skip to main |

skip to sidebar

"Once you have their money, never give it back."

Ferengi, First Rule of Acquisition

There are also claims, not substantiated as far as I can tell, that the positions and assets that were taken from customers were liquidated in a manner so as to maximize the gains to other market participants with advantageous knowledge of those positions. That is a serious charge that I don't quite understand. I hope the regulators will look into the transfer of customers assets and exactly how they were treated.

I hope that the regulators and the Justice Department can sort this out quickly, and prevent any further loss of confidence in the exchanges and financial system on the part of their customers.

I think it is fair to say that this entire situation has been handled badly. Some of the early suggestions that customers would have to take haircuts to 'share' the loss with each other, that the funds would be frozen for years, and the general secrecy that has blanketed this has contributed greatly to the anxiety felt by the more aware among investing public at large.

This is of concern even to those who have no funds involved in this, and have nothing to gain or lose from it personally. It should give a chill feeling to all customers, as it seems to be a shocking breach of fiduciary responsibility. It is not wise to wait until one's own funds and assets are confiscated before asking questions and demanding answers.

As someone else has said, if a brokerage can take customer funds and assets at will, and use them for their own undisclosed speculation, and defy all guarantees, and neither they nor their accomplices are held accountable, then nothing is safe.

This white paper is obviously being told from the perspective of the customers and their attorneys.

I would be interested to hear the story or the party who received the customer assets. But as far as I know, they are silent, and their very identity remains a carefully guarded secret.

WHITE PAPER:

Background, Impacts & Solutions to MF Global's Demise

By John L. Roe & James L. Koutoulas, Esq.

November 10, 2011

The failure of MF Global has wide ranging consequences for the American economy and its bankruptcy is being handled in a manner that is making these consequences much worse than they need to be. The freezing of customer segregated funds is having a chilling effect on global financial markets. It also has a less obvious but significant impact on the day-to-day operations of farmers, mining operators, ranchers, and other commodity consumers and producers...

In fact, the only person served by the current bankruptcy process is the Trustee who has already submitted bills to the MF Global estate at $891/hour for his time and an average of approximately $500/hour for his staff. This is the same Trustee that spent 3 years working on the Lehman bankruptcy and billed the estate over $160 million dollars despite not returning any customer funds.

If this bankruptcy is managed the same way as Lehman's, it will be the end of the United States as a viable jurisdiction for commodity trading. Congress should use whatever power it has to prevent this from happening...

By subordinating customers with collateral in segregated funds to creditors of MF Global's estate, the Trustee is essentially making the creditors the beneficiary of a criminal act. If MF Global comingled segregated funds with corporate assets, it was a criminal act. Paying such a creditor's claim with a portion of those comingled funds would make them a beneficiary of that crime.

Paying JP Morgan with an Iowa farmer's money is not only morally and legally wrong, it risks the future of the American economic model. Who would want to hold a commodities account in the United States ever again? Considering the MF Global's clients have no representation on the creditors committee, but the big banks do (like JP Morgan and Bank of America), that is exactly what will happen without intervention.

Industry groups and regulators argue that the commodities trading industry is able to function with lighter regulations than securities trading because customer accounts are segregated from firm assets. However, in the MF Global case, there is $633M in these segregated client funds that are unaccounted for, either due to sloppy accounting or nefarious activity conducted by the firm. This has resulted in a compromise of the integrity of the segregated accounts system, and a complication of the bankruptcy proceeding by involving a number of parties with little to no experience in commodities.

The bankruptcy process has been delegated to SIPC, the securities insurance regulator, after it petitioned the bankruptcy court to begin a liquidation proceeding of MF Global’s broker-dealer. SIPC stands for “Securities Investor Protection Corporation.” It was created by the Securities Investment Protection Act of 1970 and was designed to protect owners of securities in a similar way to how the FDIC protects bank depositors. However, the vast majority of customer assets affected by this bankruptcy are NOT securities, rather they are cash and commodity futures contracts, and SIPC’s attorneys have limited experience with commodity futures contracts. Despite the fact that about 11.6% of the segregated funds have yet to be accounted for, 88.4% have been. There is no reason, whatsoever, that these funds should not be immediately released to their rightful owners.

