"There was a Princeton study by Martin Gilens and Ben Page. The largest empirical study of actual policy decisions by our government in the history of our government. And what they did is they related our actual decisions to what the economic elite care about, what the organized interest groups care about, and what the average voter cares about.And when they look at the economic elite, you know, as the percentage of economic elite who support an idea goes up, the probability of it passing goes up. As the organized interests care about something more and more, the probability of it passing goes up. But as the average voter cares about something, it has no effect at all, statistically no effect at all on the probability of it passing.If we can go from zero percent of the average voters caring about something to 100 percent and it doesn't change the probability of it actually being enacted. And when you look at those numbers, that graph, this flat line, that flat line is a metaphor for our democracy.Our democracy is flatlined. Because when you can show clearly there's no relationship between what the average voter cares about, only if it happens to coincide with what the economic elite care about, you've shown that we don't have a democracy anymore."Lawrence Lessig"It [big money] mattered enormously. It mattered in the selection of candidates. You know, long before we even heard their names, the candidates were selected if they were basically comfortable working for big-money donors. And that in itself gets you out of the realm of inspirational leadership. And then, of course, it mattered in the drowning of ads and the sense that people outside of any accountable power, super PACs outside of any accountable power, were really sort of running the system."Zephyr Teachout

16 November 2014

Moyers: Our Democracy Is Flatlined - Moneyed Interests and Politics

Category:

audacious oligarchy,

Crony Capitalism,

oligarchy

15 November 2014

Potential Owners Per Ounce of Registered Comex Gold Back Over 50

Please note that this is not all the gold in Comex warehouses, merely that gold which is marked as deliverable at these prices.

Some like to use all the gold in their calculations but that seems a bit presumptuous, to consider gold merely being held by customers in storage in one of those warehouses as fair game at any price.

I am not calculating this for the purposes of a default, as you may recall. The open interest is only potential owners. The Comex is, after all, a largely paper market.

If there is a physical default it will more likely happen overseas, and come cascading back to London and New York, and the exchanges go bids up, with none offered.

In a case like that they can force settle in cash for paper, maybe, but not for the real thing.

Let's hope the imbalances between price, demand, and supply do not grow to the level.

Category:

comex warehouse,

owners per ounce

14 November 2014

Gold Daily and Silver Weekly Charts - He Dwelleth In This Land

Gold and Silver had a nice rally today, with gold stopping around the 1190 area and silver making it to the 16 handle midpoint.

Look at the gold chart and you will see the only thing that really counts. Gold must break the downtrend, and take out the potential bear flag. Silver will follow, or it could possibly take the lead, but it cannot do well without gold one way or the other.

The G20 is this weekend. Let's see if they announce anything.

I have included the economic calendar for next week.

Have a pleasant weekend.

"When the morning skies grow red,

and over us their radiance shed

Thou, O Lord, appeareth in their light

when the alps glow bright with splendor,

pray to God, to Him surrender

for you feel and understand

that He dwelleth in this land.

In the sunset Thou art night

and beyond the starry sky

Thou, O loving father, ever near,

when to Heaven we are departing

joy and bliss Thou'lt be imparting

for we feel and understand

that Thou dwellest in this land.

When dark clouds enshroud the hills

and gray mist the valley fills

yet Thou art not hidden from thy sons

pierce the gloom in which we cower

with Thy sunshine's cleansing power

then we'll feel and understand

that God dwelleth in this land."

Schweizerpsalm

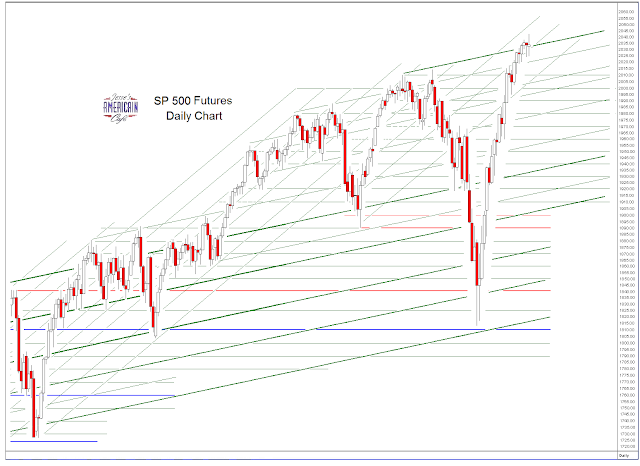

SP 500 and NDX Futures Daily Charts - Sitting On Top of the World

"It may seem strange that any men should dare to ask a just God's assistance in wringing their bread from the sweat of other men's faces, but let us judge not, that we be not judged. The prayers of both could not be answered. That of neither has been answered fully. The Almighty has His own purposes. 'Woe unto the world because of offenses; for it must needs be that offenses come, but woe to that man by whom the offense cometh.'"

Abraham Lincoln

The stock market has reached nosebleed heights.

I do not know if the wiseguys can keep it going through Thanksgiving.

But I hear that only 20% of fund managers are beating their benchmarks which is incredible given this bubble market we are seeing.

This stock market makes my skin crawl.

Have a pleasant weekend.

13 November 2014

SP 500 and NDX Futures Daily Charts

Stocks were ranging all over the place today, finishing up with a little to the upside.

There are rumours of a deal in the oil patch, Halliburton to acquire Baker-Hughes.

Nordstrom beat but lowered guidance and JC Penney missed.

Applied Materials lowered guidance and sold off a bit after hours. Applied Mat is considered a tech bellwether.

There is no broadly based organic recovery. There are only illusions and appearances based on accounting fraud, control frauds, and money printing.

Have a pleasant evening.

12 November 2014

Gold Daily and Silver Weekly Charts - Agents of Misfortune

"Do not fear those who can kill the body but are not able to kill the soul; rather, fear Him who can destroy both soul and body of the accursed."

Matt 10:28

There was intraday commentary about The Day Money Dies here.

I wrote about it primarily because it was getting a lot of play, and raising some concerns and questions. It seems to have caught the attention of many.

And as you know I am following what the G20 does this weekend in Brisbane. I do not know about rules for bail-ins, but there are some who think that the BRICS may have something to say of interest at a forum which is not dominated by the US and UK.

I have approached many such meetings with anticipation in the last few years. And mostly nothing of consequences occurs.

The usual suspects were caught rigging the markets again. You may read about JPM and the agents of misfortune, and most likely US government policy when their interests coincide, here.

Gold and silver were flat in largely lackluster trade.

There was no real delivery movement on the Comex report. The warehouses saw minor withdrawals of bullion.

A friend keeps discussing the 'delta of delivery' with me.

By this he means the movement of gold from West to East, which is a big change from prior states in the precious metals market, particularly gold.

This is a trend that it would be foolish not to note, and watch. So be advised.

Let's wait to see what the G20 have to say before we go jumping to any conclusions. But I do think that caution is advisable overall. The fundamental things apply, as time goes by.

"For what does it profit a man, to gain the whole world, but to lose his soul?"

Have a pleasant evening.

Subscribe to:

Posts (Atom)