05 November 2014

Why The Democrats Got Their Clocks Cleaned

The Democrats failed to make the most of a great moment in history because there was no Democrat brave enough, independent enough, to energize their party around the mandate for reform given to them overwhelmingly by the people in 2008.

Remember when everyone thought that the Republican party was dead, completely and utterly repudiated in 2008? And how they have risen from the dead!

Obama was a pawn of the moneyed interests before he even took office. He didn't sell out; he was a well engineered product with a well targeted brand, selected and groomed for it.

Less a politician than a thoroughly modern manager, Obama's primary objectives are to please his shareholders, whomever those may be. And they were certainly not the people who voted for him. He is not any kind of progressive or reformer once one scratches the surface.

That became clear in his first 100 days with his appointments. And in his defense, the Democrats on the whole have been throwing their constituents under the bus for the sake of Wall Street money since 1992. So Obama was not so much a betrayer as a fake, a member of the Wall Street wing of the Democratic party. He is always fumbling, and making excuses, but at the end of the day, he did as he was told.

The Democratic leadership has tried to bridge a gap between representing the people and fattening their wallets, and have ended up pleasing few. They won't become the party of the moneyed interests because they cannot sell out more deeply than their counterparts. And as for their traditional constituency in the working class, the only rejoinder is, 'the other guys are worse.' And the other guys say the same thing to their base about them. And no one is getting served, except the one percent.

I think that the 'other guys' are going to be worse, and people are just going to have to see how bad things can get, again, before they can get any better.

From an FDR 1936 campaign speech in Madison Square Garden:

"For nearly four years you have had an Administration which instead of twirling its thumbs has rolled up its sleeves. We will keep our sleeves rolled up.We had to struggle with the old enemies of peace—business and financial monopoly, speculation, reckless banking, class antagonism, sectionalism, war profiteering.They had begun to consider the Government of the United States as a mere appendage to their own affairs. We know now that Government by organized money is just as dangerous as Government by organized mob.Never before in all our history have these forces been so united against one candidate as they stand today. They are unanimous in their hate for me—and I welcome their hatred.I should like to have it said of my first Administration that in it the forces of selfishness and of lust for power met their match. I should like to have it said of my second Administration that in it these forces met their master."

Category:

corporatism,

Crony Capitalism,

money corruption,

political corruption

NAV Premiums of Certain Precious Metals Trusts and Funds

Some are asking why there is a such a deep discount to net value on the Central Funds. I think the answer is fairly simple and I think I have explained this before.

There is no coincidence that there is a reasonably simple redemption facility in the Sprott Funds, and there is none in the Central Funds.

If one wishes to 'unlock the premium or discount' in Sprott all they have to do is to take delivery of some bullion.

How does one unlock the value in the Central Funds in the short term if the discount gets 'out of bounds' with historical norms?

The answer is that one does not. The only way to unlock the NAV is if the unit values rise and one sells the units. It works in a time of rising prices, but lacks 'teeth' in a period of falling metal prices.

Otherwise that value is only theoretically unlocked upon the funds liquidation, and distribution of assets to unit holders. They pay no dividend, and there is no redemption facility.

And this makes them a very safe short, and a somewhat problematic safe haven. And so when the metals are under pressure, they can be under quite a bit of pressure through market gamesmanship.

Do people short the Central Funds by borrowing sufficient shares and reporting them? Is naked shorting forbidden?

Are there any practicable rules for the well connected anymore?

Yes there are hedges that one can engage in to try and bet on a reversion to the norm for the Central Funds. But this is obviously not so efficient is it?

It is easy to make theoretical arguments and to discuss pros and cons. And to refute them, one points to the relative performance of the Sprott funds and the Central funds in the market and says, QED.

I am not saying that the Central Funds are 'bad.' I have purchased them any number of times, especially when some event like a share offering provokes a deep discount temporarily.

But what I am saying is that in a period of protracted weakness, they tend to underperform, unless one thing precious metal markets are bottoming AND one has a longer term time horizon.

