"And the great owners, who must lose their land in an upheaval, the great owners with access to history, with eyes to read history and to know the great fact: when property accumulates in too few hands it is taken away...

Repression works only to strengthen and knit the repressed. The great owners ignored the three cries of history. The land fell into fewer hands, the number of dispossessed increased, and every effort of the great owners was directed at repression."

John Steinbeck

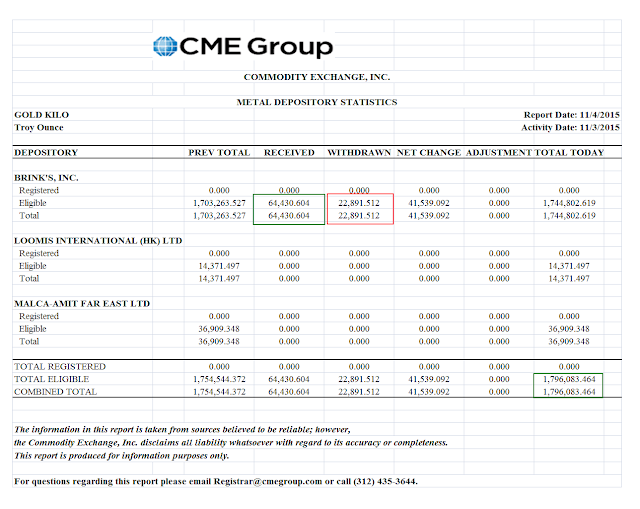

The number of potential claims (open interest) to the total amount of gold registered as 'deliverable' into those claims has reached a new high ratio of about 298 to 1.

It appears that JPM has been accumulating physical bullion which, if recent history repeats, it may be prepared to deliver into the demand for gold bullion during the active month of December if required. Some of that gold is being held in the Nova Scotia warehouse, acquired on the October contract, in addition to their own.

There are those who will say that this means nothing. And yet, we have never seen such high ratios of potential claims to gold marked for delivery before.

A 'New Gold Rush'

Why is this happening now? It is because those who are holding their gold in the Comex warehouses do not wish to see their bullion swept away in a physical short squeeze that may begin in an overseas market,

at these prices.

If a run on the available 'float' of bullion begins in earnest, the unwinding of the high levels of claims per ounce and hypothecation of ownership, especially in unallocated accounts, could provide some serious fireworks.

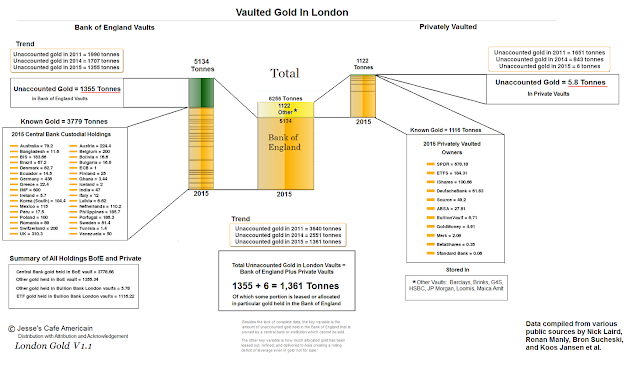

A determined campaign to control the price of gold, that has been underway since early 2013, led by the new London Gold Pool, is bumping up against shortages in available gold in New York, London, and Switzerland. The cause of course is well known, the truly impressive demand for physical bullion in the 'Silk Road' countries of China, India, Russia, and Turkey.

These sorts of things will always end in collapse, as one or two key players begin to withdraw their support and shepherd their national holdings, even repatriating them to their home countries in order to control the integrity of their ownership in an increasingly hypothecated, fragile market.

When the music stops, the rush for available seats may be more disorderly than the money masters will allow themselves to imagine.

Related:

Why Austria Is Repatriating Its Gold From London

These charts are from Nick Laird at

goldchartsrus.com.