"While everyone enjoys an economic party the long-term costs of a bubble to the economy and society are potentially great. They include a reduction in the long-term saving rate, a seemingly random distribution of wealth, and the diversion of financial human capital into the acquisition of wealth."

Larry Lindsey, Federal Reserve Governor, FOMC Minutes, September 24, 1996

"The crash has laid bare many unpleasant truths about the United States... Recovery will fail unless we break the financial oligarchy that is blocking essential reform."

Simon Johnson, The Quiet Coup, May 2009

“I recognize that there is a stock market bubble problem at this point, and I agree with Governor Lindsey that this is a problem that we should keep an eye on... We do have the possibility of raising major concerns by increasing margin requirements. I guarantee that if you want to get rid of the bubble, whatever it is, that will do it.”

Alan Greenspan, Federal Reserve Chairman, FOMC Minutes, September 24, 1996

“When you live under such an oligarchy, there is always some crisis or the other that takes priority over boring stuff such as healthcare and pollution. If the nation is facing external invasion or diabolical subversion, who has the time to worry about overcrowded hospitals and polluted rivers? By manufacturing a never-ending stream of crises, a corrupt oligarchy can prolong its rule indefinitely.”

Yuval Noah Harari

"Confusing a targeted audience is one of the necessary ingredients for effective mind control. The eternal demagogue will arise anew. He will accuse others of conspiracy in order to prove his own importance. He will try to intimidate those who are neither so iron-fisted nor so hotheaded as he, and temporarily he will drag some people into the web of his delusions. With his emotionalism and suspicion, he will shatter the trust of citizens in one another."

Joost Meerloo M.D., The Rape of the Mind, 2015

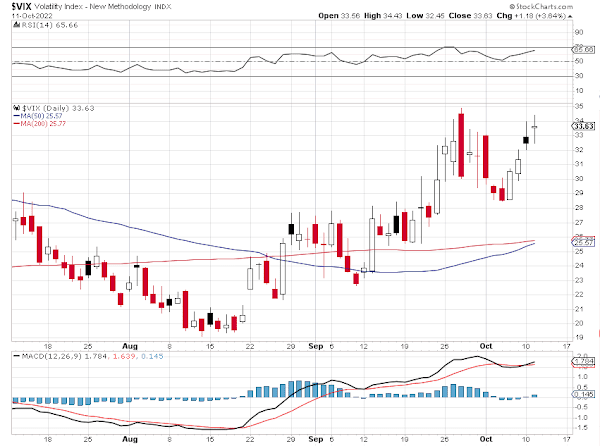

Stocks attempted to rally, again.

And then fell again, testing the prior low.

Gold was up slightly while silver fell a bit with the recessionary fears driving stocks.

Inflation and Fed concerns are driving markets, obviously.

The PPI came in a little hot this morning.

CPI tomorrow.

I am holding a little short term gold position but overall I will stick to the high ground.

Have a pleasant evening.