“I've always resented the smug statements of politicians, media commentators, corporate executives who talked of how, in America, if you worked hard you would become rich. The meaning of that was if you were poor it was because you hadn't worked hard enough. I knew this was a lie, about my father and millions of others, men and women who worked harder than anyone, harder than financiers and politicians, harder than anybody if you accept that when you work at an unpleasant job that makes it very hard work indeed.”

Howard Zinn

"There is not a more perilous or immoral habit of mind than the sanctifying of success."

Lord Acton

“People with advantages are loathe to believe that they just happen to be people with advantages. They come readily to define themselves as inherently worthy of what they possess; they come to believe themselves 'naturally' elite; and, in fact, to imagine their possessions and their privileges as natural extensions of their own elite selves.”

C. Wright Mills, The Power Elite

"A lot of white-collar criminals are psychopaths. But they flourish because the characteristics that define the disorder are actually valued. When they get caught, what happens? A slap on the wrist, a six-month ban from trading, and don't give us the $100 million back. I've always looked at white-collar crime as being as bad or worse than some of the physically violent crimes that are committed."

Robert Hare

"The wealth of another region excites their greed; and if it is weak, their lust for power as well. Nothing from the rising to the setting of the sun is enough for them. Among all others only they are compelled to attack the poor as well as the rich. Plunder, rape, and slaughter they falsely call empire; and where they make a desert, they call it peace."

Tacitus

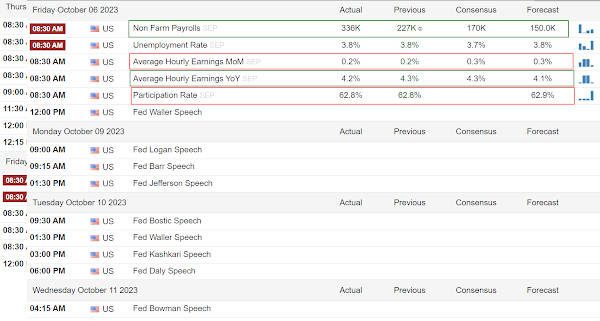

The ongoing current of statements from the spokesmodels and talking heads over the past week, as well as a number of market indicators I have learned to watch over the past thirty years or so had me thinking that we would see a terrible jobs number this morning, and a fantastic reversal and rally in equities and the metals. And I structured my trading positions accordingly, with a hedge for uncertainty.

And this morning when I heard the monster overshoot in the Jobs number I thought, 'oh no, I was wrong.' Thank God for the hedge, but I wish it was larger.

But little did I know. I'm glad I did nothing as the little set piece we call the 'free markets' played out. Am I getting more patiently wily or just lazy? Oh me of little faith.

But what else might we expect from empire building jokers who make a blasphemous religion of greed out of victimizing the innocent.

It is probably a mistake to ever underestimate the shamelessness and greed of the power elite.

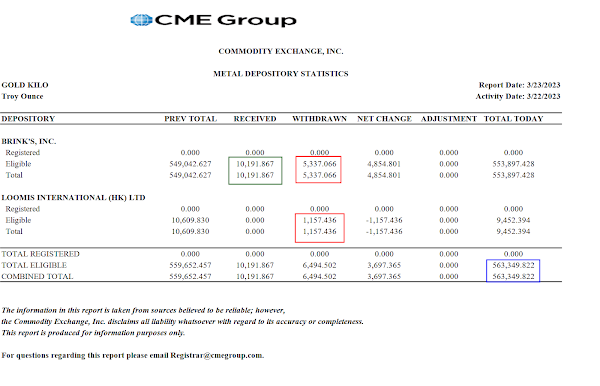

And so the Dollar this morning rocketed higher, and then dropped precipitously and ended slightly lower into the close.

Stocks did the opposite, with a monster rally crushing the shorts and hedges.

The VIX fell sharply after spiking higher.

Wash-rinse-repeat.

My eyesight continues to return, if all too slowly but surely. Whenever I might feel like getting too comfortably complacent He always seems to knock me down hard off my perch. Thank God for His loving kindness and tender mercies.

Have a pleasant weekend.