The SP is reaching a high note here. It is an attempt, in my judgement, to pump up financial assets, led by price manipulation and not any economic fundamentals or legitimate price discovery. It might go higher, but higher from here it looks like bubble territory, if we are not there already.

Overdue for a fairly stiff correction, but do not get in front of it for the sake of your portfolio. I would not underestimate the Fed's willingness to create a new bubble to attempt to counteract the effects of the last two. What else can they do given the hole into which they have dug themselves? It will take a serious financial reform and economic restructuring effort to correct this. Until then the looting continues.

24 March 2010

SP Daily Chart: The Financial Engineering of Bubble-nomics

23 March 2010

Interest Rate Swap Spreads on Treasuries Turn Negative for the First Time

Does this imply that the comparable LIBOR is lower than US Treasuries? If so, yikes (I think).

Does this imply that the comparable LIBOR is lower than US Treasuries? If so, yikes (I think).

Purely technical, the result of govenment mandates for insurance companies and pension funds to match duration obligations, and some slightly more exotic hedging from the denizens of the trading desks?

Some also speculate that this is one or two primary dealers leveraging their interest rate derivatives. And that they are anticipating some fresh antics from Zimbabwe Ben.

I am fresh out of speculation on this, so if anyone has a cogent insight on this, I would not mind hearing it. You know how to reach me by email.

It does looks like the mispricing of risk. And as we all know, that can leave a mark. It might not be so bad if this is just a temporary thing, but I get the sense that the government's sworn commitment to subsidizing moral hazard is poking the market's animal spirits in the ass, and the risk trade is back on.

This seems to be a recurrent trend here in the Hogfather's School of Economic Mischief and Misery.

And in the meantime, Watch the Bond Market, not Bank Lending or Velocity.

Bloomberg

Ten-Year Swap Spread Turns Negative on Renewed Demand for Risk

By Susanne Walker

March 23, 2010 12:45 EDT

March 23 (Bloomberg) -- The 10-year U.S. swap spread turned negative for the first time on record amid rising demand for higher-yielding assets such as corporate and emerging market securities.

The gap between the rate to exchange floating- for fixed- interest payments and comparable maturity Treasury yields for 10 years, known as the swap spread, narrowed to as low as negative 0.44 basis point, the lowest since at least 1988, when Bloomberg began collecting the data. The spread narrowed 3.38 basis points to negative 0.38 basis point at 12:40 p.m. in New York.A negative swap spread means the Treasury yield is higher than the swap rate, which typically is greater given the floating payments are based on interest rates that contain credit risk, such as the London interbank offered rate, or Libor. The 30-year swap spread turned negative for the first time in August 2008, after the collapse of Lehman Brothers Holdings Inc. triggered a surge of hedging in swaps. The difference narrowed to negative 18.56 basis points today.

“It’s hedge-related activity related to new corporate issuance,” said Christian Cooper, an interest-rate strategist at Royal Bank of Canada in New York, one of 18 primary dealers that trade with the Federal Reserve. “As more and more institutions receive, then swap rates will go lower.”

Interest Rate Hedging

Debt issued by financial firms is typically swapped from fixed-rate back into floating-rate payments, triggering receiving in swaps, which causes swap spreads to narrow. An increase in demand to pay fixed rates and receive floating forces swap spreads wider, provided Treasury yields are stable. Corporations that issue bonds also use the swaps market to hedge against changes in interest rates that may result in increased debt service costs.

The extra yield investors demand to own corporate bonds rather than government debt was unchanged yesterday at 154 basis points, or 1.54 percentage points, the narrowest since November 2007, the Bank of America Merrill Lynch Global Broad Market Corporate Index shows. High-yield debt returned a record 57.5 percent in 2009, and another 4.3 percent this year, according to the Bank of America index data.

