We are watching a train wreck in slow motion, with the Fed and Treasury putting on a smoke and mirrors show to hide the gory details of perfidy.

We are watching a train wreck in slow motion, with the Fed and Treasury putting on a smoke and mirrors show to hide the gory details of perfidy.

Recovery without jobs, solvency, real consumption, or increased manufacturing is not a recovery. This is the corpse of an economy coughing up the remnants of its vitality in response to the Fed's monetary Heimlich maneuver.

And when it is done there will be nothing left, except a pile of markers and an unpayable debt, insolvency and default.

Oh, the dollar will surely stagger for a while, and do some turns and twists to confound the speculators, but its condition is worsening. And what is unthinkable to those who maintain a studied ignorance of history will be a fait accompli... fin du régime, le siècle du dollar.

WSJ

Capmark Seeks Chapter 11

By MIKE SPECTOR, LINGLING WEI AND PETER LATTMAN

October 26, 2009

One of the nation's largest commercial-real-estate lenders filed for bankruptcy protection in Delaware, the latest sign that problems in that market are far from over.

Capmark Financial Group Inc. has been one of the biggest lenders to U.S. investors and developers of office towers, strip malls, hotels and other commercial properties. An independent company that used to be the commercial lending unit of GMAC LLC, a financing affiliate of General Motors Co., it has been in financial straits for months and warned in September that it might have to file for Chapter 11 reorganization.

In its bankruptcy filing, Capmark listed assets of $20.1 billion and liabilities of $21 billion as of June 30. Citigroup Inc. is the agent on much of Capmark's secured debt. Other holders of Capmark's secured debt include hedge funds Paulson & Co., Anchorage Advisors and Silverpoint Capital, a person familiar with the matter said. (The asset - liabilities balance does not seem all that bad. Just how dodgy and marked to fantasy are those assets anyway? - Jesse)

Some of Capmark's debt that can't be repaid might be converted to stock, the person said. Current plans call for all Capmark businesses to be preserved as part of a reorganized company or "sold as going concerns for full value," the same person said.

The filing comes amid similar troubles in the commercial-property arena. Mall-giant General Growth Properties and hotel-chain Extended Stay Inc. filed for bankruptcy in the past year, and more commercial-company real-estate ventures could fail amid an inability to refinance debts and reduced customer traffic as consumers continue to pull back. The difficulties are a blow to Capmark's private-equity owners. In 2006, a group led by Kohlberg Kravis Roberts & Co., Goldman Sachs Capital Partners and Five Mile Capital Partners paid $1.5 billion in cash to acquire lender GMAC's commercial real-estate business, which they renamed Capmark.

The difficulties are a blow to Capmark's private-equity owners. In 2006, a group led by Kohlberg Kravis Roberts & Co., Goldman Sachs Capital Partners and Five Mile Capital Partners paid $1.5 billion in cash to acquire lender GMAC's commercial real-estate business, which they renamed Capmark.

At the time, Capmark proclaimed it was poised to tap capital markets and realize the full potential of all its businesses, which include lending to commercial-property developers and investors; managing investment funds that bought commercial-real-estate debt; and collecting payments on loans, or "servicing." GMAC, meanwhile, boasted the deal would free up $9 billion in capital it could redeploy.

But the deal didn't work out for any of the parties. GMAC suffered heavy losses on its real-estate loans and faced further pressures on its car-financing operations when the auto market collapsed. It eventually had to tap federal bailout money.

KKR, which has written its Capmark investment down to zero, declined to comment. A Capmark spokeswoman didn't respond to requests for comment.

Capmark, based in Horsham, Pa., recently reported a $1.6 billion second-quarter loss. The company deteriorated along with the deep problems plaguing the commercial-property market. Capmark has originated more than $10 billion in commercial-real-estate loans, according to Moody's Investors Service.

One of Capmark's deals was the landmark Equitable Building that rises 33 stories above downtown Atlanta. In 2007, San Diego real-estate firm Equastone LLC paid $57 million for the office tower and took out a $51.9 million mortgage from Capmark Bank. Equastone planned to expand the tower and attract a tenant with pockets deep enough to rename the building.

