"They devoted themselves to the teachings and to the communal life, to the breaking of bread and to the prayers. Awe came upon everyone, and many wonders and signs were done through the apostles. All who believed were together and had all things in common; they would sell their property and possessions and divide them among all according to each one's need.

Every day they devoted themselves to meeting together in the temple area and to breaking bread in their homes. They ate their meals with exultation and sincerity of heart, praising God and enjoying favor with all the people. And every day the Lord added to their number those who were being saved."

Acts 2:42-47

"By this everyone will know that you are my disciples, if you love one another."

John 13:35

"We are not remote elites or ascetic philosophers, who dwell alone and exile themselves from ordinary human life. We do not forget the debt of gratitude that we owe to God, our Lord and Creator; we reject no creature of His hands, though certainly we exercise restraint upon ourselves, lest we make an immoderate or sinful use of His gifts. And so we travel for now with you in the world."

Tertullian

“What is hell? I maintain that it is the suffering of being unable to love.”

Fyodor Dostoyevsky, The Brothers Karamazov

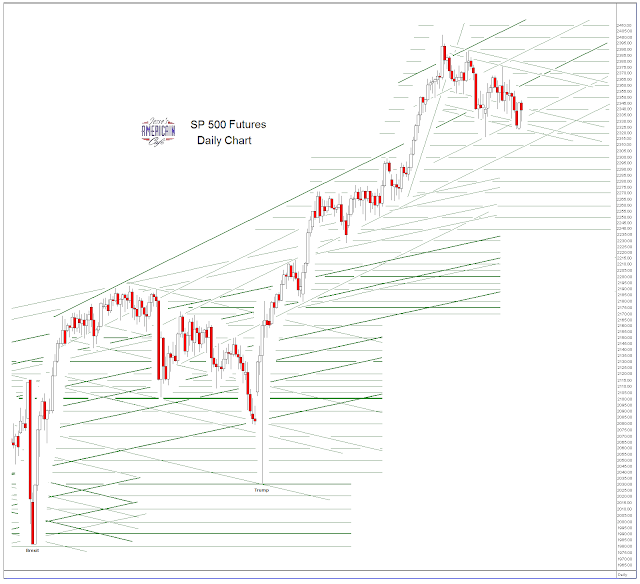

Today was a minor options expiration for stocks. The trading was quiet.

Next Tuesday is a Comex precious metals option expiration that is more significant for silver than for gold, given the activities of the metals in this month's contracts.

The markets are keenly observing the French elections this weekend.

See you on Monday.

Please remember God's creatures, especially those entrusted to your care. Remember your brothers and sisters, especially the poor both in material wealth and in spirit.

Even an animal will love their offspring because it is their own, and a wicked man loves his possessions because they are his. True love is to love what is His because it is His, formed of Him, and not because it is ours to possess and do with as we please.

We gain much from fellowship in the world, and this is not a vain thing. It is one of His greatest gifts to us. We were made for friendship, formed and born from His very breath in caring and for love.

God is love. Evil then is the absence of caring, the deficiency of love. As Dostoevsky observed, hell is the inability to love and to be loved in return. It is to be isolated and cut off from the life that sustains us.

For what does it profit a man, to gain the whole world, but to lose his soul. To choose love over selfishness and pride and possessions is the only trade worth making, because nothing else will endure.

Be a champion for love, if only in the little things of your daily life. And that being done for His sake is enough.

Have a pleasant weekend.