"It would not be an overstatement that demonetisation announced by the Prime Minister of India on November 8th might have been one of the largest self-inflicted macroeconomic shocks on a country in the absence of a short term crisis.

Given the sheer size - the decision to withdraw 85% of the cash in circulation has thrown India into disarray. Such a large and unexpected policy change naturally carries with it a large collateral damage at least in the short run."

Areendam Chanda, Notes And Anecdotes on Demonetisation

"Plunderers of the world, when nothing remains on the lands to which they have laid waste by wanton thievery, they search out across the seas. The wealth of another region excites their greed; and if it is weak, their lust for power as well.

Nothing from the rising to the setting of the sun is enough for them. Among all others only they are compelled to attack the poor as well as the rich. Robbery, rape, and slaughter they falsely call empire— and where they make a desert, they call it peace."

Tacitus

There is a major snowstorm moving on the northeastern United States that is centered now on Massachusetts and is moving up the coast as a classic nor'easter. I hear that they are expecting several feet of snow from this.

Luckily for us, the weather here is too warm for snow, but certainly cold and raw enough to discourage any thought of working outside, although feeding the birds, God's little ones, is a high priority.

There are more storms coming. Many of them have been caused by the greed and arrogance of people who lie so often to other people and their friends that they lose touch with common reality.

And so they may be shocked when the consequences of their actions come home to roost. They will say, 'no one could have seen this coming,' and what is worse, some of them may actually think they believe it.

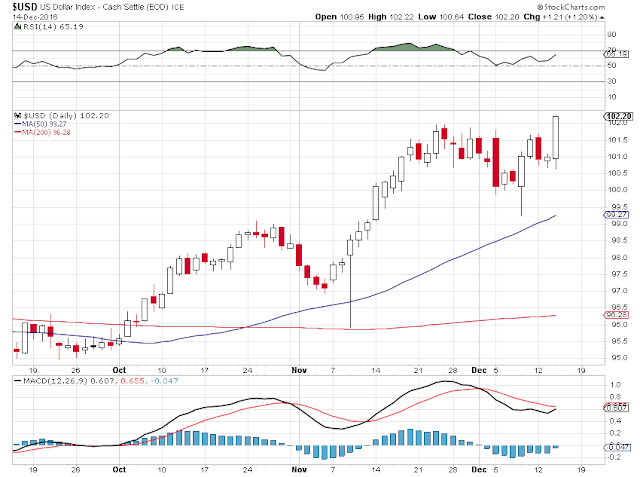

Gold and silver had a bit of a rally today, off a deeply oversold short term condition. Bloomberg TV was quick to challenge that, and show a longer term chart of gold in an intact downtrend.

Funny they did not mention silver at all. I would suggest that if we do rally from here that we have a confirmation of a massive cup and handle formation that is only visible on the weekly chart. And it is one that is also nested within an even bigger formation that can only be seen on the long term monthly charts. Silver is reflecting more of the natural market action than gold.

But that is a big

if, although many of the usual suspects will be quick to pounce on anything positive to generate breathless excitement without waiting for confirmation.

Things will be more impressive and exciting when gold and silver start moving limit up, with triple digit and triple dollar moves to the upside overnight, as the precious metal manipulation pools begin to fall apart. History suggests that they must, and eventually that they will.

Of course one cannot rule out some sort of official reaction bordering on the madness of the bureaucrats, as we have been seeing with Mr. Modi in India and his crackpot demonitisation actions.

Violence begets violence. And frightened people who are caught badly enough in a credibility trap will be tempted by extremities, after first depersonalizing those whose differences are a nuisance, and then an embarrassment, and finally a perceived challenge to power. The deplorables, the parasites, the other.

Let us remember that violence is rarely justifiable on another human being except in the most obvious acts of self-defense. That is not to say that violence doesn't happen, because it does every day.

We are such sophisticated barbarians that there are schools of thought, among them the neo-cons in foreign relations and the neo-liberals in economic policies, that see violence of whatever sort as a first choice to another people's failure to submit to their grandiose schemes of power.

Hubris warps vision, and the policies that proceed from the heights of arrogance have often produced cold-bloodedly horrific results, to which the parties are blinded, at least for a time.

Because a group is well-dressed, and covers their barbarous hearts with the trappings of culture, does not mean that they are 'civilised.' Their murders are merely more calculating and efficient— grotesquely

passionless.

And finally, let us remember each other in our prayers, so that we will not allow our love to grow cold, if there should be an increase in wickedness. Although we all do what we must do, this holding on to our own hearts and souls is the only transaction that in the very long run really matters.

If you love the Lord, truly as He loves you, then you cannot be afraid.

Have a pleasant evening.