In April, Capmark Bank foreclosed on the building after Equastone defaulted on the debt.

Adding to Capmark's pressures, the Federal Deposit Insurance Corp. had notified the company it must raise capital and boost liquidity at its Utah bank, which has roughly $10 billion in assets. The bank makes and holds commercial mortgages.

The bank isn't part of Capmark's bankruptcy filing. Capmark Bank got a $600 million capital infusion from its parent company in late September.

Capmark has retained law firm Dewey & LeBoeuf LLP and financial advisers Lazard Frères & Co. LLC, Loughlin Meghji + Co. and Beekman Advisors Inc.

The company has about 1,800 employees located in 47 offices world-wide. It recently reached an agreement to sell its North American servicing and mortgage-banking operations to a new company owned by Warren Buffet's Berkshire Hathaway Inc. and Leucadia National Corp. for as much as $490 million.

Under the deal's terms, the sale could occur while Capmark is in bankruptcy but would require a bigger cash payment.

25 October 2009

CapMark Eats Its Balance Sheet - Declares Bankruptcy

Here Comes the Monetary Expansion Bubble

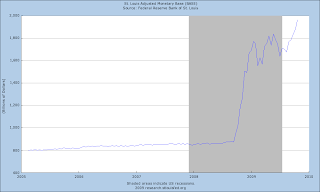

The best looking economy that debt money can buy. We have included some graphs to put this in perspective. But the bottom line is that the economy may be growing nominally based on an explosion in Federal Debt. We are almost certain that the debt is being applied in ways that will do no good, provide no sustained benefit, to anyone except a few narrow sectors and especially the FIRE sector.

The best looking economy that debt money can buy. We have included some graphs to put this in perspective. But the bottom line is that the economy may be growing nominally based on an explosion in Federal Debt. We are almost certain that the debt is being applied in ways that will do no good, provide no sustained benefit, to anyone except a few narrow sectors and especially the FIRE sector.

Too bad the chain deflator is broken, but it may catch up on adjustments. These positive numbers, especially if there is an upside surpise, are due to an unprecedented monetary inflation, not seen since the early 1930's, and a bringing forward of future sales in automobiles through government programs.

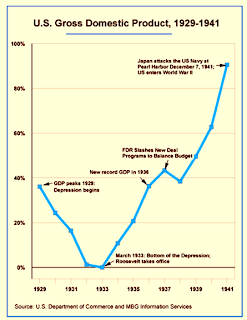

We would submit that despite the myths that have been spread, the programs instituted by FDR were significantly effective in providing the impetus to lift the US out of the Depression. However, most of the programs were later overturned by the Supreme Court, and the Fed prematurely tightened its monetary policy, caused an 'echo slump' in the late 1930's.

There is a difference this time. FDR had accompanied his dollar devaluation (vis a vis its then gold standard, about 40%) and stimulus with programs that targeted job creation and reforms of the financial sector. There was the creation of the SEC, the advent of Glass-Steagall, and widespread investigations of the corruption of the late 1920's.

We are seeing little to none of that today, since the stimulus is largely in the form of monetary inflation and debt creation, with a small amount going to jobs, and the vast majority of the money flowing to a relatively few Wall Street banks.

Stay out of the way of the propaganda rally, but watch for the double dip W in real life.

Bloomberg

GDP Probably Grew as Stimulus Took Hold: U.S. Economy Preview

By Timothy R. Homan

Oct. 25 (Bloomberg) -- The economy in the U.S. probably grew in the third quarter at the fastest pace in two years as government stimulus helped bring an end to the worst recession since the 1930s, economists said before reports this week. The world’s largest economy grew at a 3.2 percent pace from July through September after shrinking the previous four quarters, according to the median estimate of 65 economists surveyed by Bloomberg News. Other reports may show sales of new homes and orders for long-lasting goods increased.

The world’s largest economy grew at a 3.2 percent pace from July through September after shrinking the previous four quarters, according to the median estimate of 65 economists surveyed by Bloomberg News. Other reports may show sales of new homes and orders for long-lasting goods increased.