Read the rest of this White Paper here.

These dozen Congressmen are just the ones that would brag about it openly to Jack Abramoff.

Trading in insider information amongst the Congress and their staffs is a form of soft bribery that undermines the character of the legislation, and is a relative side dish compared to the huge amounts of lobbying funds being thrown around by corporate special interests. And both parties are in on it to varying degrees.

It can seem an odd corruption to the average person, given the lavish benefits and pensions granted to members of Congress. What is shocking is not that officials sell themselves, but rather, that they sell themselves so brazenly and often for so little. But it makes sense if one understands the attitude of privilege and the insatiable nature of greed.

Corruption of public officials is not news. But when it becomes epidemic, and when powerful interests can use even relatively petty offenses to blackmail representatives, when lobbyists write the legislation designed to reform their industry, and when enormous financial frauds result in show investigations and big talk but no prosecutions, then it is news. And it is a shame and the decline of the rule of law.

Big corruption starts to crowd out petty corruption, which is its seedbed. Once corruption becomes institutionalized, the morally ambivalent all aspire to be in the one percent club, as a symbol of status and power. If this is the age of greed, then not to be corrupt is to be out of step with fashion, because greed is inherently corrupting. Reformers and progressives are out of touch, and tedious. Squares.

As is so often the case amongst men in crowds, life imitates high school.

And this distortion of values becomes a self-perpetuating credibility trap, which is what the US is caught in today.

But when the status quo has lost its creative energy, is dwindling, and even become dead wood, there is always hope in the relative outsiders and the young. Life awaits the coming of Spring. Fashions change, and honor and liberty are renewed. And this may be the significance of the protests that are springing up around the country, and the world, today.

The invisible community of the mind and the spirit is resilient. Rising and falling in cycles, it sometimes hides underground beneath the surface, as the seeds of growth and freedom, ready to rise up once again. Over and over. Always.

CNBC

Congress Members Took Part in Insider Trading: Abramoff

By Eamon Javers

Friday, 11 Nov 2011

As many as a dozen members of Congress and their aides took part in insider trading based on foreknowledge of market moving information on Capitol Hill, disgraced Washington lobbyist Jack Abramoff told CNBC in an interview.

Abramoff, who was once one of the wealthiest and most powerful lobbyists in Washington before a corruption scandal sent him to federal prison for more than three years, said that many of those members of Congress bragged to him about their stock trading prowess while dining at the exclusive restaurant he owned on Pennsylvania Avenue.

But Abramoff, whose black trench coat and fedora became one of the most notorious images in recent Washington history after his fall from grace, said he didn't play the stock market himself — he considered it an inherently unfair "casino" in which the house had far more information than the players. Abramoff made most of his fortune representing — and, as it turned out, duping — Native American tribes rich with cash from casino operations.

The former lobbyist said the amounts members of Congress earned trading off their inside knowledge ranged from as little as $2,000 to, as much as "several hundred thousand dollars," that was claimed by one member of Congress.

Abramoff declined to name the members of Congress.

"It was more, 'Look at me, I'm a real great stock trader,'" Abramoff told CNBC of the congressional bragging. "All of a sudden somebody from a background maybe in law, maybe in some other unrelated business area, all of a sudden is picking winners and losers in the market."

"I was making far more money than they were," Abramoff recalled. "So I wasn't as impressed as perhaps they thought I'd be."

At the time, Abramoff, who was involved in an extensive corruption ring, didn't think much of it. But after years in prison to reflect on the culture of corruption in Washington, Abramoff says he thinks trading based on inside Congressional knowledge is wrong.

"These people should not be using whatever information they gain as public servants to benefit themselves, any more than they should be taking bribes," he said.

