"Citigroup Inc.’s London trading desk was behind a flash crash in Europe that sent shares across the continent tumbling after a sudden 8% decline in Swedish stocks. The sell off was triggered by a large erroneous transaction made by the U.S. bank’s London trading desk, according to people with knowledge of the matter who asked not to be identified discussing private information. A knee-jerk selloff in OMX Stockholm 30 Index in five minutes wreaked havoc in bourses stretching from Paris to Warsaw toppling the main European index by as much as 3% and wiping out 300 billion euros at one point."

Bloomberg, Citi’s London Trading Desk Behind Rare European ‘Flash Crash’, 2 May 2022

"Plus ça change, plus c'est la même chose."

Jean-Baptiste Alphonse Karr, Les Guêpes

"The market was thrown into confusion on 2 August 2004 when Citigroup pushed through EUR11 billion in paper sales in two minutes over the automated MTS platform. As the value of futures contracts fell and traders moved to cover their positions, Citigroup re-entered the market and bought back about EUR4 billion of the paper at cheaper prices.

The strategy was dubbed Dr Evil, after the Austin Powers character, in an internal e-mail circulated by the traders. Immediately afterwards MTS moved to impose temporary limits on the value and volume any one dealer can push through the system at a time. MTS also suspended Citigroup from trading on its bond network for one month after finding that the UK bank breached certain market regulations."

Finextra, Citi bond traders indicted over 'Dr Evil' trade, 19 July 2007

"In a community where the primary concern is making money, one of the necessary rules is to live and let live. To speak out against madness may be to ruin those who have succumbed to it. So the wise in Wall Street are nearly always silent. The foolish thus have the field to themselves. None rebukes them."

John Kenneth Galbraith, The Great Crash of 1929

Seriously, how can one expect a multi-billion dollar trading platform or its regulators to bother with safeguards and protections against sociopathic rogue traders or systemically critical 'typos.' LOL

The watchdogs of the fourth estate was too busy swooning over the international cast attending the Michael Milken conference at the Beverly Hilton to be concerned about any of these market-busting, existential questions.

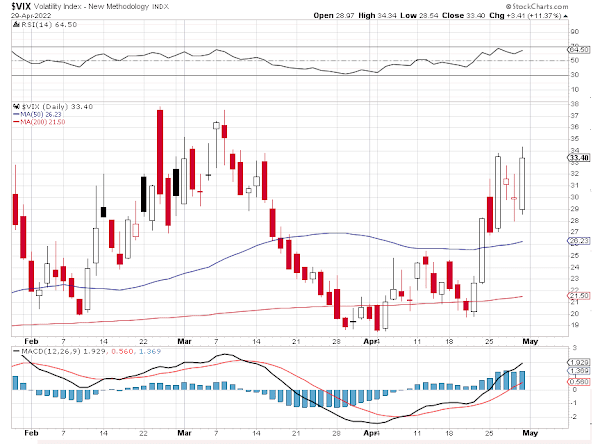

Stocks were slumping hard today, confirming those lower lows.

And then we saw a miraculous bounce in the afternoon to take them back to the green.

Sounds like a bit of bottom dithering and then a bounce.

Who could have seen that coming?

Gold and silver were slammed today, ahead of the FOMC on Wednesday and the Non-Farm payrolls on Friday.

What a surprise.

Although silver bounced back a bit in sympathy with equities.

The dollar bounced back up to the higher 103 handle.

What will they think of next?

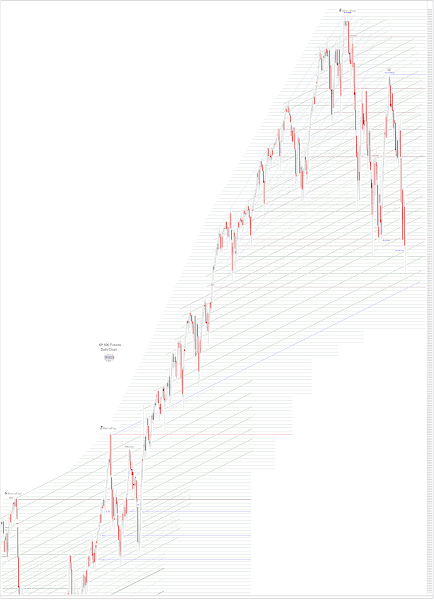

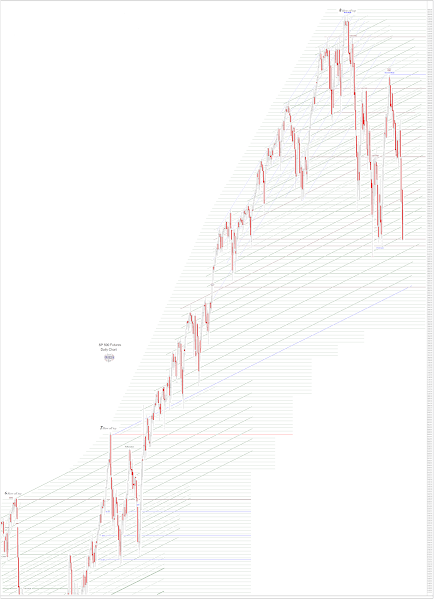

Below is an update to the market dislocation 'CrashTrak' model.

As a reminder, major market dislocations are low probability events, even at this stage.

And we are not looking at the number of times that the markets have traced this pattern, and it has not worked out to a major further decline.

The next two steps in this model are by far the most important. So far this is just flirting with disaster.

And as always, we may recall that we are in the modern era of major market intervention with easy money.

Have a pleasant evening.