Americans flocked to auto showrooms and real-estate offices last quarter to take advantage of government programs such as “cash-for-clunkers” and tax credits for first-time homebuyers. Growing demand caused stockpiles to keep falling, which will prompt companies to rev up assembly lines and help sustain the recovery into 2010 even as unemployment climbs.

“The recovery is off to a decent but unspectacular start,” said Joe Brusuelas, a director at Moody’s Economy.com in West Chester, Pennsylvania. “While another large drawdown in inventories will be a drag on third-quarter growth, it sets the stage for a longer and stronger upturn in manufacturing.”

The Commerce Department’s report on gross domestic product is due Oct. 29. The four consecutive decreases through the second quarter marks the longest stretch of declines since quarterly records began in 1947. The economy shrank 3.8 percent in the 12 months to June, the worst performance in seven decades.

Stocks Climb

Stocks have rallied as earnings at companies from Caterpillar Inc. to Morgan Stanley topped estimates. Profits exceeded expectations at about 80 percent of the companies in the Standard & Poor’s 500 Index that have released results, according to Bloomberg data. That marks the highest proportion in data going back to 1993. The S&P 500 closed at a one-year high on Oct. 19. Consumer spending last quarter probably jumped at a 3.1 percent annual rate from the previous three months, the biggest gain since the first quarter of 2007, the GDP report is also projected to show.

Consumer spending last quarter probably jumped at a 3.1 percent annual rate from the previous three months, the biggest gain since the first quarter of 2007, the GDP report is also projected to show.

September readings on household purchases, due from the Commerce Department on Oct. 30, may show the quarter ended on a soft note after the Obama administration’s car incentive expired the month before. Spending probably fell 0.5 percent last month as car sales slowed after jumping 1.3 percent in August, the biggest gain since 2001.

The so-called cash-for-clunkers program offered buyers discounts of as much as $4,500 to trade in older cars and trucks for new, more fuel-efficient vehicles. The plan boosted sales by about 700,000 vehicles, according to a Transportation Department estimate.

Homebuyer Credit

The administration’s $787 billion stimulus package, signed into law in February, included an $8,000 tax credit for first- time homebuyers that expires at the end of November. New-home sales last month increased 2.6 percent to an annual pace of 440,000, the highest level since August 2008 and reflecting the boost from the credit, according to economists surveyed. The Commerce Department’s report is due Oct. 28.

New-home sales last month increased 2.6 percent to an annual pace of 440,000, the highest level since August 2008 and reflecting the boost from the credit, according to economists surveyed. The Commerce Department’s report is due Oct. 28.

Lawmakers in Washington are debating an extension of the credit through June, and are discussing expanding it to all buyers under an income cap.

A report from S&P/Case-Shiller home-price index due Oct. 27 may show home values in 20 U.S. metropolitan areas declined in the year ended August at the slowest pace since January 2008, according to the survey median.

More Orders

Orders for durable goods rose 1 percent in September, economists project the Commerce Department will report Oct. 28. A gain would be the fourth in the last six months and indicates companies are starting to invest in new equipment. Business spending and housing “stand ready to provide the oomph necessary to generate continued optimism until consumer activity stabilizes,” said Guy LeBas, chief fixed-income strategist at Janney Montgomery Scott LLC in Philadelphia.

Business spending and housing “stand ready to provide the oomph necessary to generate continued optimism until consumer activity stabilizes,” said Guy LeBas, chief fixed-income strategist at Janney Montgomery Scott LLC in Philadelphia.

Optimism among U.S. consumers in October is forecast to rise even as unemployment probably also increased, economists said. The Conference Board’s confidence index, due Oct. 27, climbed to 53.5 from 53.1, according to the survey median.

The economy will likely grow at a 2.4 percent annual rate from October through December, according to a Bloomberg survey earlier this month. GDP will also expand 2.4 percent next year and 2.8 percent in 2011, the survey showed, compared with an average of 3.4 percent growth over the past six decades.

“This has been the mother of all recessions in our working lifetime,” Jim Owens, Caterpillar’s chief executive officer, said on a conference call last week. The Peoria, Illinois-based company, the world’s largest producer of backhoes and bulldozers, predicted on Oct. 20 that sales may rise as much as 25 percent next year.

