Flight to safety.

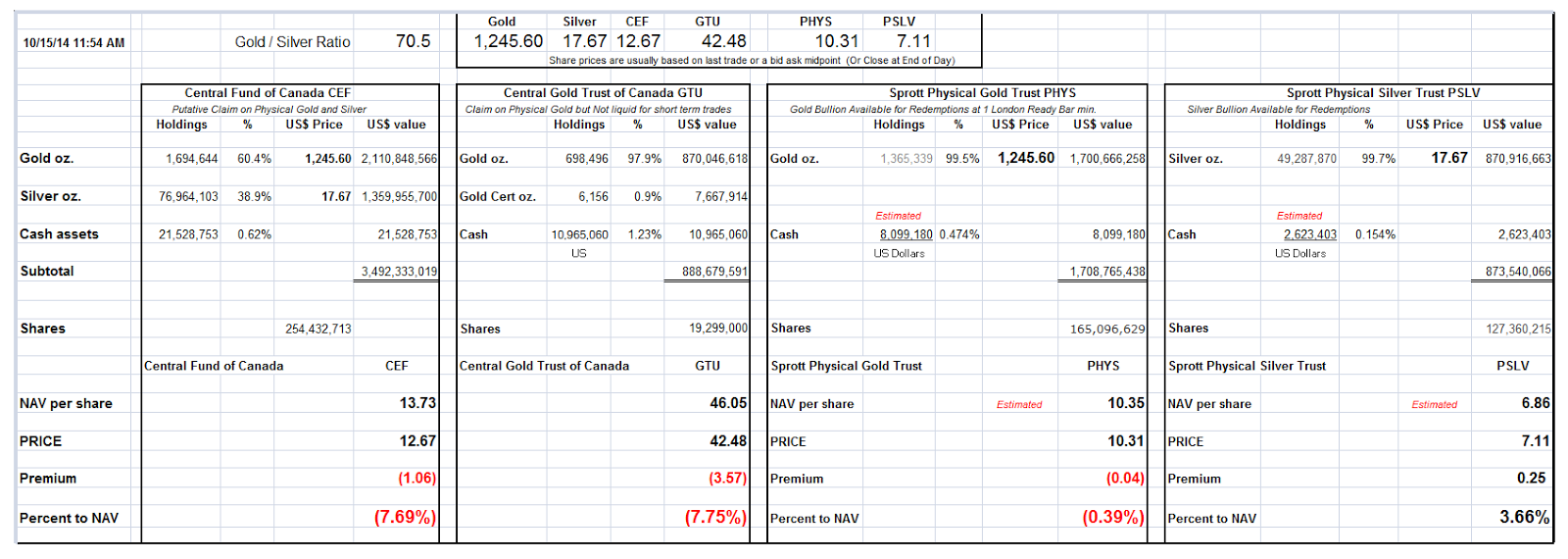

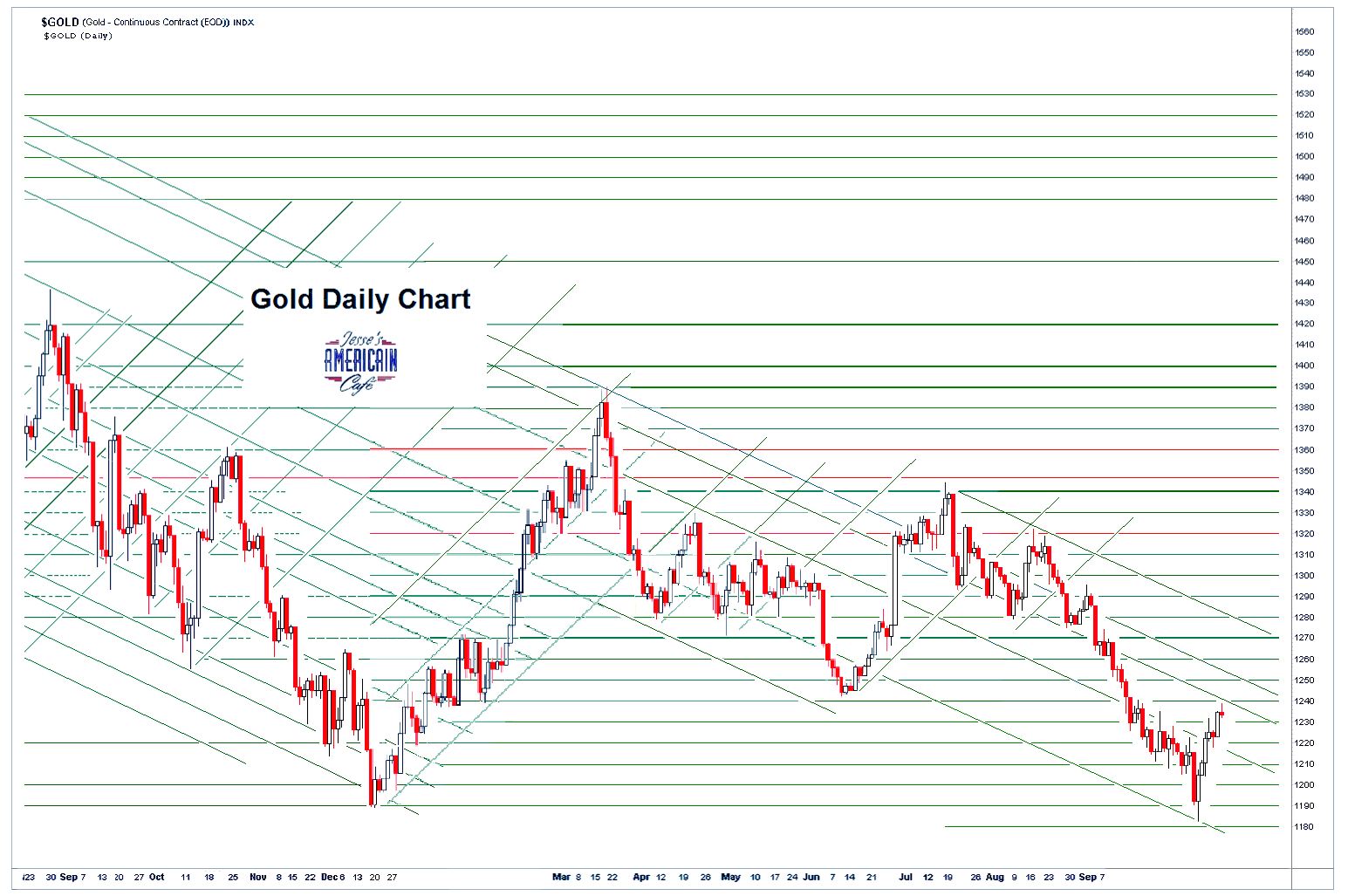

The prices have not yet begun to reflect the supply situation which is being extended and papered over by leverage.

When that leverage starts unwinding, the prices may go higher with somewhat impressive velocity.

It would be better for the price managers to allow the precious metals markets to go higher now, with a more controllable slope. But their fears and hubris may betray their wiser counsels.

I have this wonderful image of some Captain Bligh (as played by Larry Summers) of an economist shouting that they must 'hold the line' on the precious metals.

And the harried bureaucrats of Treasury and the Fed continue to lease out vast amounts of other people's gold, while privately shitting their pants with the thought of what will happen if their miscarried intervention is disclosed to the markets. My career!