07 December 2012

The Financial Crisis (With Subtitles)

This comes from a group of students at the University of Missouri at Kansas City.

There is something very wrong about hearing R. Lee Ermey speaking French. Even if the words do not match the subtitles. And would he have ever used the word 'rhetorical' in real life?

I wonder if having Darth Vader explain Modern Monetary Theory, and then arrogantly choke off any serious discussion, was intentionally satirical?

MMT is little more than a de facto debt default through monetary inflation backed by official coercion, pure and simple. It doesn't have to be, of course, but it always turns out that way. Hyperinflation and the Pernicious Myth of Modern Monetary Theory.

There is a third alternative between modern monetary inflation and destructive austerity. Reform the financial system and make the bond holders and investors take the downsides of the risks which they have incurred, in the manner of Iceland. But there is little knowledge of this, because the monied interests are controlling the discussion.

For a related topic see The Debt Prisoner's Dilemma.

Enjoy.

Category:

modern monetary theory

06 December 2012

Gold Daily and Silver Weekly Charts

Non-Farm Payrolls report for November is coming out tomorrow. I would not be surprised to see a very light, sub 100k number compliments of Hurricane Sandy.

The FOMC has a two day meeting next week, and will announce its decision on Wednesday 12 December at 12:30 PM. I expect they will do something for the economy now that the elections are past.

Stopping the sterilization of Operation Twist seems likely at the least. That would increase the size of their balance sheet, and is gold positive. This could explain in part the chickenshit bear raids on the metals all week.

Have a pleasant evening.

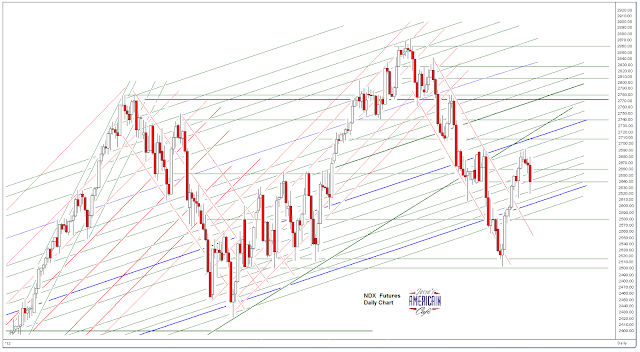

SP 500 and NDX Futures Daily Charts

AAPL caught at least a dead cat bounce today. We will have to see if it continues and proves to be something else.

Traders are starting to talk optimistically about a Santa Claus rally. They see Senator Jim DeMint leaving the Senate as a sign that the impasse over the budget is thawing. I was surprised to see a standing Senator step down like this to take a private sector position with what is essentially a lobbying organization.

"Gov. Nikki Haley of South Carolina, a Republican, will now be compelled to appoint a successor who would then run to maintain the seat in a special election in 2014, when Republican Senator Lindsey Graham, the senior senator from the state, will also be up for re-election. Aides said that Ms. Haley was surprised by Mr. DeMint’s sudden announcement."Non-Farm Payrolls Report tomorrow. We may see another light number compliments of Hurricane Sandy.

FOMC meeting next week.

Darkness Over the Earth

“How far that little candle throws his beams!

So shines a good deed in a weary world.”

William Shakespeare

Lord, how manifold are thy works! In wisdom thou hast made them: the earth is abundant with thy creations.

Psalm 104:24

Is there a darkness over the earth?

It glimmers like a candle in the night.

The darkness of our hardened hearts,

Casts images and shadows in the light.

NASA, Spectacular Black Marble Images Show the Earth in Darkness

Whalen and Ritholtz On Risk of Global Derivatives Market - Modern 'Bucket Shops'

The counterparty risks and domino in this market are enormous.

The lack of reform and regulation here is fomented by Wall Street money and political influence peddling.

It is a stimulus to pervasive market rigging since the markets are now much larger and more volatile than the economies that they purport to serve and model, the tail wagging the dog.

The first domino to fall may be a relatively small one compared to the global bond and currency markets, like a failure to deliver in a commodity that sets off a series of related counterparty failures and a break in confidence. In order to avoid this, the perpetration and subsidy of fraud takes on the nature of a larger Ponzi scheme that destroys the system under the rationale of saving it.

This is the heart of darkness of the credibility trap.

Category:

credibility trap

05 December 2012

Gold Daily and Silver Weekly Charts - Take Five, Dave

More nonsense, most of it not substantial.

Goldman came out with some babytalk about gold today. They tend to fade their advice to their customers for their own book so I think it is bullish.

FOMC meets next week. I think they will make a significant change to their quantitative easing program now that the election is past. It will probably involve more balance sheet expansion.

Dave Brubeck passed away today.

SP 500 and NDX Futures Daily Chart - Remembering Dave Brubeck

AAPL weighed heavily on tech today as analysts reports sparked profit taking.

More fiscal cliff boogie woogie. This is likely to continue until December 21.

FOMC meeting next week.

Subscribe to:

Comments (Atom)