Today was 'laundry day' at the US markets, as the foamy stock peak of the past month took a hard turn in the old 'wash and rinse' cycle, that blew off the froth.

31 July 2014

SP 500 and NDX Futures Daily Charts - Don't Worry Baby

Today was 'laundry day' at the US markets, as the foamy stock peak of the past month took a hard turn in the old 'wash and rinse' cycle, that blew off the froth.

30 July 2014

Gold Daily and Silver Weekly Charts - All Along the Watchtower

“We’ve had a lot of bombs being thrown around the world, and this is America throwing a bomb into the global economic system. We don’t know how big the explosion will be — and it’s not just about Argentina.”Joseph Stiglitz

Gold took a little hit today, and silver held its price.

Very anti-climactic given such an impressive sign of recovery in the real economy!

Nothing much happened on the Comex exhibit at Madame Tussaud's. The clearing report for all metals (gold, silver, platinum, copper) was simply 'no data' as shown below.

The tragicomedy that is the Argentine debt default continues on 'to the wire.'

As for the markets, there will be a lot of noise created, the stock and bond touts will all be out there making their pitches, but the bottom line is that the death and misery of the hoi polloi will leave the markets unfeeling, and the Fed isn't going to be doing anything except to continue to taper, but provide easy money for the fortunate few for quite some time.

The currency war has taken a hotter turn than I might have expected at this stage, with the US out banging the war drums very actively as a distraction. I suppose that one might not be so surprised. The privileged will do almost anything rather than surrender the status quo.

Have a pleasant evening.

SP 500 and NDX Futures Daily Charts - Triumph of the Swill

GDP was 'better than expected' this morning, coming in at 4.0% growth.

Well, it was not better than expected if you read my forecast about what they would do with it and the revisions.

They even improved the fourth revision of that anomalous one-off please ignore it Q1 to only -2.1% vs. a -2.9% decline. Progress!

The tech bulls are riding high, laughing it up on bubblevision.

It's a new paradigm, don't you know? They are feeding this bubble on swill.

Have a pleasant evening.

Victorian Britain: 'Yoke Up the Children'

"Many thousands are in want of common necessaries; hundreds of thousands are in want of common comforts, sir."

"Are there no prisons?"

"Plenty of prisons."

"And the workhouses." demanded Scrooge. "Are they still in operation?"

"Both very busy, sir."

"Those who are badly off must go there."

"Many can't go there; and many would rather die."

"If they would rather die," said Scrooge, "they had better do it, and decrease the surplus population."

Charles Dickens, A Christmas Carol

Efficient markets, the glory of Empire.

Britain and the Victorians were not alone in this of course. In the face of stiff opposition from industrialists who enjoyed a supply of inexpensive and pliable labour, and of course their servile politicians preaching the value of work and the evils of compassion and kindness, child labor was finally regulated by the US federal government in 1938.

I find it fairly remarkable that laws against the exploitation of child labor are under assault again, as 'a socialist impediment to the free markets.' The usual arguments and distortions are applied.

'Free trade' with the benign and universal benefits of globalisation is another economic myth that is used by greedy multinationals to erode the force of sovereign laws, and the will of democratic government, whether it be in child labour, human trafficking, or financial fraud and repression.

"It would be better for a man if a millstone were hung around his neck and he were thrown into the sea, than if he would cause harm to any of these little ones."

29 July 2014

Gold Daily and Silver Weekly Charts - Holding Pattern as The Empire Strikes Back

"Wars can be prevented just as surely as they can be provoked, and we who fail to prevent them must share the guilt for the dead."Omar Bradley

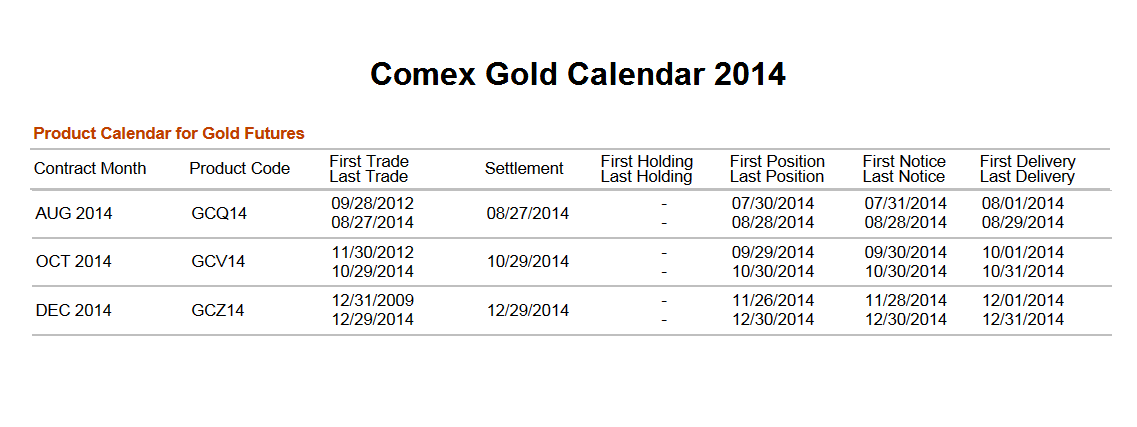

With tomorrow's trading the emphasis will likely shift from silver to gold as we move into the August contract period where gold is 'active' and silver is not.

Tomorrow brings the advance 2Q GDP number, and the results of a two day FOMC meeting in the afternoon.

Let's see how the metals make it through this gauntlet. And Non-Farm Payrolls on Friday.

Argentina may be forced into default tomorrow because of some fairly obtuse rulings by the fund friendly NY courts. The conversation about this on Bloomberg TV this morning was like something out of The Hunger Games.

The US has initiated even more sanctions on Russia. This does appear to be another manifestation of the currency war, engaged on a different level. It serves to distract and defer.

Have a pleasant evening.

Subscribe to:

Comments (Atom)