The big story today was in the stock markets, with a hugely wide ranging outside reversal from buoyant expectations fueled by ECB QE to a steep decline on pessimism about earnings, sparked by KBH but other stocks with 'good earnings' that sold off like Alcoa.

And then when the markets started doubting Draghi's ability to prod Bubba and the EU to go along with QE, stocks sold off pretty hard, with a little bounce back to unchanged near the end of day.

Oil had a big selloff, and then a late day bounce on hopes/speculation that the reports coming out tonight and tomorrow would show a draw down in inventories.

So all in all it was an 'exciting' day if you were a trader, and if not, then it was just another day.

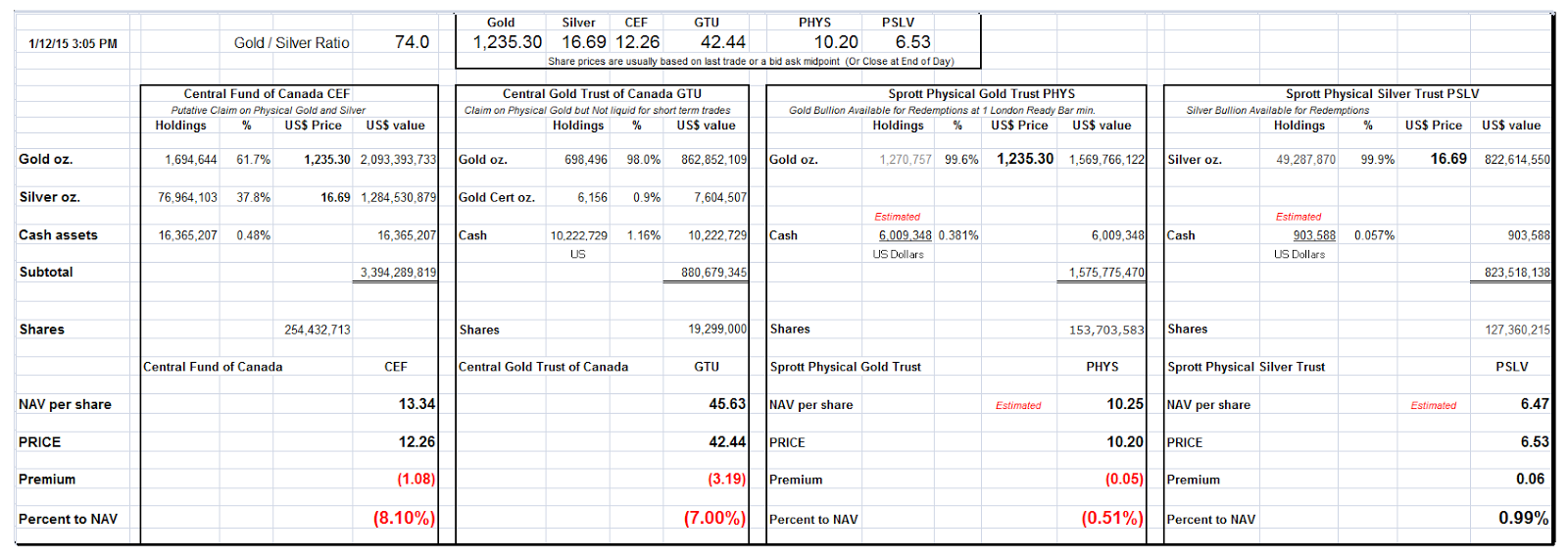

Silver held its gain for the day, but gold gave it up with a little retrenchment.

After the last few days advances on what looked like a 'fear trade' or flight to safety we were due for a pullback as I had suggested. It is the character of this pullback that will tell us quite a bit about the nature of this rally and any sustainability.

Let's see if gold can gather itself together and take the next step to break out.

Have a pleasant evening.