23 June 2016

22 June 2016

Gold Daily and Silver Weekly Charts - Brexit and Stress Test Results - Exceptional USA

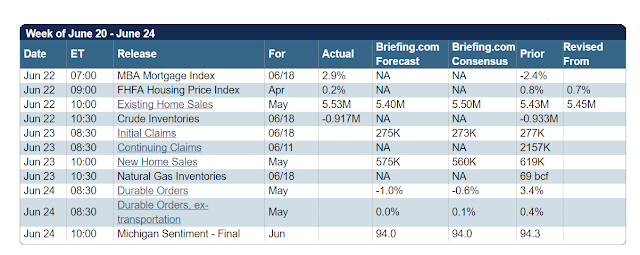

Markets were edgy ahead of the Brexit vote tomorrow.

As our friends at Wall Street on Parade point out, the Fed's latest 'stress test results' will be partially announced tomorrow as well.

The results of the vote are not likely to be known until early Friday morning, as the ballots will be hand counted. So we will be subject to rumours and speculation tomorrow perhaps.

And in the exceptional column, the IMF has warned the US about its unusually high poverty levels.

Have a pleasant evening.

NAV Premiums of Certain Precious Metal Trusts and Funds - Market Dislocation

Again the premiums to NAV are interesting. Sprott gold is still positive, with Sprott silver slightly at a discount.

The discount on the Central Fund has continued to narrow.

As you may recall, I 'forecasted' at the beginning of this year that the shortages in physical gold in London would start manifesting this month.

That may have been delayed a bit through the relief to the physical supply being received from the re-repatriation of the Venezuela gold.

Unless something radically changes I do still believe that we will be seeing a 'break' in the physical market at some point in the not too distant future.

We may already be seeing indications of this in some of the pricing, although the official price of gold has become dominated by a currency trade without respect for physical supply and demand. And as a currency it has been caught up in the trading centered on the questions and concerns raised by Brexit.

And therein lies the roots of the 'break' in the physical and paper markets should it occur. Because unlike a sovereign currency, no central bank can print additional physical bullion, but only the appearance of it. And that central bank perception game has grown very old.

Subscribe to:

Comments (Atom)