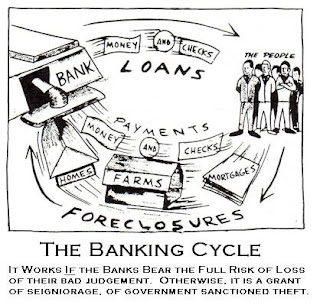

Moral hazard is the probability that a party insulated from risk will behave differently from the way they would behave if fully exposed to the risk. Moral hazard arises because an individual or institution does not bear the full consequences of its actions, and therefore has a tendency to act with increasing recklessness, literally 'without reckoning." It also encourages the rise to power of the sociopath in the affected organizations.

Moral hazard is the probability that a party insulated from risk will behave differently from the way they would behave if fully exposed to the risk. Moral hazard arises because an individual or institution does not bear the full consequences of its actions, and therefore has a tendency to act with increasing recklessness, literally 'without reckoning." It also encourages the rise to power of the sociopath in the affected organizations.It is difficult to explain moral hazard to tenured professors or the pampered princes of bureaucracy, who beat the drum with their silver spoons in support of shifting the risk of loss to the public every time that Wall Street falls into one of its own schemes and blows itself up.

It is a lesson that the average person learns by the age of twelve and relearns, sometimes spectacularly, at least once in young adulthood. If you do something wrong there can be bad outcomes, and you will pay the price and penalty. Unfortunately there is a small but powerful oligopoly of privilege that is trying to project themselves onto the global stage while believing that they are immune to ordinary consequence, and have become addicted to the notion that 'others must pay' for their failures.

Moral hazard comes from rewarding bad behaviour in markets with wristslaps and bailouts. It is a danger to the economy and to the public.

Though contracted a bit from the most recent implosion, the game still limps along with the coo-coo kisses of the Wall Street sycophants and other people's money. Now we might expect even more brazen attempts to game the system. This inevitably leads to wild gyrations in stocks and bonds and commodities. History suggests ever more brazen price manipulation so disconnected from reality that actual physical shortages result because of the corruption of the market pricing mechanism.

Can't happen? Enron made it happen in the energy markets, and almost brought California, a state the size of most countries, to its knees.

Can't happen? Enron made it happen in the energy markets, and almost brought California, a state the size of most countries, to its knees.The wristslaps and bailouts will continue until these modern Phaetons kill themselves or someone else, and create damage too great to be bought off in the backrooms of the county courthouse.

At least their descent from the heights will be impressive, if you can avoid the impact crater.

AP

Wall Street Culture Not Likely to ChangeSaturday March 22, 7:05 am ET

By Joe Bel Bruno

Culture of Risk on Wall Street Not Seen Changing Amid Bear Stearns Downfall

NEW YORK (AP) -- Wall Street investment bankers got another lesson about the dangers of risk-taking this past week with the downfall of Bear Stearns Cos. The question now obviously is, how long will it last?

Those bankers, many of whom lived through market debacles like the dot-com bust at the start of this decade, turned out to have very short memories. And so analysts believe the sale of Bear Stearns to JPMorgan Chase & Co. for a stunning $2 per share ultimately won't have that much of an impact on how Wall Street conducts business.

In fact, bankers and traders are under even more pressure to reap big returns because of the ongoing credit crisis, and risk is just part of the game.

"There's an old saying on Wall Street that, for traders and bankers, you'd have to take a normal 30 year career and distill it to 15 years," said Quincy Krosby, chief investment strategist for The Hartford. "This whole episode might change Wall Street for a little while."

Krosby believes that Bear Stearns' near-collapse, which followed the company's investing too heavily in risky mortgage-backed securities, might force some bankers to change their ways in the short term. But it won't be enough to temper the financial industry's relentless pursuit of money.

Indeed, the past decade has seen a number of investing fiascoes that Wall Street doesn't appear to have learned much from. Krosby noted the go-go Internet days -- when untested high-tech companies reaped piles of cash in public offerings. The lesson then was, don't put a lot of money into a venture that isn't on fairly solid ground -- but mortgages granted to people with poor credit are quite akin to high-tech firms that had never turned a profit. In both cases, investors gleefully looked past the risk.

Indeed, the past decade has seen a number of investing fiascoes that Wall Street doesn't appear to have learned much from. Krosby noted the go-go Internet days -- when untested high-tech companies reaped piles of cash in public offerings. The lesson then was, don't put a lot of money into a venture that isn't on fairly solid ground -- but mortgages granted to people with poor credit are quite akin to high-tech firms that had never turned a profit. In both cases, investors gleefully looked past the risk.Now investors are smarting from what happened to Bear Stearns. And traders are somewhat chastened, for now.

Erin Callan, the chief financial officer for Lehman Brothers Holdings Inc., said her firm has certainly become more wary about the risks it takes amid the credit crisis. However, the market's gyrations also offer Lehman's army of traders an opportunity to make money.

"We just try to come in, and run the business the best way we can," she said. "But, you can't survive if you take no risks at all. All we can do is plan in this environment, making sure we do all the things to optimize running the firm."

It seems there's little that will change an industry and a lifestyle attached to Wall Street, which is thought of by Americans as more than just the center of free-market capitalism. Its culture attracts men and women with a swashbuckling mentality -- smart, aggressive risk takers with the potential to become very rich. (You could use the same description for conmen, gangsters and drug dealers - Jesse)

And, their skills in trading and investment banking were proven this past week -- even after news of Bear Stearns' buyout.

Chief executives at Morgan Stanley, Goldman Sachs Group Inc., and Lehman Brothers pointed out that trading desks played a big part in offsetting massive mortgage-backed asset write-downs, which have ticked past $156 billion for global banks since last year.

As the three companies released first-quarter earnings data, Morgan Stanley said equity trading revenue surged 51 percent to $3.3 billion. Revenue at its fixed-income sales and trading group dropped 15 percent to $2.9 billion, but it was still the firm's second-highest performance ever despite having to write down $2.3 billion linked to subprime mortgages and leveraged loans.

And that pleased investors. Morgan Stanley had its largest gain in more than a decade on Wednesday, climbing 18.8 percent to $42.86. Rival investment banks also had their best week since 2001.

But, investors shouldn't get too comfortable -- the investment banking industry, and Wall Street in general, still have a long way to go before they can be called healthy. It's not just the credit market problems that are an issue, it's also the struggling U.S. economy and its potential to hurt other countries.

"Until we feel more certain about the worldwide economies, we don't see things picking up dramatically," said Goldman Sachs CFO David Viniar. "We just need to keep plugging away."