10 May 2013

09 May 2013

BBC2: Bankers Fixing the System

"In our time political speech and writing are largely the defense of the indefensible."

George Orwell

Libor scandal: Can we ever trust bankers again?

"In the five years since the crash that brought the world's economy to its knees, bankers have lurched from one crisis to another.

Scandal after scandal has raised questions about their pay, their values and their judgement and after the industry received billions in taxpayer bailouts, the public is in no mood to forgive and forget.

Like it or loathe it, banking is a vitally important industry to London and the whole of the UK.

But can we ever trust bankers again?"

If you live in the UK you may watch the series here. BBC iPlayer

Otherwise you may watch episode one below.

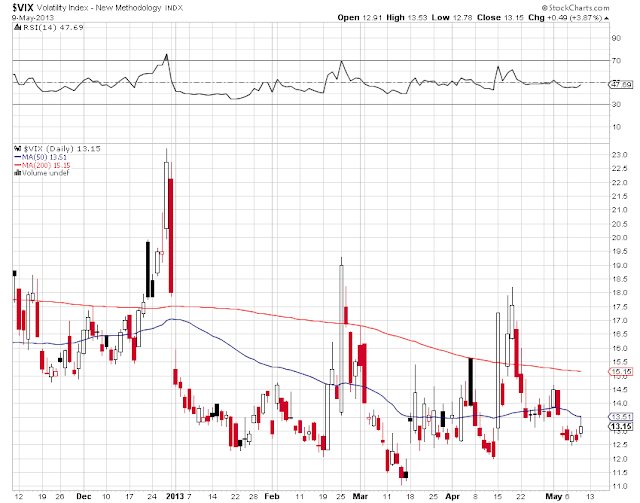

Gold Daily and Silver Weekly Charts - The BRICs Are Restless and Demanding Change

Apparently the depressed prices in mining stocks have resulted in record insider buying in junior mining shares.

The Yen broke 100 to the US dollar today. That is a 'big deal' in forex circles.

David Rosenberg thinks that:

"We currently are witnessing the Potemkin rally. For a quick background the phrase Potemkin villages was originally used to describe a fake village, built only to impress. According to the story, Russian minister Grigory Potemkin who led the Crimean military campaign erected fake settlements along the banks of the Dnieper River in order to fool Empress Catherine II during her visit to Crimea in 1787..There has been little or no mention of or word out of the G20 conference in Turkey about 'Reinventing Bretton Woods.' I have been talking about this for some time and linked to the original agenda when it first came out. I reminded you of it a couple of weeks ago. But there is little heard about it so far.

The term, however, is now used, typically in politics and economics, to describe any construction (literal or figurative) built solely to deceive others into thinking that some situation is better than it really is.."

Ben Bernanke, recently proclaimed “The Hero” by Atlantic Magazine, is the “Wizard of Potemkin.”

The G7 did call a special meeting for this weekend to discuss serious bank reform. The Bankers were not pleased with this, but apparently had no choice. And some were not happy with having to make all the last minute arrangements for this august gathering of central bankers and finance ministers.

The G7 tried to spin this as a late reaction to Cyprus, but that is what the Brits like to call 'bollocks.'

It is said to be a response to a request from China and Russia and a few associates for the G7 to get their dirty financial house in order. Cyprus was the last straw in a series of outrages. Europe is none too pleased with having been sold all that dirty paper in the last bubble. We already knew that from Jeffrey Sachs talk to the Philly Fed last month.

And as always, gold is talked about in whispers.

"It's very rare for a G7 to focus on financial regulation," one of the officials said, speaking on condition of anonymity.There is also a general displeasure about the currency games being played by London, New York/Washington and Tokyo, and their playing fast and loose with global commodity prices that are disrupting other nations' economies.

There is apparently some behind the scenes 'horse trading' going on at the G20 currency conference. And there is a push back by the Anglo Americans to defer any action or announcement until later this year, other than the usual bilateral and multilateral currency agreements.

I hear that this may culminate in September. But words are cheap, and rumours are plentiful, so let's see what happens.

SP 500 and NDX Futures Daily Charts - Excelsior

Congratulations to JP Morgan and Bank of America for their 'perfect' trading records in 1Q 13.

Perfect records in what is at least nominally an efficient market is a bit unusual. And it speaks volumes.

I read a justification at Economist's View yesterday for why stocks are not in a bubble. The primary thrust of the argument was to deflate the nominal SP 500 and compare it to its previous highs. That those highs were the peaks of grossly mispriced credit and risk bubbles apparently goes without mention.

This will end badly and the same jokers who missed the credit bubbles in tech and housing will say, 'How could we have known.'

Chris Hedges: On a Windy Afternoon In Front of Goldman Sachs - Hunger Games

“All the animals, the plants, the minerals, even other kinds of men, are being broken and reassembled every day, to preserve an elite few who are the loudest to theorize on freedom, but the least free of all.

I can’t even give you hope that it will be different someday— that they’ll come out, and forget death, and lose their technology’s elaborate terror, and stop using every form of life without mercy to keep what haunts men down to a tolerable level— and be like you instead, simply here, simply alive.”

Thomas Pynchon, Gravity's Rainbow

Although people like to imagine dystopian futures like The Road, or even The Walking Dead, if you wish to see a more possible vision of the future, especially in Europe, go see The Hunger Games.

Part 1 has been out for some time, and Part 2 is coming to theatres late this year. I read the books when all the kiddos were reading them a few years ago.

They not literary classics, but diverting and well worth reading. And I recommend them to you, so that you can at least know what many bright young people are thinking about the world which we are creating for them.

And when you see or read about the frivolous excess and self-important obsessions of the incredibly out of touch ruling elite in The Capitol, and their perfect records of achievement in games in which they make the rules as they go, recall that telling phrase of Hannah Arendt's, the banality of evil.

They would be as gods, and so revel in violence and death which, unable to create life, is their greatest power and the means of their control.

And the winners will owe their allegiance to a faceless System. And if they use power and money to pervert justice, instead of bombs and bullets, so much the better for its efficient use of resources.

Category:

Hunger Games

Subscribe to:

Posts (Atom)