"Asset prices remain vulnerable to significant declines should investor risk sentiment deteriorate, progress on containing the

virus disappoint, or the economic recovery stall.

Leverage of life insurance companies remained at post-2008 highs. Corporate bonds, CLOs [Collateralized Loan Obligations], and CRE [Commercial Real Estate] debt continued to account for a large proportion of life insurers’ assets. If these assets lose value, life insurers’ capital positions—and, hence, their ability to honor debt obligations—could be impaired.

Excessive leverage within the financial sector increases the risk that financial institutions will not have the ability to absorb even modest losses when hit by adverse shocks. In those situations, institutions will be forced to cut back lending, sell their assets, or, in extreme cases, shut down. Such responses can substantially impair credit access for households and businesses.”

Federal Reserve, Financial Stability Report, November 2021

"Foolishness has a knack of getting its way; as we should see if we were not always so much wrapped up in ourselves. In this respect our townsfolk were like everybody else, wrapped up in themselves; they did not believe in plagues."

Albert Camus

Stocks were a bit wobbly today.

Considering how far and how fast they have come in this melt up phase of the financial asset bubble, it is pretty much just a breather, so far.

I am trying to take most things people say with a grain of salt now in this period of extreme hyperbole and detachment from reality, in so many areas.

It's tough for people living in a bubble to maintain their bearings.

Madness is contagious, and a relief for many from reality.

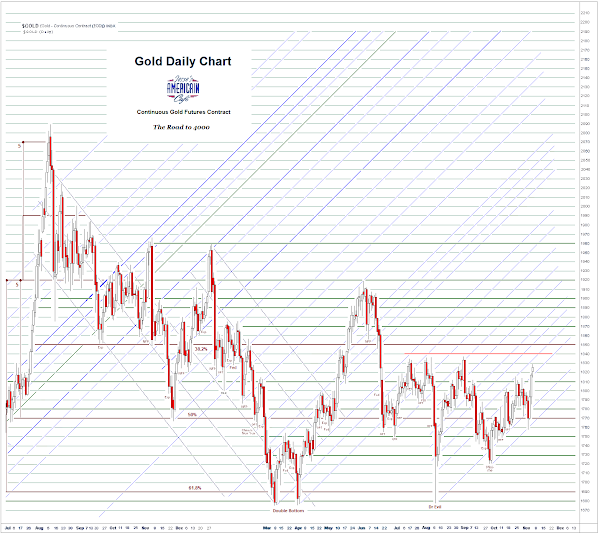

Gold was higher again. It is approaching a key resistance area.

Silver was a bit higher, but is lagging a bit.

The Dollar continued to chop sideways around the 94 handle.

Keep a good eye on yourself, moreso than the other guy.

And especially who or what it is that you serve.

Have a pleasant evening.