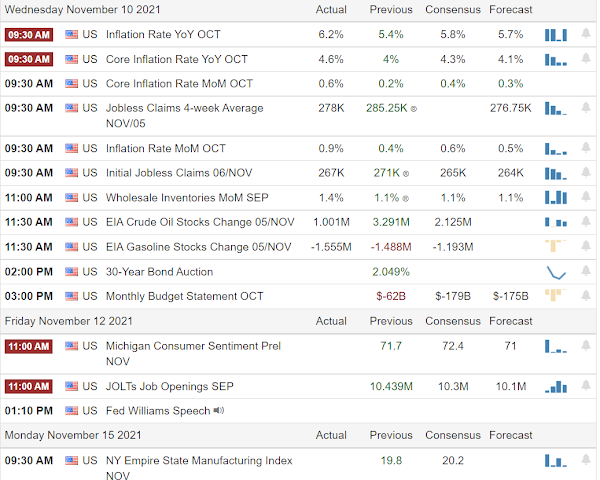

Stocks were a bit wobbly today, getting a slight nosebleed from their recent lofty valuations.

Gold and silver took off on the stronger than expected measure of inflation.

The Dollar also rallied, in what is likely a combination of a flight to safety and anticipation of higher interest rates.

Have a pleasant evening.