“There’s a lot of money on the sidelines waiting for mortgage-backeds to cheapen up,” said Cooper. “In the absence of them getting cheaper and as the end of the buyback program comes near, people are looking for high quality spread products, so a good place to park is in swap spreads.”

22 March 2010

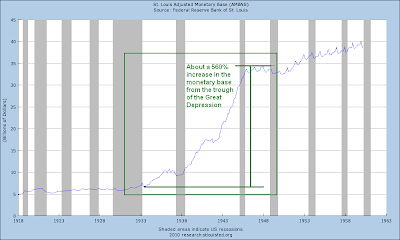

The Monetary Base During the Great Depression and Today

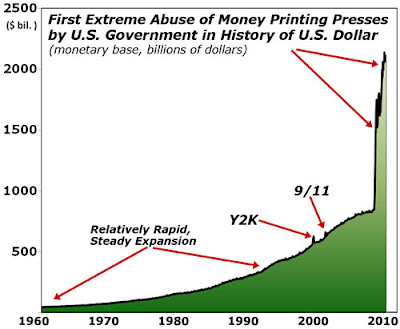

Economic commentator Marty Weiss has put out this chart with the somewhat florid headline, Bernanke Running Amuck

"Fed Chairman Bernanke is running amok, and for the first time since the birth of the U.S. dollar, our government is egregiously abusing its power to print money.

Specifically, from September 10, 2008 to March 10 of this year, he has increased the nation’s monetary base from $850 billion to $2.1 trillion — an irresponsible, irrational and insane increase of 2.5 times in just 18 months.

It is, by far, the greatest monetary expansion in U.S. history. And you must not underestimate its sweeping historical significance."

This chart with its editorial commentary are from Marty Weiss.

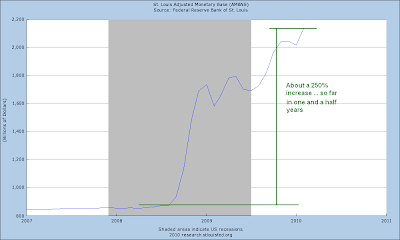

Here is a closer look at this monetary expansion, without the editorial comment

Is it without historical precedent? I wondered.

Let's take a look again at a prior period of dollar devaluation and monetary expansion in a period of deep recession, the period in the 1930's in which the US departed from specie currency to facilitate the radical expansion of the monetary base.

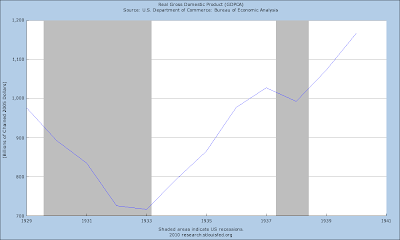

As you can see, the Federal Reserve increased the monetary base in several steps, resulting in an aggregate increase of about 155% in four years. In this chart above one can also nicely see the contraction in the monetary base, the tightening, that caused a dip again into recession in 1937.

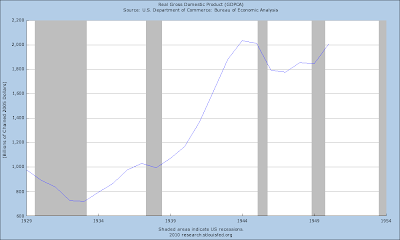

It is also good to note that the recession ended and the economy was in recovery prior to the start of WW II, which I would tend to mark from Hitler's invasion of Poland in August, 1939. There was a military buildup in Britain before then, but I believe that the common assumption that only the World War could have ended the Great Depression was mistaken.

If real GDP is any indication, the recovery of the economy was underway, but somewhat anemic compared to its prior levels, reflected in a slow decline in unemployment. It is absolutely essential to remember that the US had become a major exporting power in the aftermath of the first World War. The decline therefore of world trade with the onset of the Depression hit the US particularly hard. But the recovery was underway, until the Fed dampened it with a premature monetary contraction that brought the country back into recession, a full eight years after the great crash. Such is the power of economic bubbles to distort the productive economy and foster pernicious malinvestment.

