Remember this chart?

This is the cup and handle formation that led to the big breakout and rally in gold, the point from which gold 'slipped the leash.'

And here we are testing that handle again.

Each time they smack down the paper prices of gold and silver, they free up bullion from GLD and SLV. I wonder who decides where and how that bullion is sold into the market.

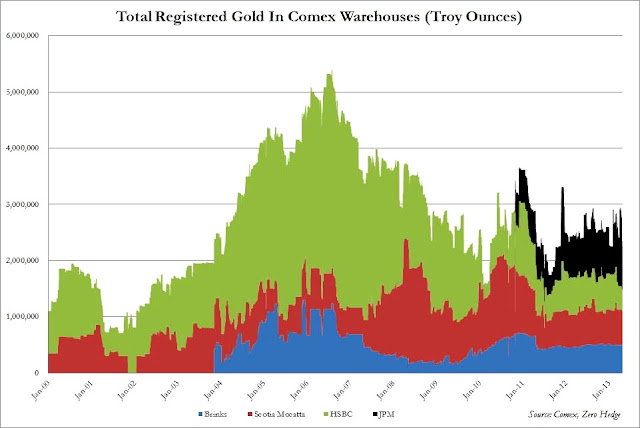

With TOCOM and COMEX scraping the bottom of their deliverable inventory, and big drawdowns on the customer inventory held at JPM, the release of tonnage from the ETFs matters.

Who is the custodian for GLD again? Oh yeah.

If and when gold finds a footing, it will be interesting to see who is holding bullion, and who has had it stripped away by this price operation that started in October of last year.

I suspect its purpose was 'to save the system' which is another word for the Banks who were caught short on that big run higher.

But this is all for conjecture for now. Let's see what happens when it happens.