After dinner, Larry [Summers] leaned back in his chair and offered me some advice. I had a choice. I could be an insider or I could be an outsider. 'Outsiders can say whatever they want. But people on the inside don’t listen to them.

Insiders, however, get lots of access and a chance to push their ideas. People — powerful people — listen to what they have to say.

But insiders also understand one unbreakable rule: They don’t criticize other insiders.'

I had been warned.

Elizabeth Warren, A Fighting Chance

And he said to me, he said, "Neil, you're a smart guy. You're a young guy. You're a talented guy. You got your whole future in front of you. You've got a young family that's starting out. But you're doing yourself real harm.” And the reason why you're doing yourself real harm is the harsh tone that I had towards the government as well as to Wall Street, based on what I was seeing down in Washington. And he told me that if I wanted to get a job out on the Street afterwards, it was going to really be hard for me.

And I explained to him that I wasn't really interested in that. And he said, "Well, maybe a judgeship. Maybe an appointment from the Obama administration for a federal judgeship." And I said, "Well, again, that would be great. But I don't really think that's going to happen with my criticisms." And he said it didn't have to be that way. "If all you do is soften your tone, be a little bit more upbeat, all this stuff can happen for you."

And I felt a real obligation and sense of duty to fulfill the oath that I took in Secretary Paulson's office on December 15th, 2008 to do the job that I was sent down there to do. But I wasn't really tempted with a big job on Wall Street. And frankly, if it meant getting a judgeship, compromising the job that I needed to do and was supposed to do, it just wasn't interesting to me.

When I had my incident with the assistant secretary that my deputy, who had come down from-- who's another former federal prosecutor, who did narcotics work, said to me, Kevin Puvalowski. And he said to me, "Neil, you were just offered the bullet or the bribe, the gold or the lead."

That's kind of what happens in a society where the rewards and incentives are, again, nobody's getting shot in the head thank goodness. But it's a breakdown of the system.

And in some ways, it creates this false illusion that there are people out there looking out for the interest of taxpayers, the checks and balances that are built into the system are operational, when in fact they're not. And what you're going to see and what we are seeing is it'll be a breakdown of those governmental institutions. And you'll see governments that continue to have policies that feed the interests of -- and I don't want to get clichéd, but the one percent or the .1 percent - to the detriment of everyone else."

Neil Barofsky, Interview with Bill Moyers

"He prompts you what to say, and then listens to you, and praises you, and encourages you. He bids you mount aloft. He shows you how to become as gods. Then he laughs and jokes with you, and gets intimate with you; he takes your hand, and gets his fingers between yours, and grasps them, and then you are his."

John Henry Newman

Here is a must read piece about the current flavor of kool-aid being quaffed by the acolytes of the credibility trap in Washington and New York.

The Anti-Knowledge of the Elites.

It has never been more important in the twin power areas of foreign policy and finance. You must believe to be an insider.

The precious metals markets are becoming dangerously over-leveraged and unstable. The cause of this is a conscious mispricing of risk that is being overlooked by the regulators because of who is doing it, and why.

We cannot maintain a sustainable economic system on a financial system grounded in the actions of a few, very powerful financial crime families and serial felons.

What are we thinking? Why does this not bear discussion? Why do we feel the need to distort our own realities to the point of our own destruction?

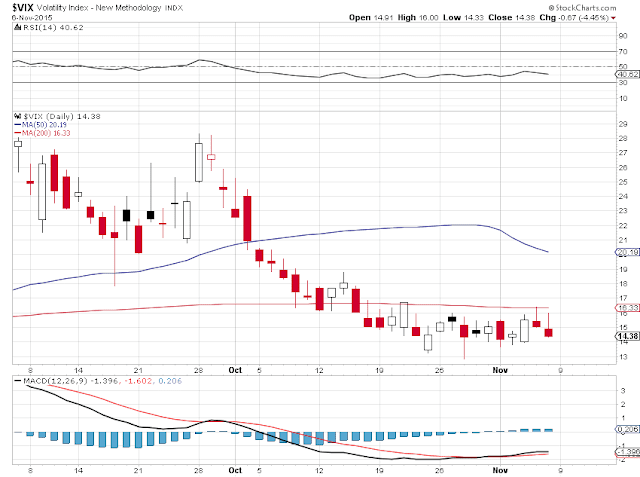

Gold and silver were hammered lower right on the release of the Non-Farm Payrolls report. So needless to say we have still not seen any short term buy signals.

The number looked like an outlier to me based on a overly generous seasonal adjustment. If they had applied the same seasonality factor which they used last October the headline number would have been around 144,000.

There was one more business day in October last year, but jobs are not jars, and production of new jobs is not a linear daily function.

This is not to say that the NFP number was 'wrong' or even purposely fat in order to provide confidence to the markets and useful cover for the Fed.

Rather, these headline numbers for a single month are very noisy as we have discussed before. They get revised several times in the short term, and then often radically so in whole revisions that go back years.

This is why I like to look at the six and nine month moving averages for jobs to get a feeling for the trend. And the trend is still fairly sluggish.

But at the end of the day, the Fed wants to raise rates for all the reasons we have discussed, mostly having to do with their own policy mechanics.

And the financiers want to do what they wish to do, and they have their way for now.

Winning.

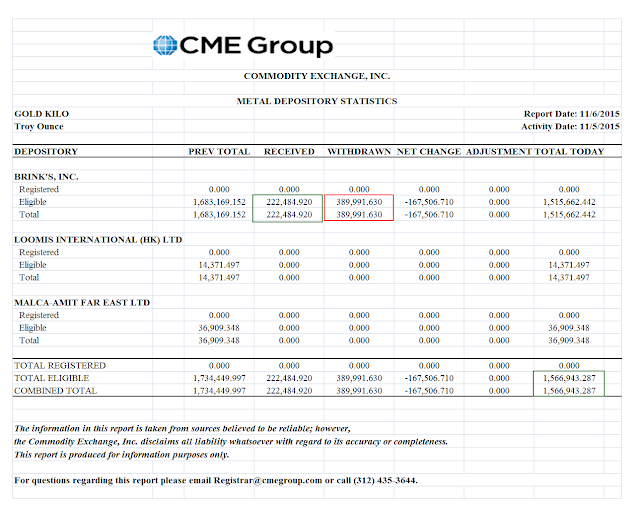

As I suggested they might, JPM has transferred their recently acquired 'house account' gold from Nova Scotia's warehouse to their own as shown in the report below.

The Bucket Shop was otherwise quiet, with the usual slow bleed out of the silver warehouses.

The precious metals are still a relatively 'small tent.' When they go mainstream, as I think that they will, I suspect that the metals will be as agnostic with regard to value, politics, and philosophy as any other form of wealth.

But perhaps not now, in these politically divisive times with the financial engineers and their courtiers in the ascendancy. All the very serious player learn soon enough to serve the world, and the will to power. They want to have access, connections, recognition, approval.

They sell themselves more cheaply than you might imagine. Not for the world, but for position, the faint praises and approval of others and, above all, for the appearances of power.

Have a pleasant weekend.