"It begins with a highly complex financial system, whose very complexity makes it difficult for anyone to know what might be going wrong; by definition, the multiple parts of the financial system are linked, which means that trouble in one institution, city, or region can travel easily and quickly to others.

Buoyant growth in the economy makes the financials system more fragile, in part due to the demand for capital and in part due to the tendency of some institutions to take on more risk than is prudent.

Leaders in government and the financials sector implement policies that advertently or inadvertently increase the exposure to risk of crisis.

An economic shock hits the financials system. The mood of the market swings from optimism to pessimism, create a self-reinforcing downward spiral."

Robert Bruner and Sean Carr, The Panic of 1907

Stock market crashes are not often 'expected' by the very important people. But it seems to me that they are often richly deserved.

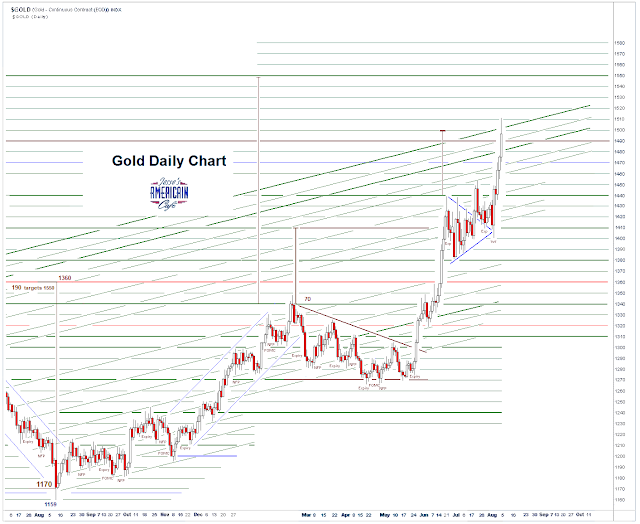

Gold and silver both broke out, somewhat decisively, today.

Gold took out 1490 like it was standing still, and went on to 1511, before finally settling back to close at 1496.

This has been an almost non-stop run higher since gold broke up from the coil of its symmetrical triangle. I have included a last look at the three alternative chart formations for this coiling action below.

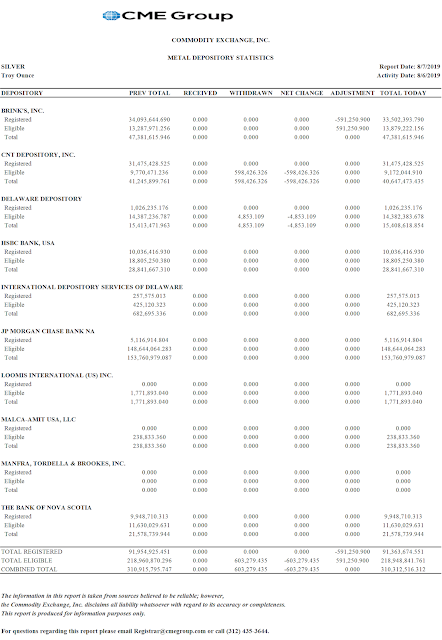

Silver was a powerhouse this week, smacking through the resistance at $17 and holding it into the close.

Stocks were clobbered again today, giving up quite a bit of yesterday's relief rally.

After the European markets closed Wall Street, and its champions in DC no doubt, were able to turn the major stock indices around and even eked out a green close.

And there was joy among the spokemodels, as their faith in the market was once again renewed.

But there was a hint of cautious fear, even as they declared a 'capitulation bottom.'

If that was a capitulation bottom then I am Tom Bombadil. It may have been a bottom, or not, but it was a cold and passionless thing.

Can US sovereign rates go nominally negative? It is not such an absurd notion as it might have been even last month.

So what next?

What next indeed.

The underpinnings of these markets are weak and shaky, and will remain inclined to rise on technical trading, and fall sharply on raw reality.

The underpinnings of these markets are weak and shaky, and will remain inclined to rise on technical trading, and fall sharply on raw reality.And watch your twitter feed for news.

"A common feature of all these earlier troubles [panics such as 1907 and 1914] was that having happened they were over. The worst was reasonably recognizable as such.Have a pleasant evening.

The singular feature of the great crash of 1929 was that the worst continued to worsen. What looked one day like the end proved on the next day to have been only the beginning.

Nothing could have been more ingeniously designed to maximize the suffering, and also to insure that as few as possible escaped the common misfortune. The fortunate speculator who had funds to answer the first margin call presently got another and equally urgent one, and if he met that there would still be another. In the end all the money he had was extracted from him and lost.

The man with the smart money, who was safely out of the market when the first crash came, naturally went back in to pick up bargains. (Not only were a recorded 12,894,650 shares sold on 24 October; precisely the same number were bought.) The bargains then suffered a ruinous fall.

Even the man who waited out all of October and all of November, who saw the volume of trading return to normal and saw Wall Street become as placid as a produce market, and who then bought common stocks would see their value drop to a third or a fourth of the purchase price in the next twenty-four months.

The Coolidge bull market was a remarkable phenomenon. The ruthlessness of its liquidation was, in its own way, equally remarkable."

John Kenneth Galbraith, The Great Crash of 1929