"We didn't truly know the dangers of the market, because it was a dark market," says Brooksley Born, the head of an obscure federal regulatory agency -- the Commodity Futures Trading Commission [CFTC] -- who not only warned of the potential for economic meltdown in the late 1990s, but also tried to convince the country's key economic powerbrokers to take actions that could have helped avert the crisis. "They were totally opposed to it," Born says. "That puzzled me. What was it that was in this market that had to be hidden?"

"I walk into Brooksley's office one day; the blood has drained from her face," says Michael Greenberger, a former top official at the CFTC who worked closely with Born. "She's hanging up the telephone; she says to me: 'That was [former Assistant Treasury Secretary] Larry Summers. He says, "You're going to cause the worst financial crisis since the end of World War II."... [He says he has] 13 bankers in his office who informed him of this. Stop, right away. No more.'"

Greenspan, Rubin and Summers ultimately prevailed on Congress to stop Born and limit future regulation of derivatives. "Born faced a formidable struggle pushing for regulation at a time when the stock market was booming," Kirk says. "Alan Greenspan was the maestro, and both parties in Washington were united in a belief that the markets would take care of themselves."

PBS Frontline, The Warning, 20 October 2009

"The banks were central to the scheme from the inception as they spent years and many hundreds of millions of dollars to overturn Glass-Steagall to allow this coup de grâce to be delivered to all holders of US dollars."

PBS Frontline: The Long Demise of Glass-Steagall, 8 May 2003

"The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government - a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF's staff could speak freely about the U.S., it would tell us what it tells all countries in this situation; recovery will fail unless we break the financial oligarchy that is blocking essential reform."

Simon Johnson, The Quiet Coup, The Atlantic Monthly, May 2009

“Crime, once exposed, has no refuge but audacity.”

Tacitus

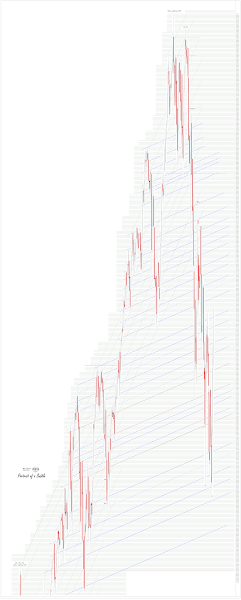

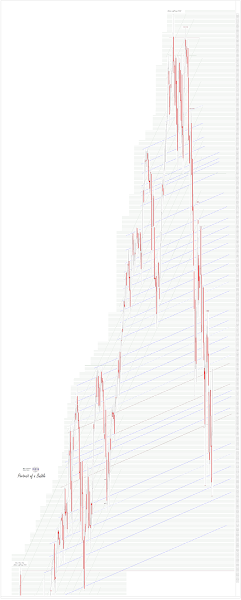

Stocks cast aside all concerns about war, pandemics, and debt, and rallied higher, going out on the highs.

Gold and silver were sold, as is traditional for a quad witching stock index expiration.

The Dollar moved a bit higher, gaining a firmer grip on the 98 handle.

It is not so much what the elites and their unspeakable enablers would do to maintain control of the financial system and the economy.

The real question is, what wouldn't they do?

Have a pleasant weekend.