"Empires communicate in two languages. One language is expressed in imperatives. It is the language of command and force. This militarized language disdains human life and celebrates harshness and brutality. It demands. It makes no attempt to justify the flagrant theft of natural resources and wealth or the use of indiscriminate violence.

The other language of empire is softer. It employs the vocabulary of ideals and lofty goals and insists that the power of empire is noble and benevolent. The language of beneficence is used to speak to those outside the centers of death and pillage, those who have not yet been totally broken, those who still must be seduced to hand over power to predators.

The road traveled to total disempowerment, however, ends at the same place. It is the language used to get there that is different."

Chris Hedges

30 June 2015

Chris Hedges: A Prayer For Democracy - Town Hall Seattle

Category:

Chris Hedges,

Nec Laudibus Nec Timore

29 June 2015

Gold Daily and Silver Weekly Charts - Capped - The Fog of Currency War

The Lord is my light and my salvation;With the VIX soaring and the US equity markets seeing their first 2% correction in many moons, the capping on the precious metals was determined and obvious.

whom shall I fear?

The Lord is the center and refuge of my life;

of whom shall I be afraid?

Psalm 27:1

So much for 'Greek capitulation.'

I think Syriza realized they were being presented an untenable solution, the 'generous offer' of extend and pretend by Merkel and the Eurocrats, with the IMF playing heavy.

This bailing out of private creditors while extracting a pound of flesh from the Greek people, facilitated by corporate friendly governments, was exactly how Greece came into this situation in the first place.

I thought fomenting a bank closure on Greece by the EU was a bit tough, and probably senseless. Showing them the lash to get them to fall to heel and all that.

Most economic commentators in the US are completely clueless about money these days, and global economics as well.

More surprises will therefore be coming I am sure.

Have a pleasant evening.

SP 500 and NDX Future Daily Charts - 2% Correction, Long Overdue

US equity markets had about a two percent correction, with the SP 500 testing its 200 DMA.

Forget the domestic economic news, it was all geopoliticals and mostly about Greece.

The markets do not like the uncertainty of what will happen in Greece, as well as Puerto Rico and the Ukraine, not to mention the wavering financial assets bubble in China.

I am treading slowly through the commentary and news about Greece. The least helpful are those who are mostly projecting their egos or some ideology.

This is primarily a political problem. Greece has a left wing government that the Western powers find unattractive compared to the puppet governments which have facilitated the bailing out of Greek's private creditors while sustaining an unsustainable economic situation.

I am puzzled by Jeffrey Sachs who suggest that Greek default on their debt, but remain in the Eurozone. I am not quite sure how they might do that, and while Jeff says their is no mechanism to actually kick them out it does seem a bit too cute. The EU does not have a mechanism for forgiving one member's debts and not another's either.

Have a pleasant evening.

NAV Premiums of Certain Precious Metal Trusts and Funds

"Force may make hypocrites, but it can never make converts."

William Penn

Despite unfolding debt crises in Greece, Ukraine, and Puerto Rico, the flight to safety in precious metals is being well managed in the paper markets.

The gold/silver ratio is nose-bleed high.

The premium on Sprott Silver is slightly positive, showing a bit of resistance for those holding physical bullion, even if by proxy.

The confidence game is long in the tooth, and some are not willing to play this time. Much moreso in the physical bullion markets of Asia. They are playing by stacking.

26 June 2015

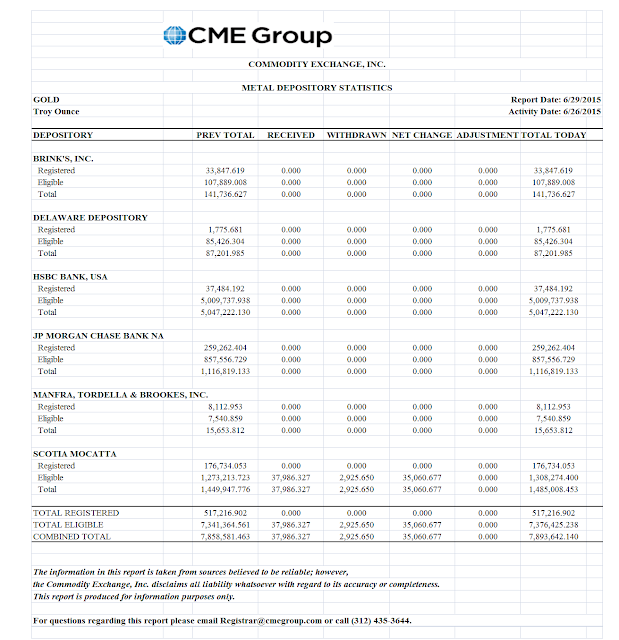

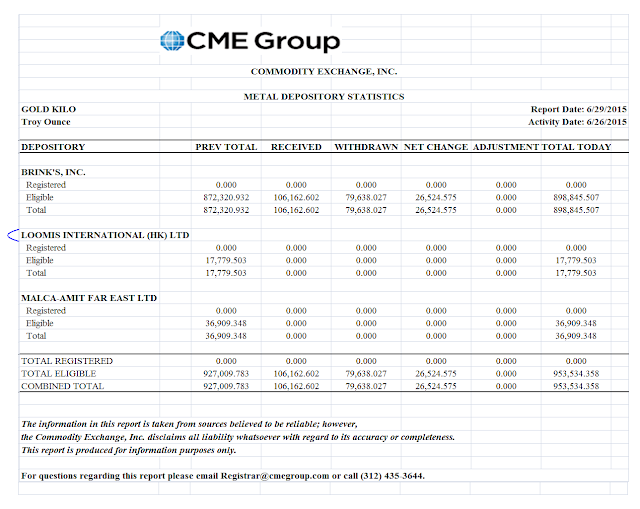

Shanghai Gold Exchange 54.2 Tonnes of Bullion Withdrawn - Total More Than All Official Gold of US

During the latest week there were 54.2 tonnes of gold withdrawn from the Shanghai Gold Exchange.

