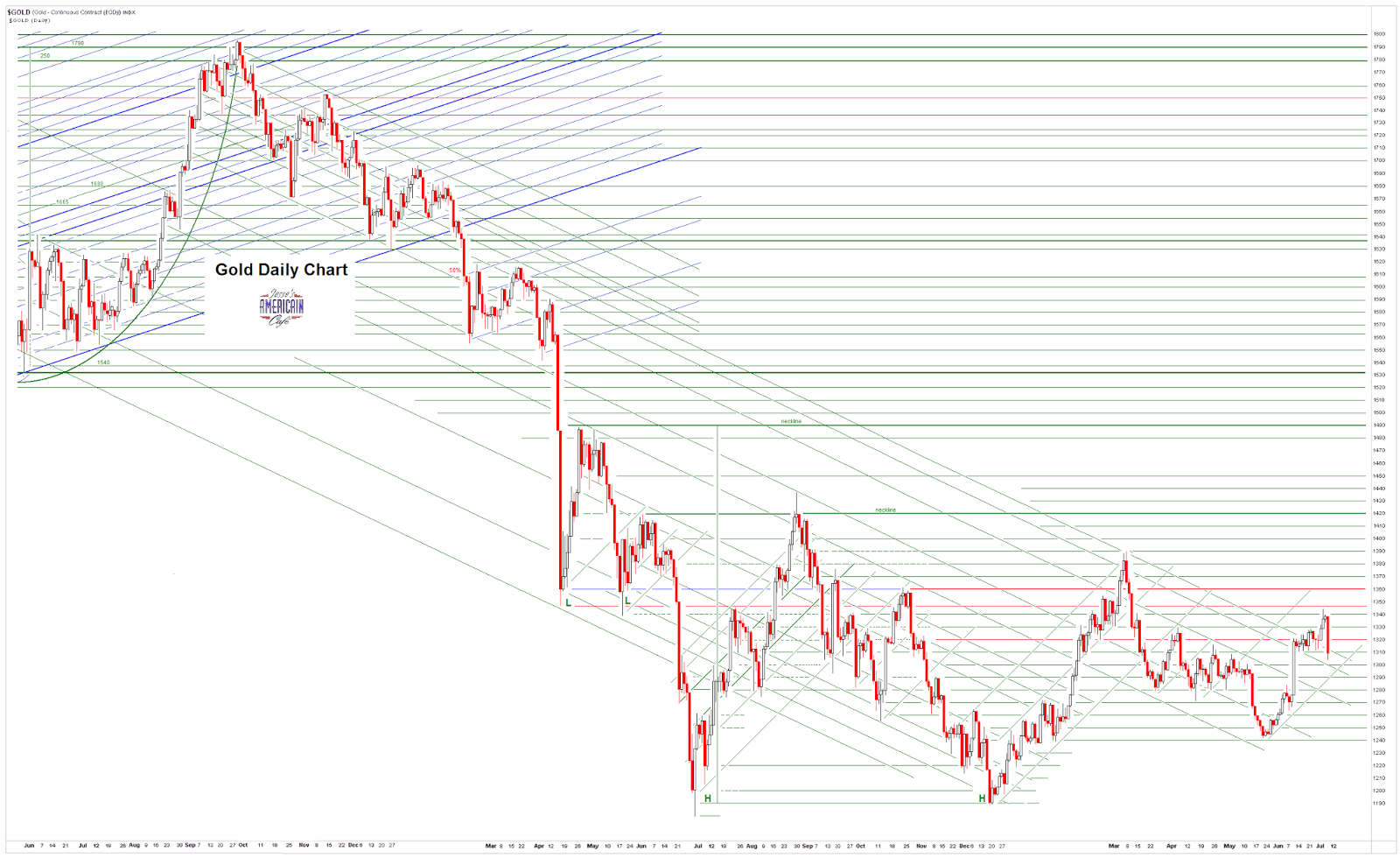

The hit on the metals began in the quiet overnight hours and received some additional momentum on the New York open. Here is a picture of a 2300 gold contract 'dump.' Just another day of price discovery, nothing to see here.

Tomorrow is when Bubbles Yellen gives her Humphrey-Hawkins testimony to the Congress.

That was a very close World Cup final game yesterday, for those who actually watched it before commenting on it. While it was largely a defensive battle, Argentina gave up a few opportunities to score that I am sure will be to their regrets in retrospect.

Götze's goal for Germany was very well done against the able goalkeeping of Romero, and was only his second of the tournament. Herr Schweinsteiger must surely have set some sort of record for the number of medical treatments on the field. But there was a general strong team play on both sides, and the sort of well executed game that graced the setting well.

Happy Bastille Day, mes amis.

Have a pleasant evening.