The thunderstorms are booming outside, and I hope this breaks the heat which has been oppressive all day. Whoops, we just lost power. Luckily I have my PC and internet access routers/modem all on UPS.

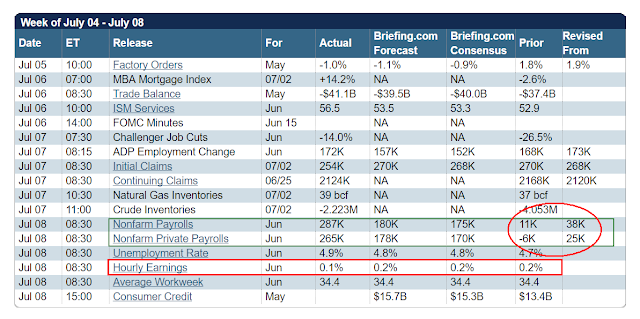

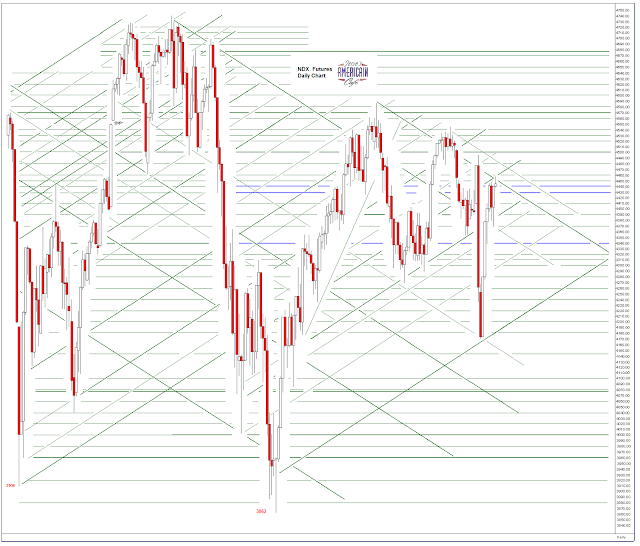

Stocks staged a rally today after the Non-Farms Payrolls came in hot and heavy.

I spent several hours today plugging all the heavily revised BLS numbers into my excel spreadsheets.

The seasonality is nonsensical, but I have not finished plugging all the numbers and analyzing them yet.

Wall Street sees things rolling their way. Jobs are coming so they can ignore the last few months. Note that the last two months were revised lower still.

But the Fed is going to find it a hard go to raise rates with the rest of the world cutting, and engaging once again in competitive currency devaluations to support exports, in a 'beggar your neighbor' strategy.

And there comes the power back on. I will try and post this before the next hit. lol

And finally it looks like it will be Hobson's choice for the corporate candidate of your choice.

Have a pleasant weekend.