"There are two kinds of realists: those who manipulate facts and those who create them. The West requires nothing so much as men able to create their own reality."

Henry Kissinger, 1963

"But in these cases

We still have judgment here, that we but teach

Bloody instructions, which, being taught, return

To plague the inventor: this even-handed justice

Commends the ingredients of our poisoned chalice

To our own lips..."

Shakespeare, Macbeth

People take their fashions from the leadership. And the leadership and role models in our culture are emblematic of our failures.

In the news,

Swiss Name Seven Banks In Precious Metals Rigging Probe.

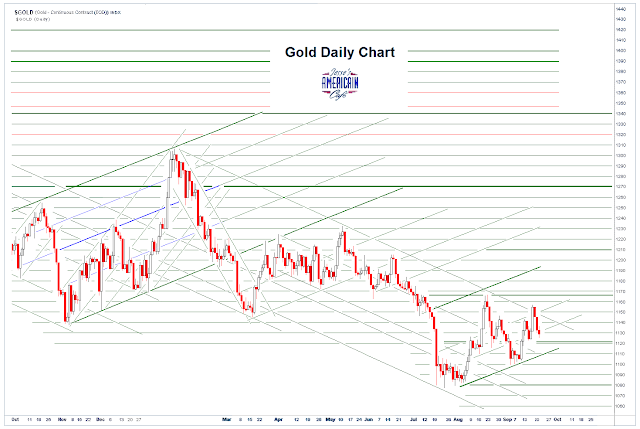

Precious metals took a hit today, as I thought that they might.

The rally last week had more to do with the option expiration than it did with disclosures of physical tightness of gold bullion in particular.

Glencore the commodity firm took a big hit today based on a sell-side analysts forecasts of doom.

The miners were taken out to the wood shed. I am seeing some big companies priced at levels I was buying them in 2002. .

I do believe this is going to come down to hard tacks. The bullion buyers of the world markets are going to keep the physical flow going until something breaks.

The wiseguys lack all restraint, and the regulators are failing to provide adult supervision because of conflicted interests and.utopian ideologies about 'naturally free markets.'

The bubble in junk paper is rolling over as can be seen on the chart below. It has plenty of room below it thanks to the Fed's misdirected policy errors.

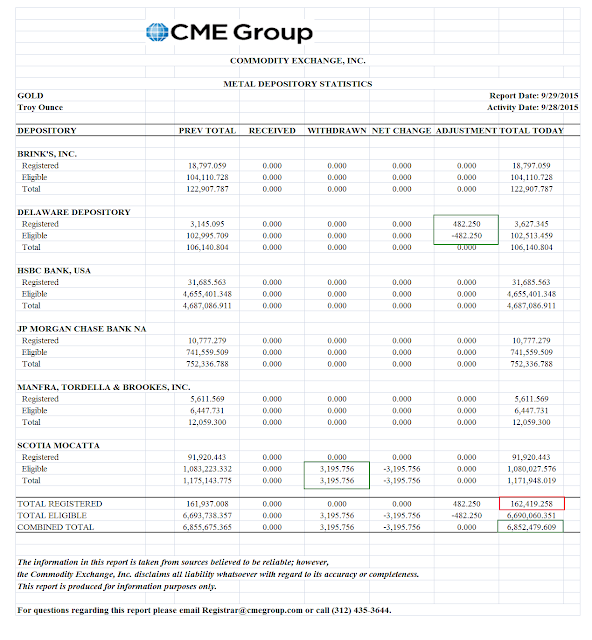

There was very little activity at The Bucket Shop to report on from Friday.

Potential claims per ounce of register gold are 262:1. The shills and trolls say don't look at it, means nothing. As well they might, as their true loyalties demand. They mention everything

except that this has never happened before in the last twenty years.

But it means nothing. Don't trust your lying eyes. Most everything is being settled on the side, over-the-counter, at undisclosed prices so as not to perturb the public pricing structure. And yet so little actually leaves the warehouses, at least for gold. Odd market price discovery mechanism that.

London is where the physical bullion is gathered, and it is flowing in an easterly direction.

Roll on, gold float, roll on.

Have a pleasant evening.