Apple's seven-for-one stock split took place today.

The split will allow Apple to take its message around the professionals and institutions directly to the retail investor who will now consider Apple 'more affordable.' It would also make it more palatable for that great stock Judas goat, the Dow Industrials average.

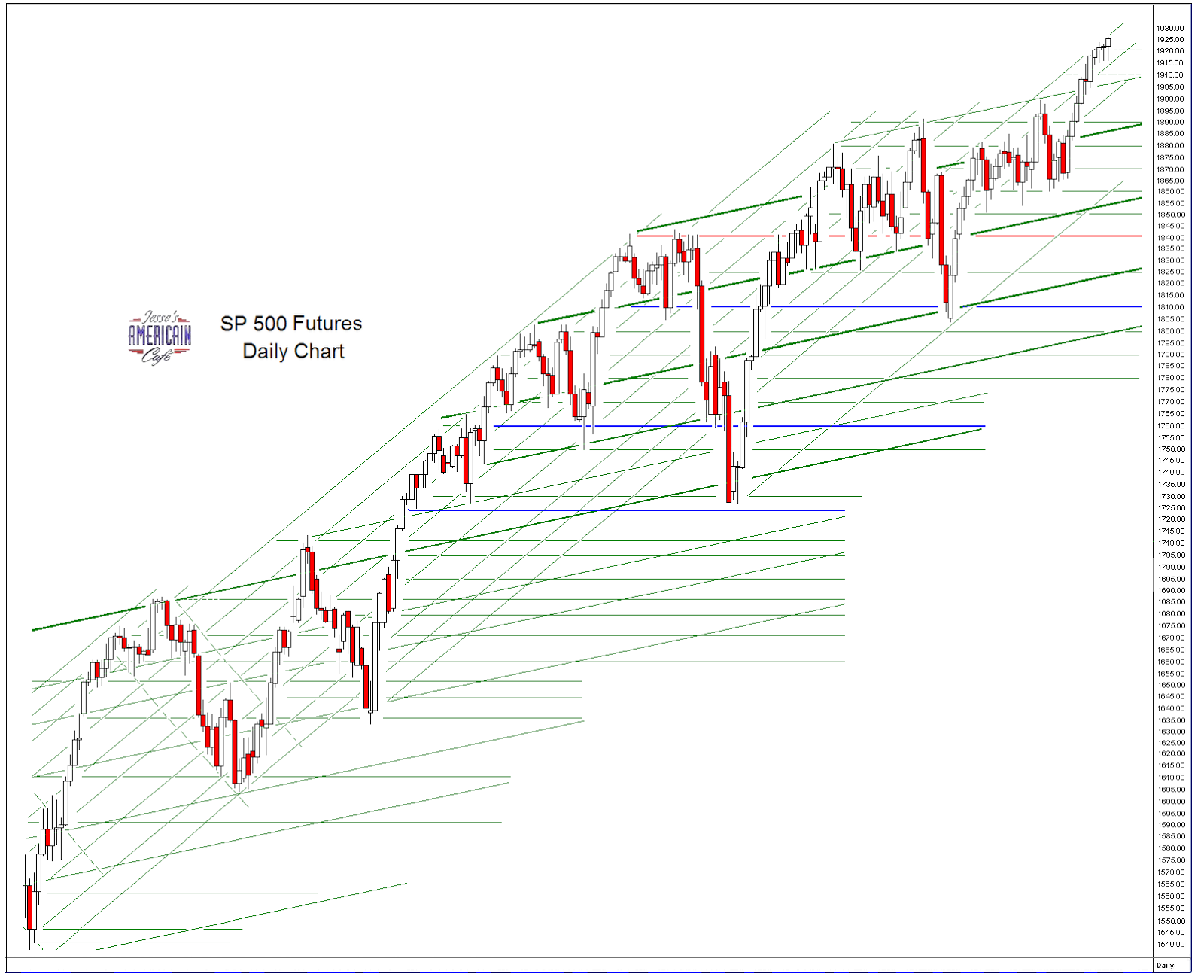

I figure the market will top out this summer, sometime around 2000 on the SP 500 futures or perhaps a bit of an overshoot. I don't know how long it will take to get there, and we may see a minor correction first. We are working off a funny kind of a stock formation that will lead to an unsustainable level unless it corrects back to the more sustainable trend.

This is barring any exogenous events which will tend to spin the market according to their own force. As the market reaches loftier levels ahead of the real economy, it becomes increasingly vulnerable, less robust. Or as Taleb might say more 'fragile.'

So we will see how it progresses, and will be able to determine if we are seeing a classic handoff of pumped up stocks to mom and pop near a top, or just an ongoing campaign by the Fed to inflate asset bubbles and reward their cronies with paper assets, while starving the real economy.

Have a pleasant evening.