And so the Fed raised rates, in the manner in which you would have expected if you frequent this site.

We are not quite out of the woods yet since the markets are certainly not transparent and efficient by any means, and this Friday is a quad witch. While it does not directly involve the metals at The Bucket Shop, it certainly has plenty of intermarket connections through the miners and the ETFs.

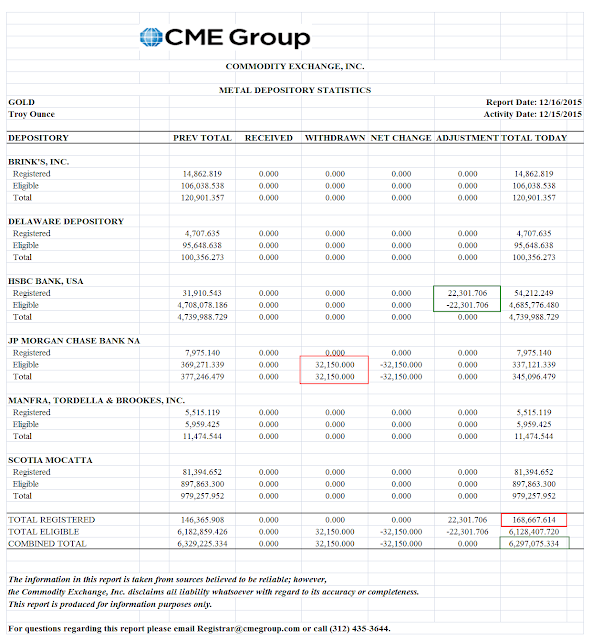

There was another handoff of gold from the house account of HSBC to the house account of JPM.

I suspect at some point if we get some customer who is willing to stand for delivery, JPM is the designated stopper.

The other day I read a fairly contrived comparison of the Comex Hong Kong to The Bucket Shop that was so twisted out of meaning as to be almost grotesque

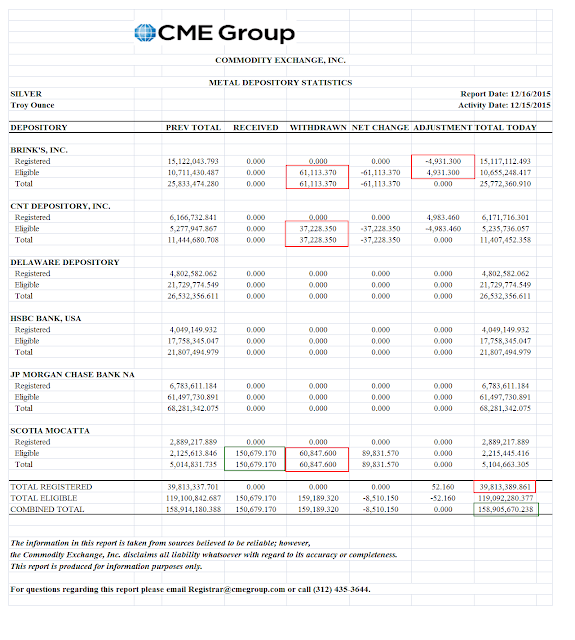

To elaborate, as you may notice I often include the 'loco Hong Kong' Comex licensed warehouses in the gold reports each day, of which at this time Brinks is the only one of note.

And as you may have further noticed, there is no 'registered' category for the gold bullion there, and large quantities of it tend to get taken out of the warehouse(s) on a fairly regular basis. So obviously comparisons of the 'leverage' feature, or potential claims per ounce at a given price from The Bucket Shop is meaningless.

The reason why is that the Comex Hong Kong, such as it is, is not really in practice a paper market dealing in synthetic gold that fluffs around between players, rarely going anywhere. Rather, it is significantly an 'over-the-counter' market in which, and such a thing is hard to believe these days, customers actually BUY gold and take it out of the warehouse to be used in some manner other than for wagering.

I am wondering if Harriet H., the Ex-Executive Director of the Comex who just took a permanent and unexpected departure from her position, had set this one up, much to the chagrin of the synthetic gold crowd. It certainly does most thing in quite the opposite manner from New York.

Have a pleasant evening.