But at that point, one also looks to higher beta products in addition, such as miners or royalty streams.

I am merely trying to explain the phenomena, not trying to make a case for anything one way or the other. An investment that is not fraudulent is neither good nor bad, except in terms of some function it is designed to serve in a portfolio. It is like arguing whether a screwdriver or a hammer are inherently good or bad.

There is a redemption risk in Sprott that is not applicable to the Central Funds for example. If someone the paper price of gold became ridiculously out of bounds relative to physical supply, it is a likelihood that there would be a redemption run on Sprott as compared to the Central Funds.

But that seems a bit of a reach, and the market seems to indicate its agreement for now. And at that extreme point the miners with reserves would be soaring so greatly that I doubt many traders would care to waste time debating it.

Category:

NAV of precious metal funds

04 November 2014

SP 500 and NDX Futures Daily Charts - The Pause For Elections

US equity markets were treading water on light economic data and a great deal of speculation about the US midterm elections today.

The big question on the table is whether the Republican Party can take a majority in the Senate.

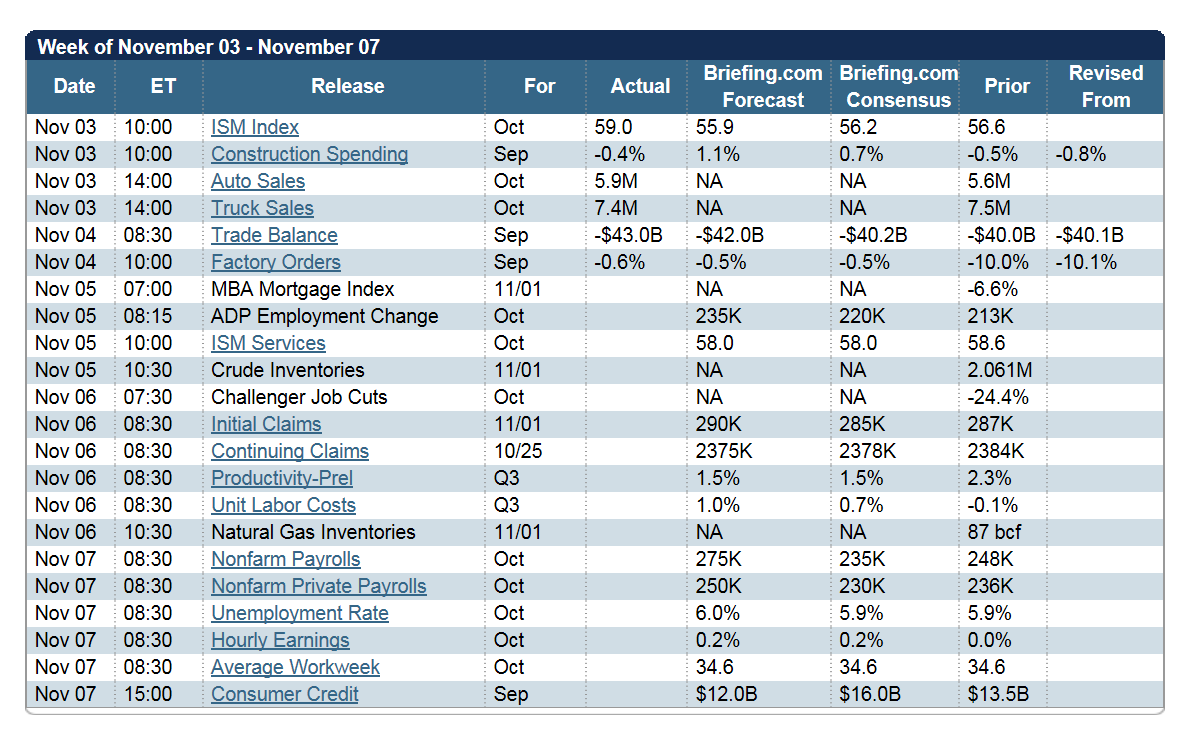

Non-Farm Payrolls on Friday will dominate the economic news this week.

