"But seeking to justify himself, the scholar of the word and the law asked Jesus, 'And who is my neighbor?'"

Luke 10:29

The modern gospel of personal prosperity and selective privilege, exceptionalism by whatever criteria a group may choose to exclude and oppress the other, although it has appeared throughout history many times and in many forms, may be one of the worst and most insidious sins against the Spirit.

"But I just want to be left alone!" Truly, if you choose to live as this, you will be excluded and left alone, for all time.

August may be a big month for the metals, and we could see a taste of things to come next week with a Comex PM option expiry and an FOMC decision.

The Fed is either going to raise rates next week, or after the November elections. They really would like to raise at least an additional 25 basis points, but may not have adequate cover from the economic results to do so. And few expect them to raise more than one more time this year, so it would be a bit of a giveaway if they did now.

As you know, the Fed's interest rate 'policy' at this point has more to do with their own policy implementation mechanics, and much less than with the real economy, which quite frankly they have been neglecting for a the past couple of decades. They are mesmerized and captured by 'the system.'

Obama's remarks today in his joint news conference with the Mexico President Enrique Peña Nieto were a magnificent example of the credibility gap in action. President Obama waxed poetic about how great things are, and what a boon to the economy that NAFTA has been, and that the TTP will be.

The irony is that the Democrats may enable the presidency of Donald Trump by nominating one of the weakest candidates possible to run against his anti-establishment sentiment. For Hillary, whatever else she might be, is the poster child for crony capitalism.

Several have been coaxing me to give an impression of where I think gold might go over the next four weeks or so. This is a mug's game really, because even if one gets it directionally correct, the magnitude and the timing of such short term moves is almost impossible to forecast more than a few days out. And then there are the absolutely unpredictable exogenous events that can move markets dramatically.

But in general, I think gold will end the year higher than where it is today, barring unforeseen events, and possibly much higher. It really depends on if and when it can break out of its current ranging trend.

To say how it gets there is quite a task, but down, up, down, up, down, and up, up, and away are not a bad for an educated guess. The timing on this is really beyond mortal knowledge, but many will make up for it by predicting a break out every week, and count it as a score when they are finally right.

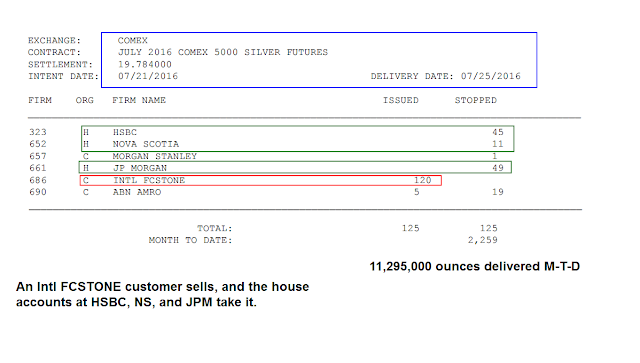

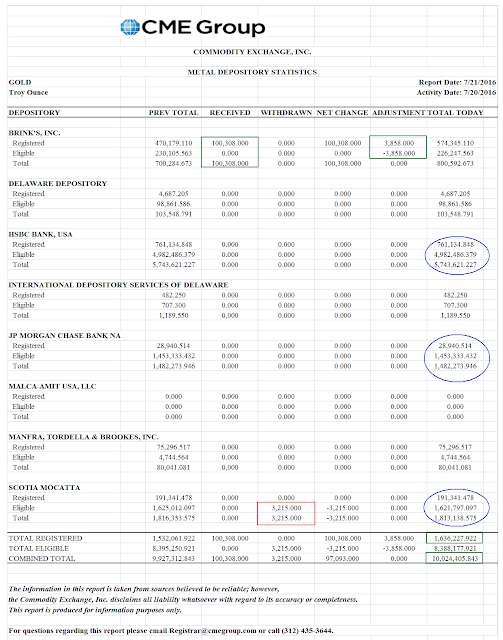

I think we will see a lot of chop and 'shenanigans' as the bullion banks and their monetary masters struggle to manage the leveraged paper against a shrinking pool of physical bullion. When the tipping point comes in this is hard to predict with any accuracy, but when it comes you will know it.

Have a pleasant weekend.