"Those among the rich who are not, in the rigorous sense, damned, can understand poverty, because they are poor themselves after a fashion; but they cannot understand destitution. Capable of giving alms, perhaps, but incapable of stripping their own souls bare, they may be moved to the sound of beautiful music, to Jesus’s sufferings, but His Cross, the reality of His Cross, will horrify them."

Léon Bloy

“Woe to you, learned scribes and the elite— hypocrites! For you are like whitewashed tombs which appear beautiful, but inside are full of dead men’s bones and all corruption. You outwardly look righteous, but inside you are full of hypocrisy and wickedness."

Matthew 23:27-28

"My name is legion, for we are many."

Mark 5:6

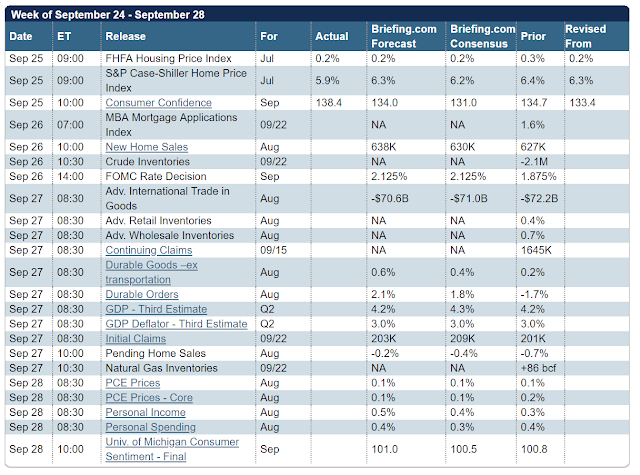

The Fed raised its benchmark rate by 25 bp today. The market had indicated a 100% probability of this according to the common measures.

They also removed the word 'accommodative' from their statement, which means pretty much nothing.

Stocks initially rallied higher, strongly.

And then Jay Powell, the Fed chair, conducted his press briefing. And the stocks plunged, led by the banking stocks.

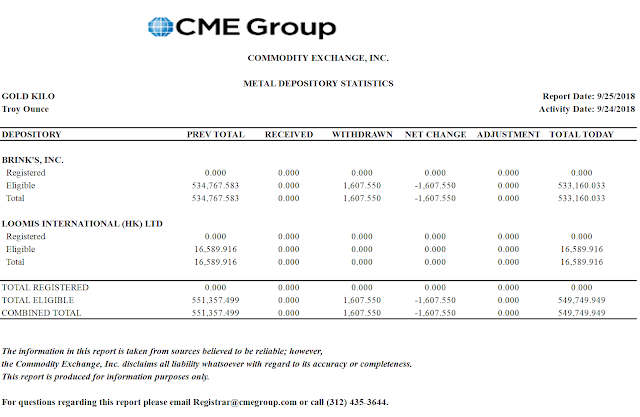

Gold and silver finished a bit lower, while the Dollar was slightly higher after an initial plunge.

Tomorrow the boob tube will be transfixed with the testimony with regard to the Supreme Court nomination of Kavanaugh, and accusations with regard to his character.

Someone on MSNBC today said that this was 'unprecedented.' Are you kidding me? They seemed too young to remember the Clarence Thomas, Anita Hill testimonies in 1991. And who bothers to read history these days in the United States of Amnesia.

The testimonies absolutely transfixed the nation each night on television, and in prime time. One night the people were given one perspective of things that happened, and the next night it was a a complete denial and reversal of opinion. I was old enough to have followed it. It was like a soap opera.

Our elite, and the pampered princes of privilege, are a legion of swine, infesting cities of whited sepulchers.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant evening.