Generally, however, legal analysts say that Wall Street insider trading laws do not apply to Congress. As an open and public institution, the legal assumption has long been that any member of the public can have access to information about how Congress works. In practice, though, that's simply not true, as powerful members of Congress come into contact daily with market-moving tidbits. That gap between the law and the reality has made Capitol Hill a virtual free-fire zone for insider trading. Over the years, academic studies have found that members of the House of Representatives beat the market by as much as six percent per year and members of the Senate do even better than that...

"In this serious hour in our Nation's history when we are confronted with grave crises in Berlin and Southeast Asia, when we are devoting our energies to economic recovery and stability, when we are asking reservists to leave their homes and their families for months on end and servicemen to risk their lives--and four were killed in the last two days in Viet Nam--and asking union members to hold down their wage requests at a time when restraint and sacrifice are being asked of every citizen, the American people will find it hard, as I do, to accept a situation in which a tiny handful of steel executives whose pursuit of private power and profit exceeds their sense of public responsibility can show such utter contempt for the interests of 185 million Americans."

John F. Kennedy, April 11, 1962

"If a free society cannot help the many who are poor, it cannot save the few who are rich."

John F. Kennedy, January 20, 1961

I am glad for any relief that might be coming for the customers of MF Global whose funds are frozen and at risk.

I wonder how extraordinary these measures referenced in this press release really are, and why they had to be extraordinary given the guarantees presented by SIPC and the regulatory responsibilities of the Exchange in the first place.

As I recall the stated reserves of SIPC are multiples greater than the total customer money said to be at risk. Is the SIPC a legitimate insurance fund acting to secure customer deposits against loss, or a fig leaf? I am therefore struggling with the statement that they required emergency funding from the CME.

Here is the CME's public relations release below. A copy of it is also available here.

I hope that there will be a thorough investigation so that customers will understand what is insured, for how much and by whom, what is regulated and by whom, and how confident they can be that this will not happen again and require such 'extraordinary measures.'

CME is acting in what is clearly self-preservation and not out of some abundance of charity. Customers are viewing these developments with a critical eye, and choosing in some cases to withdraw their funds.

Rather than rely on the kindness of strangers, I think there needs to be a greater transparency and the clarity of law and much more responsible regulation.

The temptation to hide what happened in a smokescreen and sweep it under the rug must be rather strong. But it would be a great mistake. Once confidence is lost, it can only be regained with a long and difficult effort.

This was a systemic failure of the first order and not some odd exception, or infamous 'black swan.'

The system failed.

Extraordinary measures aside, it must be fixed and made sound so that customers are not placed in such significant risk of loss based on malfeasance and 'accounting errors.'

And the public deserves a real explanation of what happened and who was involved. One benchmark for this is a straightforward answer to a simple question:

"When were the customer funds and assets transferred, to whom were they given, for what reason, and on whose authority?"

News Release Issued: November 11, 2011 3:16 PM EST

CME Group and CME Trust to Provide $300M Guarantee to SIPC Trustee to Help Facilitate Release of Customer-Segregated Funds

- Guarantee intended to assist Trustee in making prompt distribution of customer segregated funds and frozen cash balances

- CME Trust to provide its roughly $50 million in assets to CME Group market participants to offset missing customer funds held at MF Global

CHICAGO, Nov. 11, 2011 /PRNewswire/ -- CME Group, the world's leading and most diverse derivatives marketplace, today took extraordinary measures in order to accelerate the return of substantial customer cash and other assets securely held at CME Clearing, other clearing houses and MF Global custodians following the failure of MF Global.

Though CME Clearing does not guarantee FCM-held assets, CME Group is willing to provide a $250 million financial guarantee to the Trustee to give the Trustee greater latitude to make an interim distribution of cash to customers now, given the monumental task he faces to sort through considerable data and claims in order to complete the MF Global liquidation and make distributions to creditors. Additionally, CME Trust will provide $50 million to CME Group market participants in the event there is a shortfall at the conclusion of the Trustee's distribution process.

Until this point, the Trustee has authorized the distribution of $1.45 billion in customer collateral, which permitted the transfer of open positions and avoided greater losses to customers that would have been incurred through liquidation. Cash balances remain frozen. Today's proposal is designed to ensure that customers would have access to a greater percentage of the total customer-segregated funds MF Global accounted for at CME Clearing, other clearing houses and MF Global custodians.

