"Le temps mûrit toute choses; par le temps toutes choses viennent en évidence; le temps est père de la vérité."

François Rabelais

“Hubris calls for nemesis, and in one form or another it's going to get it, not as a punishment from outside, but as the completion of a pattern already started.”

Mary Midgley, Myths We Live By

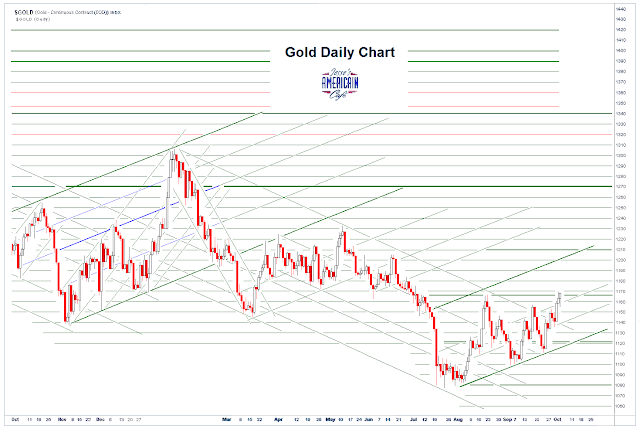

As we have seen so many times, the nature of a chart formation is revealed at key moments when the chart action approaches a critical decision point, especially after a sustained move higher or lower.

In this case gold is struggling hard to break a multi-year bear market and form a successful bottom off the big 1080 support.

The gold bulls can hope for a retracement that finds support fairly quickly, and mounts another assault at making a higher high than the last failed breakout attempt that was stopped at 1230.

The gold bears are quite confident, to the point of overconfidence in their ability to smash the price lower with an avalanche of paper sells in quiet hours after two years of having their way with this market.

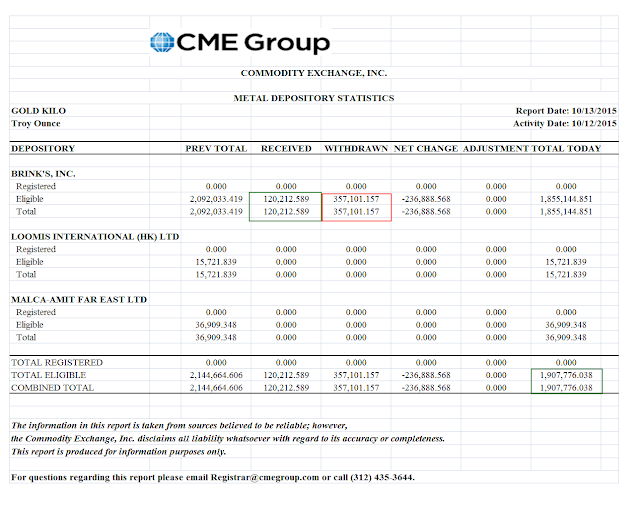

And all the while they have been setting themselves up for an eventual confrontation with the physical consequences of their actions. By now this should be a very familiar theme for a willful generation on any number of fronts.

A bullish interpretation can hold with declines even down to the bottom of a new bullish uptrending channel.

A break to the downside of 1120 negates this formation.

So in summary there are three general outcomes.

The first is a shallow retracement and a breakout that takes some greater momentum higher towards the 1300 level and makes the bottom with some decisiveness.I am not applying the normal probabilities to this evolving chart formation because of the obvious price manipulation that has been occurring in the paper gold markets, justified in the minds of the ringleaders no doubt by 'the currency war' and the flexing of monetary muscles.

The second is a deeper retracement, with support found somewhere above 1120, with another assault mounted for a breakout higher from there.

And lastly, we must keep an open mind about a possible breakdown below 1120 setting up a retest of support, perhaps down towards 1080, or the establishment of a trading range.

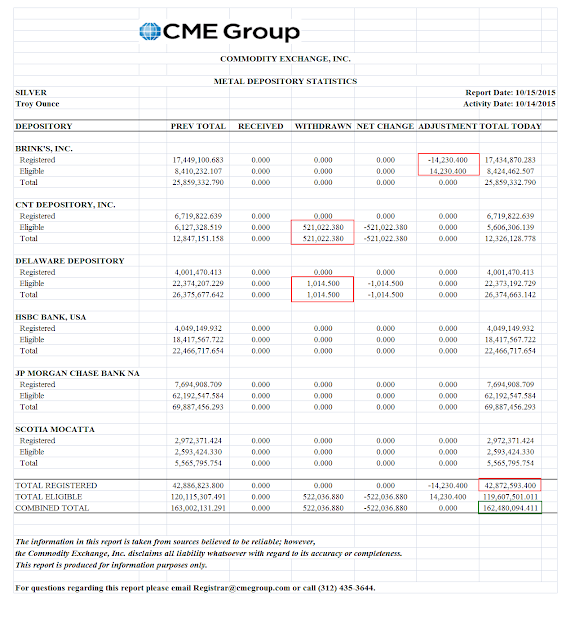

In this environment gold and silver are being traded more like currency crosses, and less like commodities with a real basis of physical supply and demand underlying the transactions.

Perhaps the money masters may take their cue from the platinum coin, and declare a pile of sand to a thousand tonnes of bullion, of whatever variety they wish.

And you might be suprised at how many true believers will gratefully rise to praise this, drinking deeply of the madness of the will to power. If only all would believe, it would be true! But alas, they never do. There are always a stubborn few who fail to follow the dream into the abyss. And so the world divides into the enlightened and the spoilers, between us, and them.

To the truly relativistic mind, nothing is impossible if you apply enough conviction and power, at least in the musings of the modern and, at the lingering last, the high walled bunkers of the few. Their pipe bowls waft out familiar dreams, of freedom from restraints, and from their own mortality, and in the end perhaps, the last of their humanity.

All will be revealed with time. We cannot presume to know exactly when.

Till human voices wake us, and we drown.