"Proclaim the truth and do not be silent in fear. We have had enough pressure to be silent. Cry out with a thousand voices. The world is rotten because of silence.

You know that every evil is founded in the love of self. Self-love is a fog that takes away the light of reason, which sustains itself by the light of faith. One is not lost without the other.

Love transforms us into what we love. Out of darkness is born the light. Be who God meant you to be, and you will set the world on fire."

Catherine of Siena

"Non pas cette pauvreté facile, intéressante et complice, qui fait l’aumône à l’hypocrisie du monde, mais la pauvreté difficile, révoltante et scandaleuse, qu’il faut secourir sans aucun espoir de gloire et qui n’a rien à donner en échange. La fortune dont la pratique séculaire est de faire tourner sa roue dans les ordures.

C’est ce qui permet à Clotilde d’aller chez lui, sans exposer à la boue d’un luxe mondain ses guenilles de vagabonde et « pèlerine du Saint Tombeau ».

De loin en loin, elle vient jeter dans l’âme du profond artiste un peu de sa paix, de sa grandeur mystérieuse, puis elle retourne à sa solitude immense, au milieu des rues pleines de peuple.

Il n’y a qu’une tristesse, lui a-t-elle dit, la dernière fois, c’est de n’être pas de saints."

Léon Bloy, La femme pauvre

And there goes April.

Non-Farm Payrolls next week.

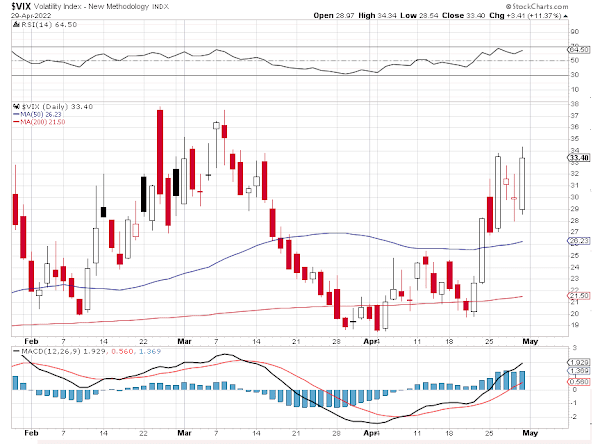

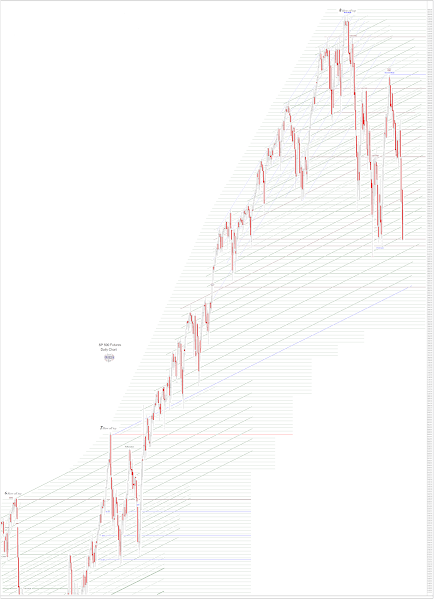

Stocks swooned to set those second lows without much doubt now.

Gold and silver rallied, but were neatly knocked back down into the close.

The Dollar fell from its recent lofty heights, but still remains fairly lofty all things considered, mostly the Yen and the Euro.

A bounce in the major stock indices at this point is customary, perhaps after some more dithering around.

And let's hope it succeeds at making a higher high.

But if not, we'll always have Paris.

Have a pleasant weekend.