Have a pleasant evening.

03 November 2014

Gold Daily and Silver Weekly Charts - Will the Fed Ever Learn?

"They will act in accord with the proverbs, 'that a dog will return to his own vomit; and the sow that was washed will go back to her wallow in the mud.'"2 Peter 2:21-22

No. The Fed will not learn.

The Fed will keep repeating their policy errors because they are well paid not to learn. And the economic bobble heads will keep agreeing with them and rationalizing their failures. This is the judicious thing to do if you wish to succeed in a disgraced profession, trafficking in expedient fantasies that may last as long as everyone that matters agrees with them.

The Fed wishes for the ECB and the other central banks to do dumb things like they and some of their friends are doing so that they all do the same dumb things together. There is safety in numbers apparently. Hey, we all did dumb things out of good intentions. Who could have known? No one saw the bubble coming. No one could have known that what we were doing was making things worse.

It worked for Greenspan. And it's working for the Banks.

The Fed is a creature of the Banks. Its members are all members of the same 'Club.' They are from the ranks of the financial demimonde, and their livelihoods and privileges are supplied by the financial-political complex.

Insiders never speak ill of insiders. And whistleblowers and reformers are left at the curb. Or tossed under a bus.

As a regulator the Fed is one of the worst possible choices, just a quarter step removed from pure 'self-regulation' by the Banks. The Fed acts as their proxies and manservants.

The recent tapes of NY Fed meetings with Goldman are no surprise, except perhaps to those who live in an illusion of morally superior technocrats, ruling wisely with perfect virtue, cloaked in their models and jargon. And of course, you have no need to know, and could not understand it if you did.

I'm sorry, but this is just not how things are in the real world. The US and UK are caught in an awful credibility trap, and are destined to suffer stagnation and growing inequality until reform comes. And as we have seen in the case of Japan, that can be a very long time.

Speaking of things that make you go what the heck?, on CNBC this morning the assertion was that 'the gold market is not driven by supply and demand. It only responds to fear and greed.' That is, it's only fundamental basis is emotion.

And you know what? In the West, in London and New York, that's true.

The gold and silver markets have the depth and substance of a game of Liar's poker. They are rigged, like most of the other markets with global consequences have been. The precious metals market hasn't been cleaned up yet because the pinheads who are running the scam have no real track record or experience in trading physical commodity markets.

They think they can keep leasing out what isn't theirs and leveraging up ad infinitum, without ever incurring any real world consequences. And the Banks are perfectly willing to take their cuts because they are covered with plausible deniability, just following orders.

But this divergence from reality is not the case everywhere. Certainly not in the Asian and Mideastern markets where some accountability still exists, and delivery tends to imply taking possession.

And in that convergence of these two markets, the physical and the paper, there is both risk and opportunity. When the reckoning comes it is likely to be quite impressive.

There will be a Non-Farm Payrolls report on Friday.

The Comex Delivery Report for Friday is late, as if it is about anything that is actually delivered anywhere but on paper. There was the usual moving around the plate in the silver bullion warehouses. Gold was a snoratorium.

There is speculation now by the economists about when wage inflation will return. They are looking at 2015 for it.

I would point to the Japanese experience of 3.6% unemployment, at least on paper, and a massive underemployment running about 40%, with general wage stagnation and a large portion of the population struggling along on near subsistence wages.

Tell me again what is going to change to allow Labour to demand higher wages from a system totally dominated by two political parties both paid to represent the moneyed interests, driven by an insatiable greed for more?

Change will come, but not from within.

Something will have to happen to bring people back to their senses, and put some humility and a sense of obligation and proportion back into the masters of the universe. I won't go so far as to suggest a sense of shame. Perhaps just respect, if not for the law, then for justice.

What that will be I do not know.

Subscribe to:

Comments (Atom)