"Sometimes I wonder whether the world is being run by smart people who are putting us on, or by imbeciles who really mean it."

Mark Twain

Russell Napier of ERIC has apparently disclosed that the G20 will be announcing a 'bail in' structure for bank deposits. His source seems to be from the UK Treasury.

This is from a story carried by ZeroHedge. I do not know if this is an accurate prediction, an informed leak, or what not.

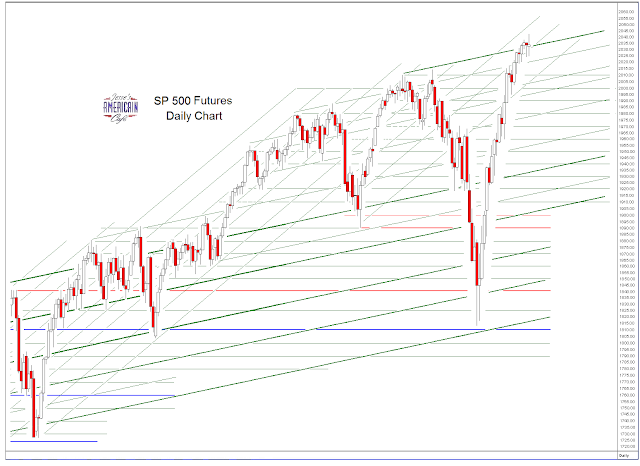

I have been hearing warnings here and there anecdotally about a market correction. A very large investment firm was warning some large clients of a correction in equities. But not much else.

I thought perhaps some brokers were chasing bonuses on what might be interest sensitive products carrying bounties from the firms that manage them. Believe me, this does happen. I had a broker disclose to me that if he persuaded me to make a large transfer into a well known investment fund that he would receive a $20,000 bonus for it.

Perhaps this is just a pervasive rumour. And trading desks and hedge funds have been known to start even destructive rumours that might favour their trading books. Some announcement may be forthcoming but we do not know what its implications might be.

I have absolutely no 'inside knowledge' on this one. If I did I would let you know. I have told you everything I have heard, which I have filed under 'interesting' but not well understood.

Let's see what actually comes out this weekend. As you may recall I wrote yesterday that 'I have the sense that now is not a bad time to start positioning portfolios for a market downturn. We may not get it until after the first of the year, but stocks overall look to be fully valued.' That was based on the action on the tape and the charts, and not anything more intense. Some people like to claim inside knowledge and it certainly sells clicks. But it most often is not the whole or real story.

It seems a little on the edgy, screaming headline vein of reporting information. I like cash and gold as well as the next guy, but I doubt the governments of the West will so overtly throw their public to the wolves. But then again I cannot rule it out. And therein lies the dilemma with a non-transparent system in which justice and the public interest have been loosely honored.

This is from ZeroHedge.

"It is with regret and sadness we announce the death of money on November 16th 2014 in Brisbane, Australia...

On Sunday in Brisbane the G20 will announce that bank deposits are just part of commercial banks’ capital structure, and also that they are far from the most senior portion of that structure. With deposits then subjected to a decline in nominal value following a bank failure, it is self-evident that a bank deposit is no longer money in the way a banknote is.

If a banknote cannot be subjected to a decline in nominal value, we need to ask whether banknotes can act as a superior store of value than bank deposits? If that is the case, will some investors prefer banknotes to bank deposits as a form of savings? Such a change in preference is known as a "bank run."

Russell Napier Declares November 16, 2014 The Day Money Dies

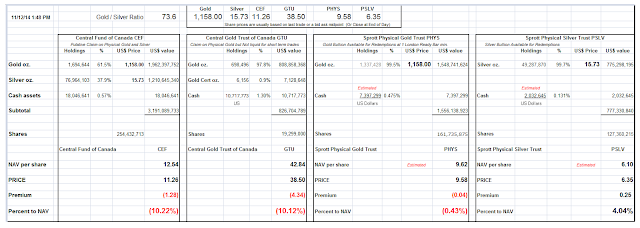

It does make sense IF the central banks declare for deflation and intend to give up or weaken insured deposits for savers, which is foolish. I don't think the one percent keeps a high percentage in passbook accounts yielding almost nothing.

This would be the time for the Fed and the government to come forward and do something useful for the public.