Since the beginning of 2009 there have been 9,030 tonnes of gold taken out of the Shanghai Exchange into China.

That is more than 290,320,000 troy ounces of fine gold in bars.

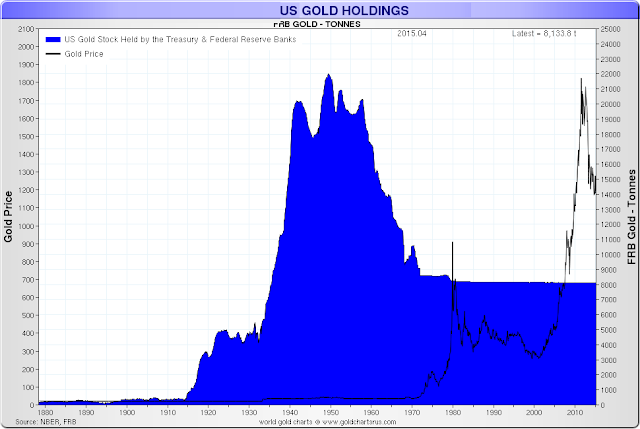

Just for the sake of comparison, as shown in the last chart below, the total official holdings of the United States are about 261,498,926 ounces of gold.

So it does seem that since 2009 more gold has been withdrawn from the Shanghai Exchange than is in all the official holdings, vaults, forts, mints and Federal Reserve Banks of the United States.

Related: Why Shanghai Gold Withdrawals Equal Chinese Gold Demand

Current Report: May 31, 2015

Deep Storage: That portion of the U.S.Government-owned Gold Bullion Reserve which the Mint securesin sealed vaults that are examined annually by the Treasury Department's Office of the Inspector General.

Deep-Storage gold comprises the vast majority of the Reserve and consists primarily of gold bars. (Formerly called "Bullion Reserve" or "Custodial Gold Bullion Reserve").

Working Stock: That portion of the U.S. Government-owned Gold Bullion Reserve which the Mint uses as the raw material for minting Congresssionally authorized coins.

Working-Stock gold comprises only about 1 percent of the Reserve and consists of bars, blanks, unsold coins, and condemned coins. (Formerly listed as individual coins and blanks or called "PEF Gold").

Category:

Shanghai Gold Exchange

Gold Daily and Silver Weekly Charts - China the Wild Card On Gold, Greek Referendum Vote July 5

The Bucket Shop on the Hudson was quiet in this day after precious metal options expiration.

There was intraday commentary here about China's desire to make the yuan a global reserve currency, and some possible implications for gold from the head of Bloomberg precious metals analysis. You may read about that here.

The capping in gold and silver was continuing.

The open interest in silver is now over a billion ounces. This is greater than all annual mine production in the world. As it comes with falling prices, it is most likely initiated by the bears, and is 'undeliverable' at these prices from a purely practical standpoint.

How it resolves will be another matter. But the fact that it exists, apparently unexamined and largely unremarked, is one of the reasons why I refer to the US Precious Metals Futures market as The Bucket Shop. If this does end badly, and the analysts, regulators, and exchanges dare to say 'we could not see it coming,' then we might want to nominate them for the next Oscar awards.

The open interest in silver is now over a billion ounces. This is greater than all annual mine production in the world. As it comes with falling prices, it is most likely initiated by the bears, and is 'undeliverable' at these prices from a purely practical standpoint.

How it resolves will be another matter. But the fact that it exists, apparently unexamined and largely unremarked, is one of the reasons why I refer to the US Precious Metals Futures market as The Bucket Shop. If this does end badly, and the analysts, regulators, and exchanges dare to say 'we could not see it coming,' then we might want to nominate them for the next Oscar awards.

We will see the end of the quarter next week, a holiday weekend in the US for the Fourth of July, and another Non-Farm Payrolls Report on Thursday, July 2.

Many eyes will be on the Greek debt situation as the June 30 deadline for payment to the IMF approaches.

Addendum: After the bell, Tsipras has called for a special referendum vote on July 5 to decide on the ultimatum given to Greece by the Troika.

Have a pleasant weekend.

Addendum: After the bell, Tsipras has called for a special referendum vote on July 5 to decide on the ultimatum given to Greece by the Troika.

“After five months of hard negotiations our partners, unfortunately, ended up making a proposal that was an ultimatum towards Greeks democracy and the Greek people. An ultimatum at odds with the founding principles and values of Europe. The values of our common European construction. We have been presented with an ultimatum, and it is the historic responsibility of our country and people to answer this ultimatum.”

Have a pleasant weekend.

Subscribe to:

Comments (Atom)