What prolonged the Depression in the US was the Federal Reserve's preoccupation with inflation that caused it to prematurely contract the money supply. In addition, the Supreme Court overturned most of the New Deal employment programs before the economy had fully recovered from the shock of the Crash of 1929, and the severe damage inflicted by liquidationism on the financial system and the real economy. One can hardly appreciate today the impact of repeated banking failures, with no recourse or insurance, on the public confidence.

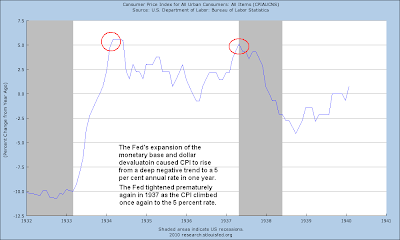

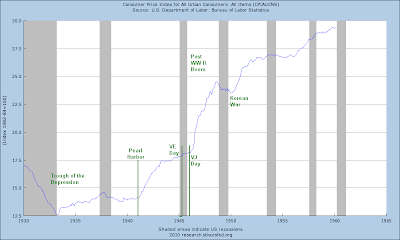

It is instructive to look at the Consumer Price Index for that period of time to see what was motivating the Fed.

It is fair to say that the Fed made several policy errors out of a fear of inflation. Keep in mind that it was only 1933 that the Fed had been freed of the gold standard, and there was tremendous pressure from the monied interests to maintain a strong currency, as we can see, to a fault. The public interest was sacrificed to protect the pre-Crash gains of the wealthy.

The US economy had a more difficult time adjusting to the collapse and the Depression because it had been a net exporting nation in the 1920's. The decline in markets for its exports, and the constrictions in international trade symbolized in the US by the Smoot-Hawley tariffs, affected it much more than other nations that had been net importers, and which exited the Depression earlier.

With the collapse of its export business, the US would have been well-advised to stimulate its domestic markets, to help take up the slack and help to rebalance its productive capacity. In this case, domestic liquidationism was exactly the wrong thing to do. This, by the way, is why the Wall Street money men starting looking at foreign direct investments in the domestic production of recovering economies such as Germany and Italy in the late 1930's. Indeed, the search for profit was so compelling that several of the money houses, and famous men, did not stop investing with the Nazis until they were prosecuted under the Trading with the Enemy laws.

This provides an instructive example to the exporters German and China in this modern crisis perhaps. Now is the time for them to stimulate domestic markets. China must create internal markets, and Germany best try and hold the EU together and keep it healthy.

Japan is in a much more difficult circumstance because of its particular demographics and cultural homogeneity. I see no way out for them in the short term.

Here is what the monetary base did during World War II. As one can easily see, war is bad for people but good for industrial output and monetary expansion.

Expansion of the monetary base during the war was nothing short of astonishing, if one forgets that there was a significant monetization of war debts occurring, and there was less opportunity for inflation because of rationing and wage and price controls. But inflation there was, and it gained a significant leg up after the War.

Here is our real GDP chart extended through the War so one can more easily see the build up and then the flattening of growth post War.

Where Do We Go From Here?

The status quo has failed in its own imbalances and artificial distortions. But while avoiding bubbles in the first place through fiscal responsibility and restraint is certainly the right thing to do, plunging a country which is in the aftermath of a bubble collapse into a hard regime, such as the liquidationists might prescribe, is somewhat like taking a patient which has just had a heart attack and throwing them on a rigorous treadmill regimen. After all, running is good for them and if they had run in the first place they might not have had a heart attack, so let's have them run off that heart disease right now. Seems like common sense, but common sense does not apply to dogmatically inclined schools of thought.

What the US needs to do now is reform its financial system and balance its economy, which means shrinking the financial sector significantly as compared to its real productive economy. This is going to be difficult to do because it will require rebuilding the industrial base and repairing infrastructure, and increasing the median wage.