This unprecedented guarantee offered by CME Group would be used by the Trustee in the event that a final accounting determines that the Trustee distributed more property than was permitted by the Bankruptcy Code and CFTC regulations. In addition, if there is a shortfall at the conclusion of the distribution and the $50 million Trust has not been exhausted, the remainder of those funds will be used to restore the other CME Group customer accounts that suffered a shortfall in customer-segregated funds held at MF Global. The Trust was designed to be used in cases such as this if customers lose money due to the failure of a clearing member.

"The failure of MF Global and the firm's mishandling of customer segregated funds is absolutely uncharted territory for this industry, and this extreme measure will help to provide all former MF Global customers access to their account balances that had previously been frozen in the liquidation," said CME Group Executive Chairman Terry Duffy. "Throughout this process, we have been working with the Trustee to help him release securely-held customer property at CME Clearing to customers and transferee clearing members. We have and will continue to advocate on behalf of customers - wherever they cleared or traded."

"CME Group believes it is critical to pursue this option with the Trustee to distribute additional securely-held customer assets," said CME Group CEO Craig Donohue. "Our primary concerns are the protection of our customers at CME Clearing and the integrity of all futures markets. We recognize that the U.S. Bankruptcy Code requires the Trustee to account for all customer assets and claims to ensure a fair, pro-rata distribution of those assets, and we sincerely appreciate how complex this task is for the Trustee.

We believe this extraordinary measure is necessary to ensure that all customers are treated fairly during the unique and challenging circumstances surrounding the failure of MF Global. We continue to work with the Trustee to return all of the remaining segregated funds to customers as soon as possible as allowed by law."

Gold and silver rallied back from the bear raid yesterday.

The correlation between metals and stocks is still troubling, but it does provide a ready hedge to bullion positions. This suggests that the metals are rising with liquidity and expectations of money printing, and that short term reductions in liquidity will drive the price lower.

Speaking of gold and money, here is a recent video interview with Jim Grant and Jim Rickards, in which they discuss these topics and others.

It is well worth a look, although I admire him greatly, I fear Jim Grant makes a stand on somewhat shaky ground when he calls out Paul Krugman to explain how monetary and fiscal policy worked with regard to 'the depression of 1920-21' and compares it to the current US economy.

Jim forgets to mention that a significant driver for that particular slump was the end of World War I, the return of the soldiers from overseas, and the adjustment from a wartime to a peace time economy.

There is also the little detail that Europe had been ravaged, but the US infrastructure and industrial machine was untouched, and only in need of retooling. The US needed a strong currency to control inflation, and the Fed's primary task was to manage money supply in the face of a naturally growing aggregate demand and rising incomes in the post-war period.

Krugman might be tempted to have some fun with that example and the prescription that raising interest rates now and tightening money supply is the right thing to do. Far from comparable, the situation is almost the opposite! The US is now a net debtor and importer of goods, and domestic demand is slack due to a stagnant median wage.

Yes, the Fed was overly accomodative in the 1920's as can be shown in the last chart in this blog, but the discussion is much more complex than time allows.

Rickards is on case with his discussion of the mispricing of the gold standard back then, and with regard to the SDR as a possible successor to the dollar, although he likens it too much to the US dollar, and says that the IMF has a printing press. He ignores the fact that the SDR is tied to an external standard, in this case a basket of currencies. And there is a contentious discussion amongst the trade powers with regard to the change in that basket. China and Russia are lobbying for other currencies and gold and silver to be included.

So it is a bit glib to suggest that the IMF can print SDR's at will. They *could* do that at some point, but not under the current system. That change in the composition of the SDR could be a key development in the currency war.

Speaking of Currency Wars, it is the title of Rickards new book, and I am waiting patiently for my copy to arrive.

In the meanwhile I started reading Jack Kennedy by Chris Matthews. It is very well written. Matthews is a natural story-teller, and he offers a fresh view of Kennedy based on first person information from JFK's friends, colleagues, and family.

