"Make no mistake about it, just as Lehman Brothers was set up to take the fall for triggering the 2008 collapse, China is being groomed as the new scapegoat for the coming crisis. But China’s economic slump is only a symptom, not the disease...

The reality is that the repeal of Glass-Steagall ushered in the greatest wealth transfer scheme in the history of America, allowing six mega banks in America to control the vast majority of insured deposits, use those taxpayer-backed deposits to gamble for the house, loot the bank from the inside by paying billions of dollars to select employees and customers and then hand the gambling tab to the taxpayer when the casino burns down. This model is a staggering headwind on both U.S. and global growth because it has created the greatest wealth and income inequality since the Great Depression.

Pam and Russ Martens, The Real Reason Global Stocks Are Flashing Red this Morning

Gold benefited from a fairly obvious 'flight to safety' today, even though it was clipped a bit in the afternoon as stocks rallied back in what felt like a technical bounce.

Silver had a little upside but not nearly as much. It is not a flight to safety metal in the same manner as gold, in part because of its dual nature as both monetary and industrial.

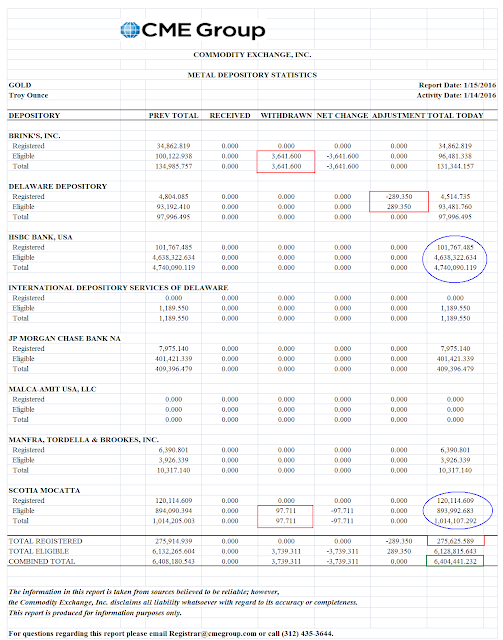

When things really fall apart you will know it, because gold, real gold, will go to an absolute scarcity that may be shocking.

Sooner or later, everyone sits down to a banquet of consequences.

Have a pleasant evening.