The US needs to relinquish the greater part of its 720 military bases overseas, which are a tremendous cash drain. It needs to turn its vision inward, to its own people, who have been sorely neglected. This is not a call to isolationism, but rather the need to rethink and reorder ones priorities after a serious setback. Continuing on as before, which is what the US has been trying to so since the tech bubble crash, obviously is not working.

The oligarchies and corporate trusts must be broken down to restore competition in a number of areas from production to finance to the media, and some more even measure of wealth distribution to provide a sustainable equilibrium. A nation cannot endure, half slave and half free. And it surely cannot endure with two percent of the people monopolizing fifty percent of the capital. I am not saying it is good or bad. What I am saying is that historically it leads to abuse, repression, stagnation, reaction, revolution, renewal or collapse. All very painful and disruptive to progress. Societies are complex and interdependent, seeking their own balance in an ebb and flow of centralization and decentralization of power, the rise and fall of the individual. Some societies rise to great heights, and suffer great falls, never to return. Where is the glory that was Greece, the grandeur that was Rome?

The lesser concern for the US now is globalization, new trade agreements, and its debt, which is largely held by foreigners who have provided vendor financing while using exports to build their own economies. The mercantilists are addicted to exports because it provides them the means to bring in national wealth for the benefit of a narrow elite, without empowering the masses and allowing them a greater measure of say in their government, with only a modestly improved standard of living.

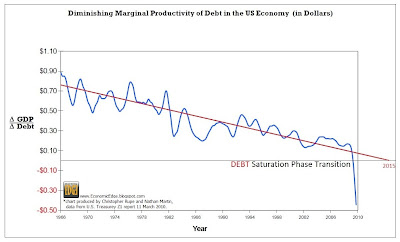

This Will Not Be Your Father's Inflation

Why is this important? Because as I think is apparent in the stunning chart contained in Debt Saturation in the US Dollar Economy, the US dollar is already entering an inflationary spiral that will lead to its destruction and reissuance..jpg)

Although as you know I always allow that deflation and inflation are policy decisions, at some point a threshold can be passed, and the likelihood of one event or the other becomes more compelling. The US is at that crossroads wherein it must change, or go down the painful path of selective monetary default, of a degree different than a hyperinflation, more similar to that which was seen in the former Soviet Union, than the monetary implosion of a Weimar.

One can watch the growth of the traditional or even innovative money supply figures, and be reassured at their nominal levels, only to misunderstand that money has a character and quantity of backing, that can erode as surely as the supply of money can increase, to produce a type of inflation that comes upon a nation quickly, like a thief in the night. It will bear the appearance of stagflation, because it is caused by a degeneration of the productive economy coupled with a disproportionately increasing money supply.

A transactional economy can have all the appearance of vital growth and activity, when in fact it may be an increasingly hollow shell, a Ponzi scheme, and prone to unexpected collapse. Such a systemic collapse was almost witnessed when the US financial system was threatened by the fall of Lehman Brothers. That event was averted. But the system still remains in a precarious, unreformed state of imbalance.

What does a country have to providing a backing to its money, except its natural resources, its productive labor, and the ability to create products of value? Some countries, or more properly empires, may provide the backing for their currency through force and fraud, and a sort of indirect or de facto taxation on the many. These types of arrangements can last many years, but can disappear quickly, based as they are on conditional situations, subject to relatively sudden change.

Cutting expenses to reduce deficits is a weak attempt to reform. One does not starve themselves back to health. What is needed is growth, savings and investment, the reallocation of capital and true valuation of goods and services. The productive economy must come back into balance with the administrative sectors, those being finance and government.

At the end of the day, some of the greatest impediments to economic recovery reside in the selfish and fearful desire for control and power in rather narrow oligarchies, both in the East and the West. They were the primary beneficiaries of the status quo, and they will seek to maintain and even recreate it, even though it has proven to be unsustainable.