“Panics do not destroy capital; they merely reveal the extent to which it has been previously destroyed by its betrayal into hopelessly unproductive works”.

John Stuart Mill

“The second factor contributing to speculative euphoria and programmed collapse is the specious association of money and intelligence. There can be few fields of human endeavor in which history counts for so little as in the world of finance.”

John Kenneth Galbraith, A Short History of Financial Euphoria

"The bankers are going to be unrelenting in their attacks on the middle class and the poor. The attacks are threefold:

1. resisting financial and political reform which caused the crisis in the first place. Three years after the crisis and no major player has even been indicted, the bonus system is flourishing again, and politicians are taking many millions in funds from the bankers and wealthy elite to promote their agendas.

2. blaming the victims, and compelling them to take the greatest pain of the bailouts, and continuing bailouts and subsidies to the financial class through spending reallocations. The bailouts and spending on the military industrial complex are crowding out the fundamental public functions of government.

3. shifting the impulse to reform from financial reform to 'tax reform' that further supports the monied interests. Cut taxes for the wealthiest as your primary agenda using a variety of deceptive means like promoting a consumption tax, or a flat income tax but with offshore havens and loopholes,

Jesse, Of the 1%, By the 1%, and for the 1%, 9 April 2011

"The suspicions that the system is rigged in favor of the largest banks and their elites, so they play by their own set of rules to the disfavor of the taxpayers who funded their bailout, are true. It really happened. These suspicions are valid.”

Neil Barofsky, TARP Inspector General

It is ironically funny and even remarkable when ordinary people get all exercised about relief for those crippled by monopoly turbocharged medical bills or the interest on credit card debt, when they just stand slack-jawed and silent while Wall Street literally takes trillions in bailouts and subsidies, cheapening the currency and transferring the wealth of a generation to themselves.

And not only that, they self-righteously and vociferously stand for those who are the enablers for the con men that have been robbing them blind for the past thirty years.

“Persuading the people to vote against their own best interests has been the awesome genius of the American political elite from the beginning.”

Gore Vidal

Stocks were in rally mode today, although the action was a bit more subdued than last week.

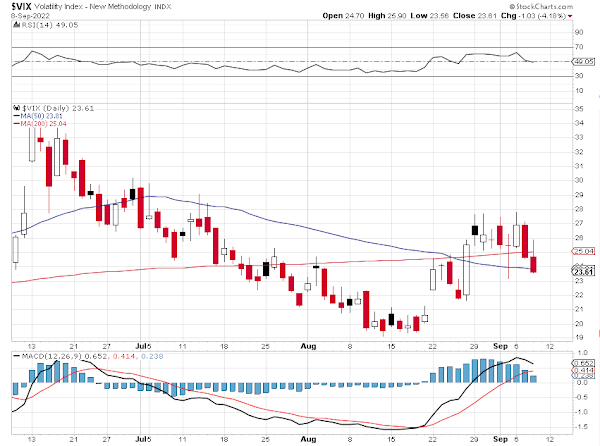

VIX ticked a bit higher.

Gold and silver popped early as the Dollar declined.

Gold gave back a chunk, but silver was once again rallying higher, hitting $20 intraday.

Physical silver inventories in London continue to plummet.

CPI tomorrow. An extreme read could move markets.

Let's see if the rally in the metals can continue.

Have a pleasant evening.