Stocks took a beating today, particularly in the HFT trading of the first hour that saw the DJIA down over 1,000 points.

I think the 'fragile' underpinnings of these paper asset markets became all too clear this morning. And they have not changed, not one bit.

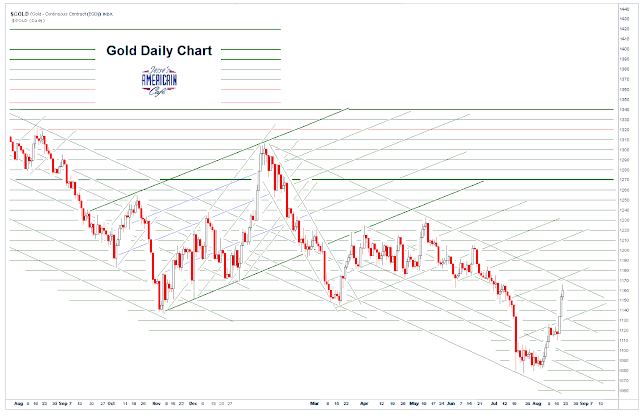

Gold initially caught a stiff flight to safety, but was hit with selling even as the stock market saw a remarkable bounce off its bottom. How unusual.

The US Dollar was certainly no safe haven today as it slumped to a seven month low.

Silver is going to be a pivotal player I think, moreso in the next month than now in this inactive month of August.

Gold is now outperforming the SP 500 for the Year-To-Date. See the chart below. How about that for pet rocks. Both are lower priced in dollars. Gold has been rallying in most other currencies.

The Fed's Lockhart came out this afternoon in a speech on the West coast and reiterated his opinion that the Fed would raise rates this year, although he waffled a bit on his prior certainty. I would say that September will be off the table unless stocks can rally higher and make people forget was the underside of an asset bubble looks like.

There was very little action in The Bucket Shop on Friday, with no deliveries and little warehouse movement as shown below. Its a funny month that started off with big buys in gold, almost clearing out the available inventory, and then a big lapse into nothing.

Let's see how China and Europe trade overnight.

Have a pleasant evening.