"Wall Street did not accidentally run a barge aground and leave a small oil slick on the Hudson River. Wall Street did not accidentally release tainted lettuce that sickened a few dozen people. What Wall Street did was intentional and criminal: it financially engineered a toxic subprime house of cards which it knew from its own internal reviews was going to collapse; it then molded the toxic product into inscrutable bundles; it sold the bundles to unsuspecting investors around the globe while making side bets that it would all come crashing down.

Then, after causing the greatest financial collapse in the United States since the Great Depression, Wall Street’s unrepentant scoundrels paid themselves billions of dollars in bonuses with taxpayer bailout funds. The 2007-2009 financial crash was more than the product of greed. There was both knowing and criminal wrongdoing, but none of those responsible have gone to jail. None of the regulatory gaps that allowed this to happen have been rectified. The biggest Wall Street banks have grown even bigger and remain too-big-to-fail."

Wall Street On Parade, The Power Players Behind Silencing Wall Street Reform, October 18, 2017

"Each time banks fail, by bailing the system out again, we teach our finance sector a lesson: you can safely take too much risk because, when you lose, the taxpayer will pick up the bill. Such a system is destined to fail, but the party can run for a long time."

Simon Johnson and Peter Boone, Economic Donkeys, 19 September 2009

"Moral hazard is the probability that a party insulated from risk will behave differently from the way they would behave if fully exposed to the risk. Moral hazard arises because an individual or institution does not bear the full consequences of its actions, and therefore has a tendency to act with increasing recklessness, literally 'without reckoning." It also encourages the rise to power of the sociopath in the affected organizations.

Unfortunately there is a small but powerful oligopoly of privilege that is trying to project themselves onto the global stage while believing that they are immune to ordinary consequence, and have become addicted to the notion that 'others must pay' for their failures.

Moral hazard comes from rewarding bad behaviour in markets with wristslaps and bailouts. It is a danger to the economy and to the public."

Jesse, Moral Hazard, 22 March 2008

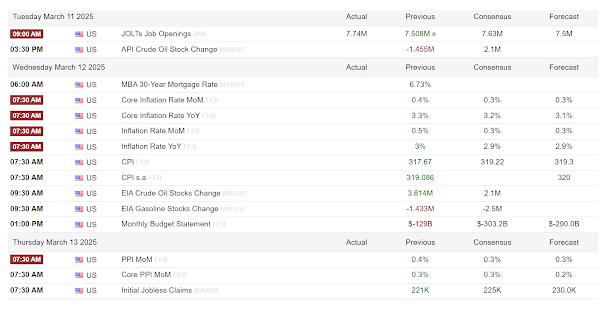

Today was a risk off day, with the commensurate flight to safety that occurs sometimes when the dawn of reason breaks through the fog of the mispricing of risk.

VIX surprisingly did very little. This to me is a strong sign that this, at least for now, is a managed unwinding of bubble assets by a select group of relative insiders.

The Dollar rose.

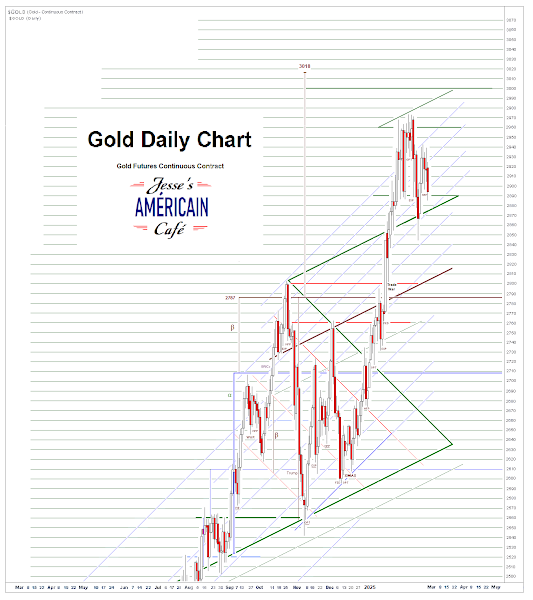

Gold and silver soared.

Gold futures continuous contract tagged the 2999.7 level today before close a few dollars lower.

Silver took out the prior managed resistance and just thrashed it with some authority.

That Gibraltar of safe havens, Bitcoin, fell back down to the 80,000 level.

Like fools, a new meme coin seems to be born every minute, severely diluting the hot money crowd.

Stocks are hitting some 'must hold' levels. The slow managed decline suggests that we may not be done with this unwinding, flash relief rallies notwithstanding.

To their credit the attempts to halt the Ukraine proxy war is well appreciated by anyone who is not a slavering neocon.

Otherwise Trump and His Merry Grifters seem to be stressing the global monetary and political system, with what appears to be gratuitous showboating, and not of particular benefit to the broader American public.

Moral hazard is not a purely economic function. It applies to those who wield power more generally as well.

Have a pleasant evening.

.jpg)