It is a delight to read so far. It is a little light on 'scholarship' for some tastes, but it rings true, and includes an enormous amount of primary source interviews. It is insightful, a unique perspective, and a great read. It answers the question, "Who was Jack Kennedy, and what was he like?" I am thoroughly enjoying it. Matthews hit this one out of the park.

The situation with MF Global is an absolute disgrace. I am spending quite a bit of time looking into it, and will try to keep you apprised of any developments.

Have a pleasant weekend.

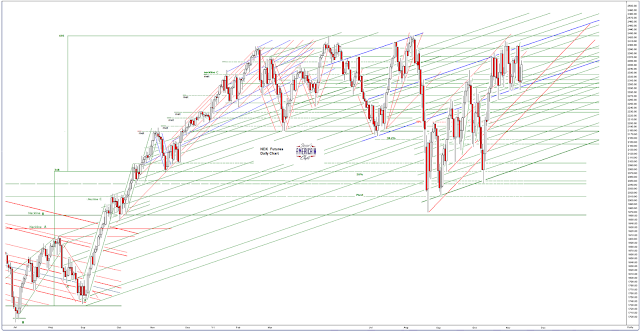

There was intraday commentary on the SP 500 chart that shows some important chart formations and levels of support and resistance.

The market rallied today on relief that Italy's bond prices relented somewhat, and consumer confidence came in 'better than expected.'

Volumes were light and the bond market and banks were closed for Veteran's Day.

Keep an eye on the European situation, as it will continue to drive the markets.

The last few times these symmetrical triangles at rally tops have broken decisively to the downside.

We are in such a formation now. I have marked levels that might be good indicators of a breakout or breakdown and some short term targets.

I think the greater risk is to the downside while the European financial and political situation remains unresolved, but I do not wish to get ahead of this.

A lot of guys are expecting this to move up to a high around 1275 which is only about 15 points away. They might get the rug pulled out from under them. Some pundits are also talking book to 1310. That is possible. But first they need to take out the triangle, and then they have a clearer shot, but with a lot of overhanging headline risk. I'd rather stay out than risk it, and have to sleep with one eye on Italian and Spanish bonds.

Volumes in today's rally are laughably light. The adults in the bond market have taken the day off.

This is a story about the first, albeit selective, potential default in the US by a major clearing exchange in the postwar period. And the cause of it remains a mystery, possibly by intent.

In the essay excerpted below, analyst Ted Butler brings out a key aspect of the failure of MF Global that has received far too little attention.

The self funding by the players of their industry's insurance seems to be one of the main sticking points in this impasse.

Why should the CME members pay back the MF Global customers, when they know full well what large institution took the collateral, probably illegally, sold it, and is refusing to give the money back and take the loss?

"Once you have their money, you never give it back,"

Ferengi - First Rule of Acquisition

And in their greed, they are risking the entire US exchange system in order to get their way with the government. Why not, it has worked before.

The failure of self-regulation, the rabbit hole of other scandals yet to be disclosed, and the political bickering are all matters that complicate the resolution. If MF Global had been a major bank, the FDIC would have immediately stepped in and made the depositors whole, and taken an active hand in the disposition of assets.

Is SIPC little more than a fig leaf, a false protection that fails when it is called upon to act as the insurance it purports to be?

This is a truly shocking scandal. And what may be even more shocking is the scant coverage it is receiving in the corporate media. They don't want to touch it because it brings the rottenness of the financial system out into the light of day. This is not some rogue trader, this is not even Bernie Madoff. This is the heart of the beast.

And that is why we may never hear the actual truth of it, which will be hidden under a smokescreen of 'accounting errors' and 'misunderstanding of risk' and a cloud of legal jargon.

It brings out in sharp relief the flaw in the ideological fairy tale that markets do not require outside regulation, that they are naturally efficient, and that people if left to their own judgement are all virtuous and objectively rational. But anyone who has ever driven on a modern freeway during rush hour knows the ridiculousness of those assumptions.

