10 June 2016

09 June 2016

Gold Daily and Silver Weekly Charts - Big Deliveries at Big Price Resistance

"What is at stake is a rather heroic rebellion by a very beleaguered people against a doctrine which has been destroying their lives— the austerity doctrine and the whole neoliberal project."

James K. Galbraith

Although Jamie was speaking about Greece, this can be applied across the developed nations.

There was another big delivery day for NY gold yesterday, at least by Comex historical measures, as HSBC led the delivery of over 100,000 ounces of gold at 1,249, with the house account and mystery customer at JPM as the big stoppers.

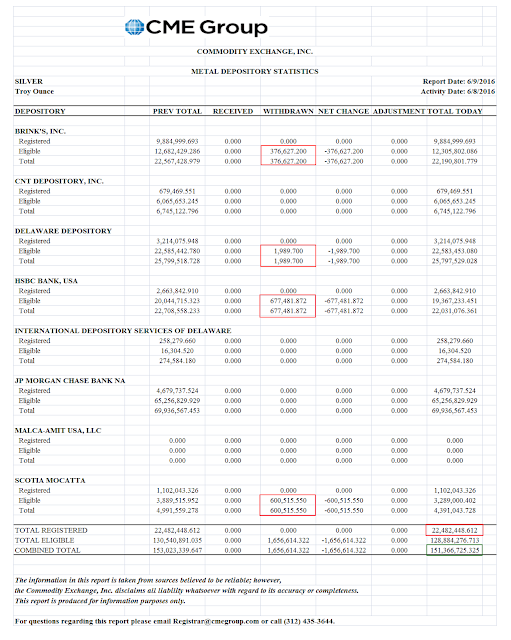

Silver is not so active this month, due to the nature of its June contract, but bullion keeps trickling out of the warehouses. Denver Dave has suggested that this might be an arbitrage play between NY and Asia.

Gold is banging its head against the big resistance at 1,270. If it takes out that level then the next battleground will be for the breakout around 1300.

As a reminder there will be a highly watched FOMC meeting next Tuesday and Wednesday.

President Obama endorsed Her Royal Hillary Clinton today. What a surprise. Her campaign slogan could be 'more of the same, but with a corporate servility even more brazen and tawdry.'

I am not sure which of the two candidates is more fraught with risk. As you may have gathered I do not care for either of them. Well, that is just me perhaps.

I am expecting it to be a rough four years no matter which of these two chuckleheads are elected. The 'establishment' is not going to give up its good thing easily, and we seem to be nearing a 'break point.' As John K. Galbraith put it so well:

"People of privilege will always risk their complete destruction rather than surrender any material part of their advantage. Intellectual myopia, often called stupidity, is no doubt a reason. But the privileged also feel that their privileges, however egregious they may seem to others, are a solemn, basic, God-given right."

John Kenneth Galbraith

Let's see what happens. Whatever may come, it may be a good idea to hang on tightly to one's integrity, as well as their wallet.

Have a pleasant evening.

SP 500 and NDX Futures Daily Charts - Buoyant On Light Volume

What is making the Fed's interest rate waffling is not the impact of 25 or 50 or even 100 basis points on the real economy.

Rather, the impact is coming from the highly leveraged risk assets like bonds and stocks. A little movement by the Fed is swinging a big stick in the speculatively mispriced markets, creating quite a bit more tail risk than most would be assuming.

Let's see how this all works out.

Have a pleasant evening.

Some Charts at 9 AM EDT - Disordered Economic Thinking

"For in that universal call,

Few bankers will to Heaven be mounters;

They'll cry, 'Ye shops, upon us fall!

Conceal and cover us, ye counters!'

When other hands the scales shall hold,

And they, in men's and angels' sight

Produced with all their bills and gold,

'Weigh'd in the balance, and found light!'

Jonathan Swift, The Run Upon the Bankers

Gold and silver have come back sharply to the levels that they had occupied before the smackdown related to options expiration and perception modifying in preparation for the Jobs Report.

I suspect that the Fed will try to squeeze in at least one rate increase before the Presidential elections. I don't think they can do 50 bp but a 25 bp increase might be feasible with the right wording.

June seems a bit of a stretch, but it does leave the door open for another increase should they find a favorable set of data to smooth their way.

In a very real sense the slight movement of interest rates do not matter all that much at this point to the real economy. They are a blunt instrument, more symbolic than effective. But they are almost hypersensitive to unbalanced financial markets made tipsy by excess.

Most of the cheap money is flowing into speculative activities of the same jokers who overturned the financial markets and tanked the real economy in the first place. And despite their denials, the Fed has their hand on the tiller of regulatory persuasion and power that could change that if it had the will to do it. But as career minded timeservers, they do not. They follow power, and the power is in the hands of Big Money and the Banks.

This is the price of a failure to reform. This is the outcome when one tries to serve two masters. This is the last stand of a failed ideology and a broken system foundering in the face of hard reality.

This is not policy, it is the hypocritical nicety that excuses mere looting by the powerful in the aftermath of a crisis.

Negative interest rates are the product of disordered economic thinking. They are the result of an inability to confront the real, more serious problems in the banking system. And so like so many compromises they are producing unintended effects that are actually counter-productive.

And this is why gold and silver are so attractive as a safe haven refuge, and why disordered minds despise them.

07 June 2016

No Updates Tonight

"When despair for the world grows in me

and I wake in the night at the least sound

in fear of what my life and my children’s lives may be,

I go and lie down where the wood drake

rests in his beauty on the water, and the great heron feeds.

I come into the peace of wild things

who do not tax their lives with forethought

of grief. I come into the presence of still water.

And I feel above me the day-blind stars

waiting with their light. For a time

I rest in the grace of the world, and am free.”

Wendell Berry

I was out all day with my son in rural Pennsylvania.

I will be out of pocket quite a bit of tomorrow as well dealing with the usual routine medical matters.

I will try to update tomorrow evening.

The Mask Falls Off

Corporate Media Attempts Clinton Coup d'Etat On Eve of Super Tuesday Elections

By Pam Martens and Russ Martens: June 7, 2016Hillary Clinton was not having a very good morning yesterday. The New York Post had devoted its full front cover to suggesting that Clinton has a Dr. Jekyll and Mr. Hyde personality disorder, based on an explosive new book by a former Secret Service agent who was stationed directly outside former President Bill Clinton’s Oval Office and is alleging outbursts and physical violence by the former First Lady.

The book has shot to number one on the nonfiction bestseller list at Amazon.com, meaning more headwinds for the Clinton campaign. On top of that, news was swirling that Senator Bernie Sanders had a good shot of trouncing Clinton in the following day’s critical primary in California, where a massive 475 pledged delegates are at stake. (Five other states are also set to vote today in primaries: New Jersey, Montana, North Dakota, South Dakota, and New Mexico.)

And then a funny thing happened. At 8:20 p.m. last evening, the Associated Press, which syndicates its news feed to newspapers around the country, ran a story with this headline: “Clinton has delegates to win Democratic nomination.” That quickly morphed into bizarre headline pronouncements that Clinton had actually “won” the Democratic Presidential nomination. Bloomberg News’ went with the craziest headline of the lot, writing: “Clinton Wins Democratic Presidential Nomination.”

Most Americans reading that would assume the Democratic Convention had just been held, votes taken, and Clinton had walked away as the winner. The actual votes won’t be taken until July 25-28 when the Democratic National Convention takes place in Philadelphia....

Read the entire story from Wall Street On Parade here.

Subscribe to:

Comments (Atom)