"The tendency of things is, indeed, to make matters worse still. The poor are every year becoming poorer, and more dependent upon those who feast upon their sufferings; while the wealth and power of the realm are annually concentrating in fewer hands, and becoming more and more instruments of oppression.”

John C. Cobden, 1854

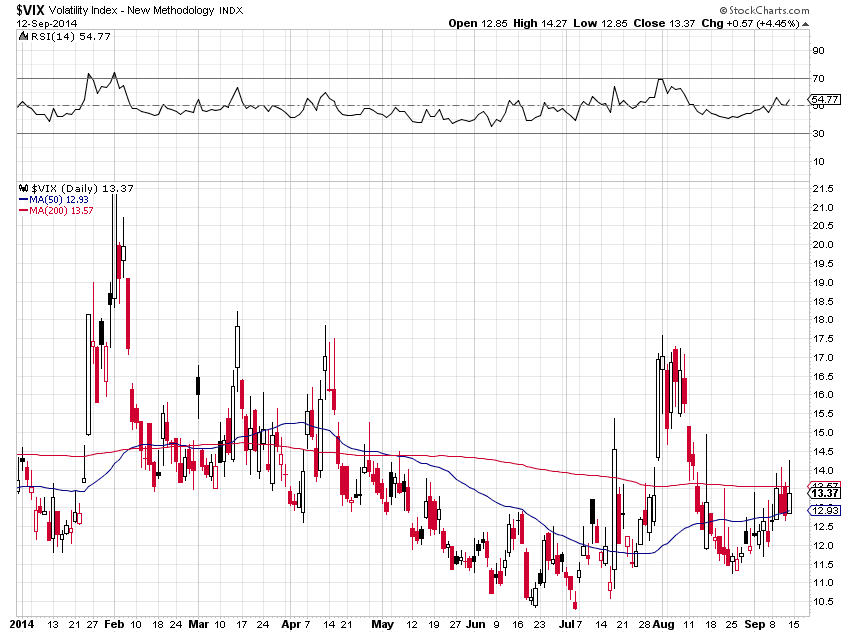

Retail sales came in a bit hot today, triggering a 'good news is bad news' selloff in stocks, at least according to the spokesmodels on bubblevision.

The retail sales results were really not all that impressive, just coming

in-line for sales ex-auto. And who the heck knows what adjustments were used to cook up the hot auto sales number? These one shot numbers are a flash in the pan.

I think the sell off today, ahead of the weekend, is due to the cumulative jitters of the markets, given the drumbeats to war in Iraq, Syria, Ukraine, and the potential 'Yes' vote in Scotland for independence.

"The White House is characterizing the U.S. mission against Islamic State militants as a war, similar to the one waged against al-Qaida and its affiliates."

The skeptical part of me wonders if this is the 'wash and rinse' that I suspected they might try to sneak in ahead of the actual Alibaba IPO. In our economy war is a good thing, to the extent that it is good for business.

It must be good. We seems to look for wars all the time, and even in the most unlikely of places, on the suspicion that someone there must be up to no good. The US did a rather effective

stop and frisk with extreme prejudice on Iraq, for example. They are still trying to get their lives back together.

And apparently Obama wants to do the same thing to Syria.

We lift things up, and put them down. And that includes not only tyrants, and vicious rebels, but whole nations and peoples.

So let's see what happens next week. Besides the FOMC two day meeting, which will provide us their guidance on the afternoon of Wednesday Sept 17th. A calendar for next week is included below.

Nothing particularly interesting occurred in the Comex warehouses for precious metals yesterday.

In other news of the day, the Fed has just formed the

Committee on Financial Stability led by Vice-Chair Stanley Fischer.

When this news came out it reminded me of the (in)famous

Comité de Salut Public, or Committee on Public Safety which became the de facto executive government during the worst parts of the French revolution.

I would bear in mind that this unelected committee of the Fed has no standing to make

laws, and is part of a private organization which unfortunately has been given too many discretionary regulatory powers by the ideologically crippled, do-nothing Congress.

And in cheerier news,

Golem XIV is back from his holiday. Welcome back.

I am looking forward to hearing more about the momentous vote in Scotland next week as the election day approaches. So many English

nouveau riche and political

parvenu of the master class have issued nearly hysterical screeds against it that I know it must be of some importance.

As they advise, we must always 'be afraid, be very afraid.' And have only a little hope. After all, government is complex, and these matters are best left to the ruling class.

"Hope. It is the only thing stronger than fear. A little hope is effective. A lot of hope is dangerous. A spark is fine, as long as it's contained."

President Snow, The Hunger Games

Have a pleasant weekend.