You might be surprised to see this chart of GDP in the United States from 1929 to 1940. See The FDR-Failed Myth for more information. If there is a difference with our current monetary expansion, which is on a par with the Fed actions in 1933 and the exit from the domestic gold standard, it is that the vast majority of the liquidity is going directly to the banks this time, and not to the public and for specific employment projects. It is a New Deal for the wealthy financiers.

22 October 2009

Of Bubbles and Busts: Which Way for China?

"Mischief springs from the power which the monied interest derives from a paper currency which they are able to control, and from the multitude of corporations with exclusive privileges...which are employed for their benefit." Andrew Jackson

While the crowd has been chortling over the anticipated decline and fall of the American Empire, they may also be overlooking the dangerously unstable bubble in China, and the implications for that phenomenon when the global economy shifts again.

There has been little doubt in our minds for a long time that China was in an impressive growth cycle that was fueled by overly cheap money and a spectacular equity bubble. This is why we posted that documentary about the Crash of 1929 yesterday, in commemoration of the 80th anniversary of Black Thursday tomorrow.

There has been little doubt in our minds for a long time that China was in an impressive growth cycle that was fueled by overly cheap money and a spectacular equity bubble. This is why we posted that documentary about the Crash of 1929 yesterday, in commemoration of the 80th anniversary of Black Thursday tomorrow.The collapse of bubbles will not be in the US alone, and the description and atmosphere as described in that film sounds much more like China today than it does the US.

The reasoning behind this is fairly straightforward.

It may be hard to remember from the current lofty heights of the 'China miracle' but their economy was a train wreck in the latter part of the 20th century. Prior to 1980 the state owned People's Bank controlled all the financial resources of the command driven economy. The government created State Chartered Banks (SCB's) in the 1980's, but their business activities were still driven by state policy initiatives, and they quickly became burdened by bad debts.

A speculative push and some tax breaks for foreign direct investment helped to further distort the economy, which led to a severe domestic slump, with banks burdened by Non-Performing Loans. But it was still a centralized economic regime, with a reminder served by the brutal suppression of the student demonstrations in Tiananmen Square in 1989.

In 1994 China tried to cure the serious problems in their domestic economy by devaluing the yuan from 5 to 8.3 to the US dollar in order to facilitate an export driven recovery. That is a 40% devaluation! All your costs were just marked down 40% relative to the competition.

China was able to make key investments in the 1996 Democratic party campaign, and Bill Clinton championed China's favored nation status in 1998, smoothing the way for China's admission into the World Trade Organization in 2000, while still maintaining a deeply devalued currency that was 'pegged' to the US dollar.

As a general note, a country does not engage in unrestricted trade with another country that maintains a currency peg after a devaluation, unless there is some significant ulterior motive. The rational economic response is to first maintain trade tariffs to control the flow of goods and the de facto subsidies and barriers imposed by an artificially manipulated currency. Whenever anyone says that a currency that is 'pegged' and subject to tight exchange controls is not manipulated, except in highly unusual circumstances such as a gold standard, the people in the room just should laugh them on their way out the door.

Pegging the yuan to the dollar helped to encourage foreign direct investment, and helped to stabilize the artificially low prices that US importers could achieve, most notably the Arkansas based WalMart.

Pegging the yuan to the dollar helped to encourage foreign direct investment, and helped to stabilize the artificially low prices that US importers could achieve, most notably the Arkansas based WalMart.Those are the roots of the China bubble: cheap money. It used to be said that the Japan Miracle was a result of their real estate price explosion, the 'monetization of the land.'

This is a bit of an oversimplification since was a bubble fueled by government industrial policy known as mercantilism. But using this analogy, China was monetizing the cheap labor of its people, as a means to provide cheap goods to the West, and allow business to erode the wage gains which labor had achieved through the worker's union movements of 1930 to 1970. And if one looks at the progress of the US median wage from 1980 to 2009, it worked. The US middle class is flat on its back.

