"One of the most important barometers of the world's financial health could be sending false signals. In a development that has implications for borrowers everywhere, from Russian oil producers to homeowners in Detroit, bankers and traders are expressing concerns that the London inter-bank offered rate, known as Libor, is becoming unreliable.

[See below: It was subsequently shown to be fraudulent.]

Libor plays a crucial role in the global financial system. Calculated every morning in London from information supplied by banks all over the world, it's a measure of the average interest rate at which banks make short-term loans to one another. Libor provides a key indicator of their health, rising when banks are in trouble. Its influence extends far beyond banking: The interest rates on trillions of dollars in corporate debt, home mortgages and financial contracts reset according to Libor.

In recent months, the financial crisis sparked by subprime-mortgage problems has jolted banks and sent Libor sharply upward. The growing suspicions about Libor's veracity suggest that banks' troubles could be worse than they're willing to admit."

Carrick Mollenkamp,

Bankers Cast Doubt On Key Rate Amid Crisis, Wall Street Journal, April 16,2008

"I've been hesitant to write about the LIBOR scandal because what I want to say goes so much further. We now know that Barclays and other major global banks have been manipulating the calculation of LIBOR through the quotation data they provided to the British Bankers Association. What I suspect is that this is not a flaw but a feature of modern financial markets. And if it was happening in LIBOR for between 5 and 15 years, then

the business model has been profitably replicated to many other quotation-based reference prices.

Price discovery is not a sexy function of markets, but it is critical to the efficient allocation of scarce capital and resources, and to the preservation of the long term wealth of investors and the economy as a whole. If price discovery is compromised by manipulation, then we will all be gradually impoverished and the economy will be imbalanced and unstable."

London Banker,

Lies, Damn Lies, and LIBOR, 10 July 2012

"The Commodity Futures Trading Commission (CFTC) has been negligent in failing to terminate the obvious manipulation ongoing in silver. Furthermore, the agency may be complicit in this manipulation. Worse, it has lied to the public and elected officials. This all goes back to the time when Bear Stearns was taken over by JPMorgan in March of 2008.

It is well known that Bear Stearns went under as a result of a sudden loss of liquidity amidst a run by creditors and customers. What is not well known is that those problems were greatly exacerbated by a $2 billion margin call on silver and gold short positions from the end of December 2007 to March 2008. I believe the silver and gold margin calls were at the heart of Bear Stearns’ failure.

We know now (from CFTC correspondence to lawmakers in 2008) that JPMorgan took over Bear Stearns’ giant silver and gold short positions on the COMEX. Up until that time, we did not know that Bear Stearns was the concentrated silver and gold short. Using Commitment of Traders Report (COT) data, Bear Stearns had a COMEX silver short position of no less than 35,000 net contracts and a COMEX gold short position of no less than 60,000 net contracts from the end of December 2007 to their takeover by JPMorgan two and a half months later.

From December 31, 2007 to mid-March 2008, the price of silver rose by $6 (from $15 to $21) and the price of gold rose from $850 to over $1000. Based upon the number of contracts held short by Bear Stearns and the price movement at that time, that resulted in margin calls of $2 billion. I would contend that was the real reason for Bear Stearns’ demise."

Ted Butler, Illegalities, May 25, 2012

"The key to a general reform has been and still is campaign finance reform and a reduction of lobbying payments and campaign contributions as soft bribes to Congress. As the banks cannot regulate and reform themselves, at least according to John Mack's recent advice to the American people, so the Congress and the federal government seem incapable of reforming and managing themselves. If one does it, takes liberties with the law, then they all want to do it to a greater or lesser degree; and in some ways they must if they are to be competitive, if the administration of justice creates the opportunity for selective exceptions, the weakening of regulation.

And too many are yearning for a strong leader, someone who will tell them what to do. A great man, who will exercise authority with a directness and little or no discussion. Someone who will 'put things right.' The primary question seems to be less policy than fashion, whether to wear brown shirts or black, and whether torchlight is too retro."

Jesse, A Partnership Between Wall Street and Government Until the System Collapses, 19 November 2009

And the wash and rinse continues.

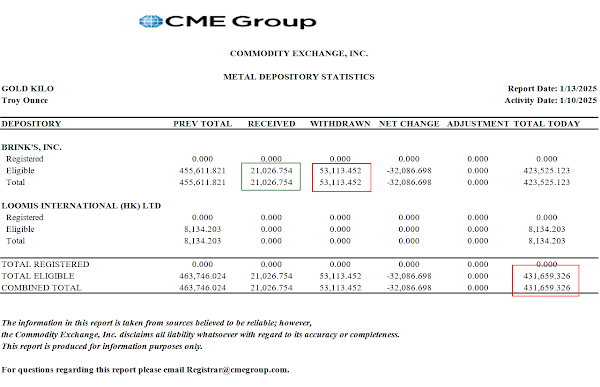

I came in prepped for the post Non-Farm Payrolls kickback wash cycle.

Gold and silver were slammed this morning.

The Dollar gained a little in a mostly sideways chop.

VIX fell.

Stocks fell sharply but managed to take back their losses into the afternoon close.

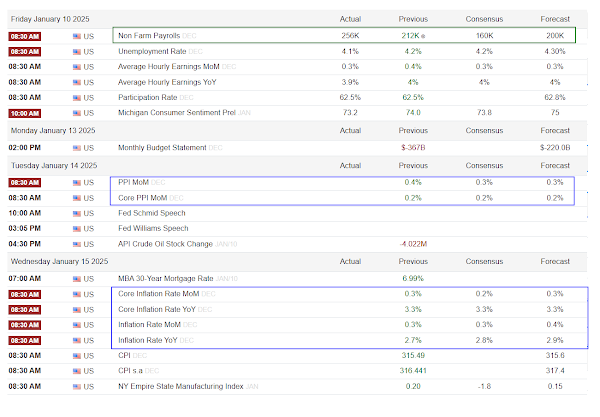

Keep an eye on the option expirations and the upcoming CPI and PPI numbers.

Wouldn't it have been nice if, instead of throwing away hundredsof billions of dollars in corrupt adventures in proxy wars, theft, and murder en masse overseas, we had spent a portion of that money on hardening the US infrastructure, including the water systems, public transportation, energy independence and the electric grid?

“The worst crimes were dared by a few, willed by more, and tolerated by all.”

Tacitus

This is why nations, and empires, fail.

Have a pleasant evening.

Related: Corruption as an Element of the Financial Crisis, Le Cafe, February 2009