"God has created me to do Him some definite service; He has committed some work to me which He has not committed to another. I have my mission. I may never know it in this life, but I shall be told it in the next....

I am a link in a chain, a bond of connexion between persons. He has not created me for naught. I shall do good, I shall do His work; I shall be an angel of peace, a preacher of truth in my own place, while not intending it, if I do but keep His commandments and serve Him in my calling.

Therefore I will trust Him. Whatever, wherever I am, I can never be thrown away. If I am in sickness, my sickness may serve Him; in perplexity, my perplexity may serve Him; if I am in sorrow, my sorrow may serve Him. My sickness, or perplexity, or sorrow may be necessary causes of some great end, which is quite beyond us. He does nothing in vain.

He may prolong my life, He may shorten it; He knows what He is about. He may take away my friends, He may throw me among strangers, He may make me feel desolate, make my spirits sink, hide the future from me --still He knows what He is about."

John Henry Newman, Meditations and Devotions

08 June 2013

Weekend Reading

07 June 2013

Gold Daily and Silver Weekly Charts - 'When the Music Stops'

The metals were hit with a fairly determined bear raid today for two reasons:

a) it was a Non-Farm Payrolls day with a weak number (as I suggested last night)In the late stages of a system in decay, there is a great deal of formula and ritualization in what were once considered meaningful actions.

b) it was a Friday.

That is it. Nothing more, nothing less. It was as expected. Nothing has changed.

People underestimate the depths of greed and uncaring selfishness that predominate in the cultures on Wall Street and, unfortunately, in the government and even universities. And the love of many will grow cold...

They know what they are doing. They do not care. To the extent that they bother to look ahead, they think that when the time comes, they will stick you with their losses.

This evening's Commitments of Traders shows that the four largest commercial traders (banks) are now net LONG gold. With the Comex registered inventory at record lows which generally precede a strong rally the setup is interesting.

Have a pleasant weekend.

h/t Dave in Denver

SP 500 and NDX Futures Daily Charts - 'We Can't Help Ourselves'

I do not know what spin the financial channels put on it, but the Non-Farm Payrolls report was mixed to weak, and enough so to show that all this talk of QE tapering, at least based on a sustainable broad-based economic recovery, is nonsense.

I don't think people quite understand the environment on Wall Street and in Washington as it has become over the past fifteen years.

At least not yet.

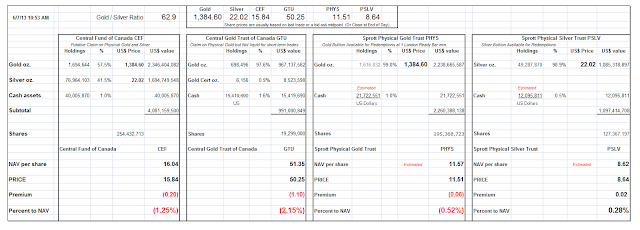

NAV Premiums of Certain Precious Metal Trusts and Funds - Heart of Darkness

The expected bear raid in precious metals occurred as the Non-Farm Payrolls report for May was released.

The report was mixed, although the headline number was somewhat deceptive. I cannot stress enough that the individual monthly numbers have more value for spin and speculation than for real analysis. It is the trends that are important.

Having said that, the headline seasonally adjusted number came in a little on the high side. But that was achieved with an equally significant downward adjustment in the prior month, so it was pretty much a wash. Jobs growth remains sluggish.

The unemployment rate ticked up. The manner in which unemployment is measured does not work well in a period of protracted unemployment where those whose benefits expire are eliminated from the count. Labor Participation Rate is a much more meaningful measure. And that measure is not good.

Hardly anyone mentioned the fact that hourly earnings came in flat, at zero growth. There will be no sustained recovery until the wage situation improves for those who provide the bulk of consumption for GDP.

The Birth Death model came in spot on at 205,000 jobs added to the raw number. The average of May for the prior two years is 208,000. I think this Birth Death model is just a further means of 'adjusting' the number. It does not appear to be based on any empirical data. At least they break it out so we can keep an eye on it.

I see where Steve Schwarzman, the CEO of Blackstone, has founded a scholarship program for promising Western students to pursue their business degree in China to gain insights from their management models and business methods. It is being pretentiously likened to the model of Cecil Rhodes' famous scholarship program at Oxford that spawned Bill Clinton. I wonder what the section on warehousing workers in mind-numbing firetraps will be called.

It was a little embarrassing to see Wesley Clark and Colin Powell, some of the political celebrities who feed at the Blackstone watering hole, rolled out for a favorable endorsement. One shrinks a bit, if they can recall the last time Mr. Powell was utilized to provide an endorsement, then at the UN, for another, greater act of foreign adventure based on shaky premises. How are the mighty fallen.

The students will be housed in a special unit at Schwarzman College with extra care given to the filtration of the air and the water, and unfortunately, the Internet. I wonder if it will be called Kurtz House.

“We penetrated deeper and deeper into the heart of darkness.”

Joseph Conrad

Comex Registered Gold Inventory Continues Its Decline - Fat Tails

Comex registered gold levels continued their decline to the sub 1.5 million ounce level.

As you know tomorrow is Non-Farm Payrolls day in the US.

The trading desks typically like to hit gold and silver with a bear raid on a day like that, especially if there is a whiff of QE to come.

There is quite a bit of gold sitting in the eligible category at the Comex. Let's see what it will take to get the owners of that bullion to consider parting with it.

There are 2,950 gold contracts remaining open for June, for the equivalent of 295,000 ounces. So there is certainly plenty of room for the wiseguys to keep pressing their luck. Although we must remember that as easy as it may be to transfer bullion from the eligible to the registered category, the reverse of that process is also present. Owners of eligible bullion may change the status of their bullion to 'not offered for delivery' or eligible, not registered.

While the music keeps playing, they must keep dancing, as former CEO Chuck Prince of Citigroup said during the run up to the recent financial crisis in 2007.

There are a total of 374,891 gold contracts open now representing 37,489,100 ounces. Of those 214,870 contracts are open for the next active delivery month of August representing 21,487,000 ounces.

The average daily volume of trading is about 165,000 contracts, representing 16,500,000 ounces.

Very few contracts are ever taken to delivery. The price setting mechanism for the global gold market these days is largely a paper exercise involving little actual metal ever changing hands.

While this facilitates speculative interests, it is hard to rationalize how this depth of liquidity and volatility, without ties to fundamental anchors of supply and demand in the real world, provides any real benefit to producers and consumers who wish to obtain products and hedge risks.

I think that the exemptions that were granted to some institutions which are neither legitimate producers and users of the commodities, or representatives of producers and users, has financialized the markets to an extraordinary degree.

The lack of effective position limits and disclosures for the basis of very large positions, specifically in the silver market for example, is setting up a potentially volatile situation. And that is surely visible to other organizations and entities around the world.

To continue to ignore this is probably not a wise policy. A single announcement by a large organization or even a foreign entity could have a deleterious effect on the quality of confidence in these highly leveraged markets that deal in products with real world consequences. A loss of confidence is easier to avoid than to repair.

There is big money to be made with leverage. And that causes reforms to be resisted, and regulators to bend to the political and ideological pressures of the monied interests.

These things can go on like this for quite some time. And they normally do, in normal times.

Let's see what happens.

Category:

comex warehouse

Subscribe to:

Comments (Atom)