All that history aside, what is going to happen now with China? It was important to take some time to establish the roots of its current bubble, because people have become wide-eyed and accepting of the miracle. Yes, cheap labor helps, but there are plenty of countries around the world that have cheap labor. It tends to get less cheap when the country develops, and when the domestic economy and education and infrastructure improves, while the government can continue to provide subsidies via tax breaks and cheap currency and subsidized debt from banks that are still controlled by the State.

The trade surpluses that have created China's enormous two trillion dollar reserves are a direct result and indicator of the China bubble formulated by Western banks and a domestic government made increasingly nervous by popular unrest due to their economic blundering. Those surpluses in turn have fueled a monumental asset bubble in China that they must handle with care.

The China miracle is a new paradigm in the same way that the tech bubble introduced a new era of permanent prosperity in the US in 2000, and trading margin created a vibrant US economy in 1929. There are many true believers in this miracle, most notably Jimmy Rogers, but that does not mean it is not simply what it is: a bubble created by monetary and policy manipulation.

China is faced with a period of transition. It must move from a export economy to a more balanced domestic consumption economy. This will raise living standards and education levels, and disposable incomes of its people. If a ruling party is an oligarchy, whatever political label one wishes to attach to it, then they are often jealous and insecure of their power base, and anxious about losing control.

If there is a continuing collapse in trade, and the world economy, the theory of decoupling promoted by analysts like Peter Schiff appears to be exceptionally unlikely, unless China can make the transition to either a regional predatory power or more domestically self sufficient.

China can do this, but it is quite important to remember that they do not have market capitalism at their backs and a history of well regulated banks and markets to help them allocate their new found riches in productive, non-corrupt ways. The China miracle is highly dependent on Western multinationals.

China can do this, but it is quite important to remember that they do not have market capitalism at their backs and a history of well regulated banks and markets to help them allocate their new found riches in productive, non-corrupt ways. The China miracle is highly dependent on Western multinationals.In some dimensions, China is more like the US in 1929 than the US itself resembles that paradigm today. This would imply that China is more likely to experience the kind of devastating crash and long economic Depression if world trade collapses.

As you may recall, the US was a heavy net exporter and an economic miracle itself in the 1920s having largely escaped the economic devastation of the first World War.

Perhaps this is a long way of saying that the outcome for China is hardly pre-determined, but it is not nearly so rosy as the believers in the miracle might think. They will have a choice, but that choice is going to lead them to a crossroads quickly, between becoming a free nation with a burgeoning middle class that is increasingly free to make its own choices, or a military dictatorship that seeks to establish client states to provide raw materials and receive its manufactured goods in return.

We should expect the 'One World Government' crowd to make another play when things get particularly bad. Never waste a crisis. The oligarchies do not particularly care whether your flag is red, yellow, or red, white and blue, as long as they are in control. Early on Bill Gates went to China, and upon his return said, "This is my idea of capitalism." The China Bubble and the Convergence of Oligarchies

So, in summary, there is a great deal of facade around the China miracle that is of recent and somewhat shaky construction than most people realize. The Chinese economy is still highly artificial and centrally controlled, with enormous rot underneath that shiny facade in the form of bad debts, malinvestment and over capacity in some areas with insufficient development in others.

China will continue on, as well as the US. The question is really about how and what they will become, and what investment opportunities and perils they represent to the individual. Will the yuan appreciate if the economy collapses into a nasty deflation, as the deflationary theorists think happens when a currency credit bubble breaks?

Oh, if only life were that simple and linear. The strength of a currency can fluctuate short term in response to temporary contractions and squeezes, as the US dollar had done in reaction to the eurodollar short squeeze caused by the collapse of dollar securitized debt assets and some remarkably bad risk management practices by the large European banks.

At the end of the day, a currency is going to be supported by the underlying value of what it represents, because unless it is specie, that is all it represents. And in many ways this is one of the most quiet, almost hidden reasons for the rush to commodities and the bull market in gold. Investors around the world are running from bubbles and monetary manipulation, and seeking safer harbors in those things that have undeniable value and usefulness, or have stood the test of time as nations and currencies have risen and fallen.

Empires may dwindle, but all bubbles collapse, and sometimes spectacularly.