“It is a far, far better thing to have a firm anchor in nonsense than to put out on the troubled seas of thought.”

John Kenneth Galbraith

If this is not resolved, customers might be correct in assuming that nothing in the US financial system is safe. Someone needs to pass a note to Turbo Tim that this could be a big one, Elizabeth, if it is allowed to continue to fester. And maybe a copy of The Panic of 1907 by Robert F. Bruner.

Silverseek

An Unmitigated Disaster

By Theodore Butler

11 November, 2011

"Let me cut to the chase here and pinpoint the real problem – the CME Group. I know I have continuously criticized the CME, even calling it a criminal enterprise on many occasions, but in truth I may have understated the case. Yes, I would agree that the immediate cause of the MF Global bankruptcy was MF Global itself; but what turned it into a disaster of unprecedented proportions was the CME Group.

The CME Group was the front line regulator for MFG, responsible for auditing and insuring the safety of customer funds and for guaranteeing those funds in a worst case scenario. The CME failed at every turn. Not only did its auditing fail miserably, the CME failed to step up to the plate to safeguard customer funds after it was discovered that $600 million was missing. This is like a case of paying premiums for years on an insurance policy only to be denied coverage when presenting a claim for the first time. I know that the federal commodity regulator, the CFTC, has been negligent in the case of MF Global as well, but that does not mitigate the CME’s failures.

Of the twin failures by the CME in the MF Global bankruptcy, clearly of more significance is its failure to stand up and guarantee that all MFG customers would be immediately made whole by the clearinghouse system run by the CME.

The clearinghouse system, a consortium of financial firms whose collective finances stand behind every trade, has been the main backstop to all futures trading for many decades. It was widely understood by all market participants that if a clearing member failed, all the other clearing members and the exchange itself would step in to guarantee customer funds and prevent contract default.

The CME boasts on its web site that anywhere from $8 billion to $100 billion in protection is available in the event of a clearing member failure. If it was telling the truth, it would seem $600 million should be no problem.

Instead, we all have a very big problem, thanks to the CME Group. Our financial and credit systems are based upon trust and belief. The word credit itself comes from the Latin word “credere” or to believe.

What the CME Group has done by not immediately guaranteeing all MF Global customers and positions is to undermine belief in the futures market clearing system. So important is this issue that I am at a loss to explain how the CFTC hasn’t yet mandated that the CME do the right thing. And I have been somewhat dumbfounded that the analytical community and media haven’t been all over this, but there was an article in today’s NY Times that discusses the CME’s failures for the first time. In addition, there was a well-written article on the Internet that did describe the problem and the CME’s role. Please pay particular attention to the comments submitted on both articles.

Worst of all, even MF Global customers who held no open futures positions and only cash and unencumbered assets, like registered warehouse receipts for silver, gold and other commodities, have found those assets under the control of the bankruptcy trustee. If you do own warehouse receipts on silver or other commodities that are tied up in the MF Global bankruptcy, you must run, not walk, to a securities attorney to secure your legal rights to your property. This is not a matter of what is right or wrong, as the unauthorized appropriation of private property is never correct. This is a matter of law, which sometimes is not the same as what seems right or wrong. Please don’t delay. The CME is to blame for all of this, but blame must be saved for later...

One other small bonus that has emerged from this disaster is that the event has revealed as a lie all the nonsense that CME leaders have publicly proclaimed about the integrity of their markets. For the past few years, the smug and arrogant leaders of the CME have testified publicly before congress and the media about how the exchange’s clearinghouse system withstood and avoided the failures of the non-clearinghouse financial system as typified by AIG.

CME officials trumpeted the advantages of it being a Self-Regulatory Organization (SRO), quite capable of handling regulatory matters without the need for further government regulation. Unfortunately, even high officials of the CFTC were apparently sucked in by the appearance of financial strength and integrity portrayed by the CME’s clearinghouse system of guarantees and the wisdom of letting it continue to regulate itself. That has now all been shown to be a lie. What good are guarantees if they are not honored when need be? What good is self-regulation if it leads to the wholesale abandonment of the customers’ financial interest?"

Read the entire piece here.

Based on this shocking lapse in insurance and stewardship, it appears that some people whom I have spoken to and read about plan to shift the focus of their US dollar funds out of certain non-banking Wall Street institutions, and instead to place them in more conventional banking accounts and other assets held by safer hands.

The average person cannot tolerate such a precipitous loss of capital and freezing of funds. This is unacceptable. I was stunned at the trial balloons floated in the financial media that customers might have to accept haircuts and years of delay and litigation in receiving back their money.

MF Global Customers Have Few Options to Access Frozen Cash

Here is what I think and what I hear based on news and information from a variety of sources.

Obviously I cannot know the exact details or all the facts. And this becomes a little more speculative than normal, but that is the consequence of the lack of information and the cover up.

The facts are what the official investigation should uncover. Whether we find out what actually happened is another matter altogether.

We still cannot find out who had the customer assets, which is shocking. People know who it is, but they will not say. And here is the reason why.

There is a determined smokescreen that has been thrown up around this by MF Global and the financial industry.

The regulators and Justice Department are trying to discover the facts and then figure out how to deal with it. There is a public relations spin machine that is attempting to shape the perception of this event, with a variety of objectives and concerns, some at odds with each other.

First the good news, the customers will probably be paid. There may be a delay and it may involve some loss.

The Wall Street pros are trying to settle this behind the scenes in a way that masks the outrageous abuse of stewardship and systemic weaknesses. They are terrified of triggering a loss of confidence and a run on the system if people think that ownership of even Treasuries on account with Wall Street is a thin facade of security and not safe.

It is all about loss of confidence and disposition of responsibility.

The government and the financial system do not wish to expose their failure to properly protect customer money. Those who are lobbying against further financial regulation and investigations are concerned that a major scandal and lapse in 'self-regulation' would provoke a public reaction and a demand for greater transparency and safeguards.

And although this is more vague and speculative, the scandal is only the tip, a whiff of a much greater problem that no one wishes to even discuss, involving a broader misappropriation of assets and gaming of customer accounts.

They plan to blame it on 'accounting errors,' and sweep it under the tarp, as it were. But the sticking point is this: who pays, and how do you explain it?

There is no chance of finding a single rogue trader, so the effort will involve painting MF Global as a 'rogue broker.' By the way, the scandal involves their London trading operation as far as the transactions gone badly, but the details are not clear. They appear to have been 'set up' by another entity.

The regulators led by Jill Sommers and Bart Chilton are trying to understand what happened, but a smokescreen has been thrown up around this while the monied interests squabble about who will make good for the money.

A large institution took the customer funds as a loan collateral, but does not wish to disgorge the proceeds of the liquidated assets, because the loss would be theirs. And the details are politically sensitive.

A cover story is under construction but the major impediment is the argument about how the loss will be apportioned and the extent to which the public's demand for accountability will be satisfied.

The similarity of this to the 'settlement phase' of LTCM is striking, except of course that the Fed has not called the players together and forced a resolution and allocation of the losses amongst the players. This is why there is a delay.

The scandal involves public 'outsider' money, and has political implications, so the reluctance to accept the losses is greater, and at the same time 'touchier.'

This is why there is so much delay and confusion.

By the way, I hear that attorneys had to file an emergency motion in court this morning to prevent JP Morgan from jumping ahead of MF Globals segregated account owners in the disposition of assets.

As you may recall JPM is a major holder of MF Global unsecured debt, somewhere in excess of 1.2 billion. People obviously have wondered if they were the recipient of the segregated customer funds that were posted as last minute loan collateral, or whether that was done to secure an additional loan from another party.

Perhaps this indicates that JPM is not the holder of collateral, because to liquidate it, and then try to jump in front of customers when they attempt to collect as well, would be a monumental act of sheer piggery.

Many are interested in the identity of who may have provided last minute funds. Its a real financial detective story. Maybe some of the usual suspects are already queuing up for the book rights.